Answered step by step

Verified Expert Solution

Question

1 Approved Answer

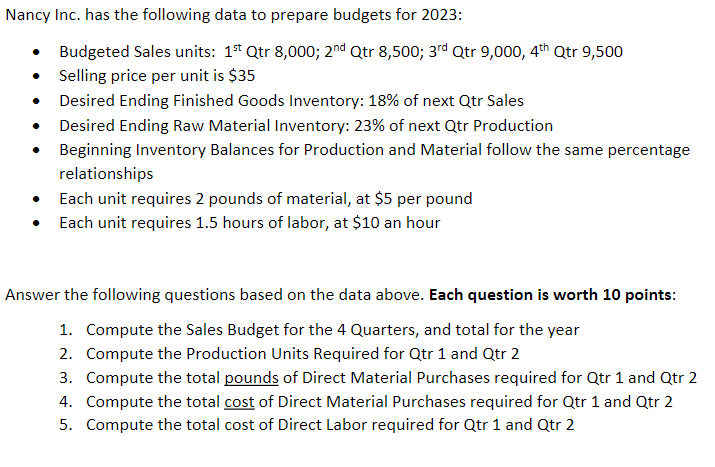

Nancy Inc. has the following data to prepare budgets for 2023: Budgeted Sales units: 1st Qtr 8,000; 2nd Qtr 8,500; 3rd Qtr 9,000, 4th

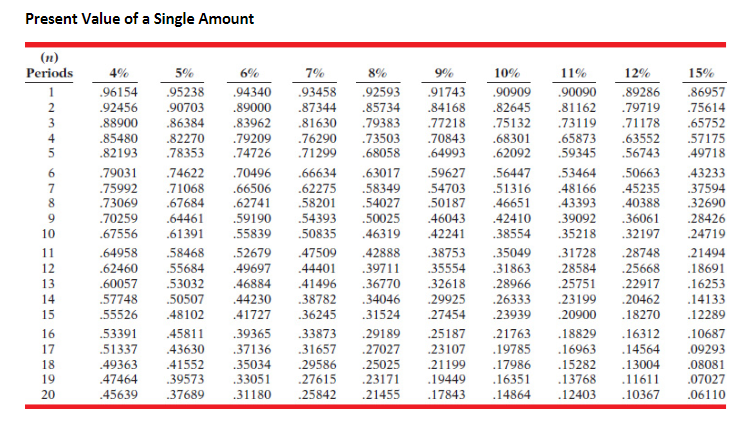

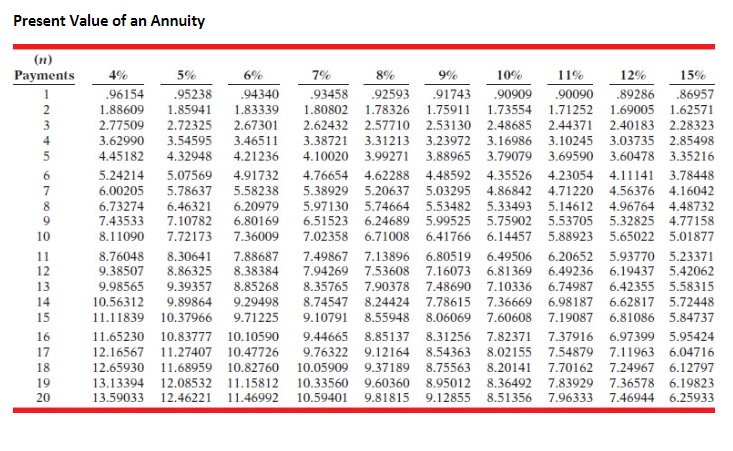

Nancy Inc. has the following data to prepare budgets for 2023: Budgeted Sales units: 1st Qtr 8,000; 2nd Qtr 8,500; 3rd Qtr 9,000, 4th Qtr 9,500 Selling price per unit is $35 Desired Ending Finished Goods Inventory: 18% of next Qtr Sales Desired Ending Raw Material Inventory: 23% of next Qtr Production Beginning Inventory Balances for Production and Material follow the same percentage relationships Each unit requires 2 pounds of material, at $5 per pound Each unit requires 1.5 hours of labor, at $10 an hour Answer the following questions based on the data above. Each question is worth 10 points: 1. Compute the Sales Budget for the 4 Quarters, and total for the year 2. Compute the Production Units Required for Qtr 1 and Qtr 2 3. Compute the total pounds of Direct Material Purchases required for Qtr 1 and Qtr 2 4. Compute the total cost of Direct Material Purchases required for Qtr 1 and Qtr 2 5. Compute the total cost of Direct Labor required for Qtr 1 and Qtr 2 Present Value of a Single Amount (n) Periods 4% 5% 6% 7% 8% 10% 1 .96154 .95238 .94340 .93458 .92593 .91743 234in .92456 .90703 .89000 .87344 .85734 .84168 11% .90909 .90090 .89286 .82645 .81162 .79719 12% 15% .86957 .75614 .88900 .86384 .83962 .81630 .79383 .77218 .85480 .82270 .79209 .76290 .73503 5 .82193 .78353 .74726 .71299 10 67890 .79031 .74622 .70496 .68058 .66634 .63017 .75992 .71068 .66506 .62275 .58349 .73069 .67684 .62741 .58201 .54027 .70259 .64461 .59190 .54393 .50025 .46043 .75132 .70843 .68301 .64993 .62092 .59627 .56447 .54703 .51316 .50187 .46651 .42410 .73119 .71178 .65752 .65873 .63552 .57175 .59345 .56743 .49718 .53464 .50663 .43233 .48166 .45235 .37594 .43393 .40388 .32690 .39092 .36061 .28426 .67556 .61391 .55839 .50835 .46319 .42241 .38554 .35218 .32197 .24719 11 .64958 .58468 .52679 .47509 .42888 .38753 .35049 .31728 .28748 .21494 12 .62460 .55684 .49697 .44401 .39711 .35554 .31863 .28584 .25668 .18691 13 .60057 .53032 .46884 .41496 .36770 .32618 .28966 .25751 .22917 .16253 14 .57748 .50507 .44230 .38782 .34046 .29925 .26333 .23199 .20462 .14133 15 .55526 .48102 .41727 .36245 .31524 .27454 .23939 .20900 .18270 .12289 16 .53391 .45811 .39365 .33873 .29189 .25187 .21763 .18829 .16312 .10687 17 .51337 43630 .37136 .31657 .27027 .23107 .19785 .16963 .14564 .09293 18 .49363 .41552 .35034 .29586 .25025 .21199 .17986 .15282 .13004 .08081 19 .47464 .39573 .33051 .27615 .23171 .19449 .16351 .13768 .11611 .07027 20 .45639 .37689 .31180 .25842 .21455 .17843 .14864 .12403 .10367 .06110 Present Value of an Annuity (n) Payments 1 4% .96154 11 23456789012 13 14 15 16 17 18 19 20 .94340 1.88609 1.85941 1.83339 2.77509 2.72325 2.67301 3.62990 3.54595 3.46511 4.45182 4.32948 4.21236 5.24214 5.07569 4.91732 6.00205 5.78637 5.58238 6.73274 6.46321 6.20979 7.43533 7.10782 6.80169 8.11090 7.72173 7.36009 8.76048 8.30641 7.88687 9.38507 8.86325 8.38384 9.98565 9.39357 8.85268 10.56312 9.89864 9.29498 11.11839 10.37966 9.71225 11.65230 10.83777 10.10590 12.16567 11.27407 10.47726 12.65930 11.68959 10.82760 13.13394 12.08532 11.15812 13.59033 12.46221 11.46992 5% .95238 6% 7% 8% 12% 15% 9% 10% 11% .93458 .92593 .91743 .90909 .90090 .89286 .86957 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 5.01877 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5.72448 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 10.59401 9.81815 9.12855 8.51356 7.96333 7.46944 6.25933

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 1 Compute the Sales Budget for the 4 Quarters and total for the year Sales Budget 1 1st Quarter Sales units 8000 Selling price per unit 35 Sales 8000 35 280000 2 2nd Quarter Sales units 8500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started