Question

The Fraud Case Study? Builder Inc. is an innovative construction company located in Western Canada. It employs staff of 150 and is relatively successful. Even

The Fraud Case Study?

Builder Inc. is an innovative construction company located in Western Canada. It employs staff of 150 and is relatively successful. Even though the company experiences steady growth in recent years, competition is fierce and margins are shrinking. A significant portion of the CEO's pay (Steve Smith) is profit-related. During audit planning this risk is identified and appropriate audit procedures are to be planned and executed to address this risk?

The General Journal?

The company provided you with a partial General Journal (GJ_Case_Study_A.csv). The total balance of the Journal is around $ 4,4 million. The FY start date is 1 January. Go to Case Data, and download the data file to your computer. Please note that the materiality for this audit engagement is $10,000 (reduce the weightings for the material value control point to 5% in the MindBridge tool). It is also important to note that bookkeeping is regularly done on weekends.?

Your task?

Analyze the general jornal using the MindBridge tool addressing the above fraud risk. Identify no more than 20 transactions using the various investigative features in MindBridge's Ai Auditor. Create 'tasks' for these transactions and export them from the Audit Plan section.

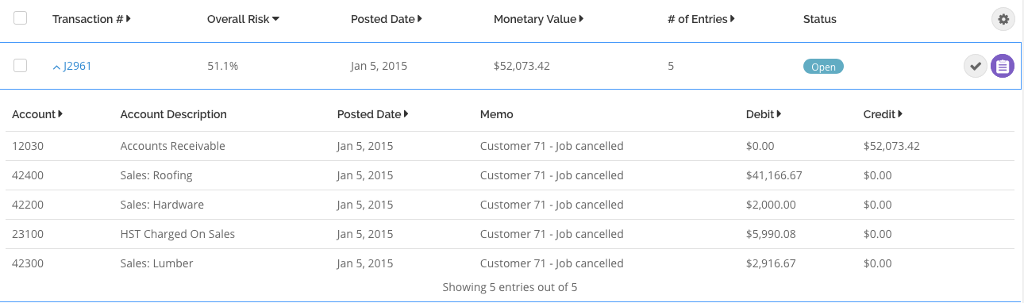

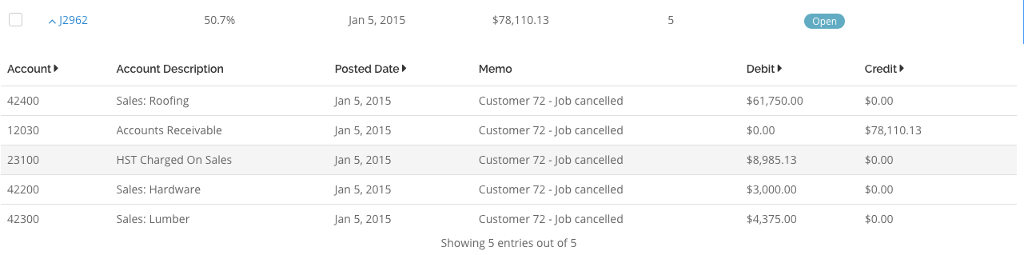

0 12030 Account 42400 42200 23100 Transaction # 42300 ^J2961 Overall Risk 51.1% Account Description Sales: Lumber Accounts Receivable Sales: Roofing Sales: Hardware HST Charged On Sales Posted Date Jan 5, 2015 Posted Date Jan 5, 2015 Jan 5, 2015 Jan 5, 2015 Jan 5, 2015 Jan 5, 2015 Monetary Value> $52,073.42 Memo Customer 71 - Job cancelled Customer 71 - Job cancelled Customer 71 - Job cancelled Customer 71 - Job cancelled Customer 71 - Job cancelled Showing 5 entries out of 5 # of Entries 5 Debit $0.00 $41,166.67 $2,000.00 $5,990.08 $2,916.67 Status Open Credit $52,073.42 $0.00 $0.00 $0.00 $0.00 * Account 42400 12030 23100 42200 ^ J2962 42300 50.7% Account Description Sales: Roofing Accounts Receivable HST Charged On Sales Sales: Hardware Sales: Lumber Jan 5, 2015 Posted Date Jan 5, 2015 Jan 5, 2015 Jan 5, 2015 Jan 5, 2015 Jan 5, 2015 $78,110.13 Memo Customer 72-Job cancelled Customer 72-Job cancelled Customer 72-Job cancelled Customer 72-Job cancelled Customer 72-Job cancelled Showing 5 entries out of 5 5 Debit $61,750.00 $0.00 $8.985.13 $3,000.00 $4,375.00 Open Credit $0.00 $78,110.13 $0.00 $0.00 $0.00

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 Both the transactions are material as per the materiality limit o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started