Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nancy, the owner of a very successful hotel chain in the Southeast, is exploring the possibility of expanding the chain into a city in

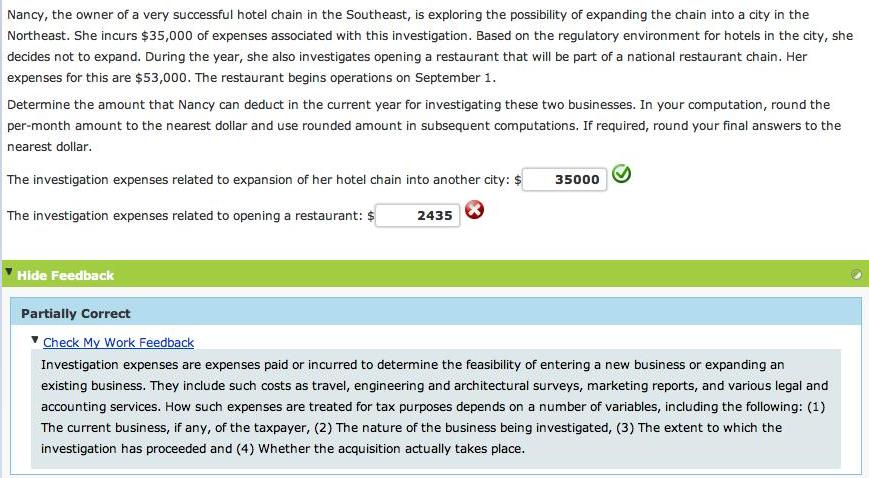

Nancy, the owner of a very successful hotel chain in the Southeast, is exploring the possibility of expanding the chain into a city in the Northeast. She incurs $35,000 of expenses associated with this investigation. Based on the regulatory environment for hotels in the city, she decides not to expand. During the year, she also investigates opening a restaurant that will be part of a national restaurant chain. Her expenses for this are $53,000. The restaurant begins operations on September 1. Determine the amount that Nancy can deduct in the current year for investigating these two businesses. In your computation, round the per-month amount to the nearest dollar and use rounded amount in subsequent computations. If required, round your final answers to the nearest dollar. The investigation expenses related to expansion of her hotel chain into another city: $ 35000 The investigation expenses related to opening a restaurant: $ 2435 Hide Feedback Partially Correct Check My Work Feedback Investigation expenses are expenses paid or incurred to determine the feasibility of entering a new business or expanding an existing business. They include such costs as travel, engineering and architectural surveys, marketing reports, and various legal and accounting services. How such expenses are treated for tax purposes depends on a number of variables, including the following: (1) The current business, if any, of the taxpayer, (2) The nature of the business being investigated, (3) The extent to which the investigation has proceeded and (4) Whether the acquisition actually takes place.

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

ren trat the expenses incurred for the inu It is given ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started