Question

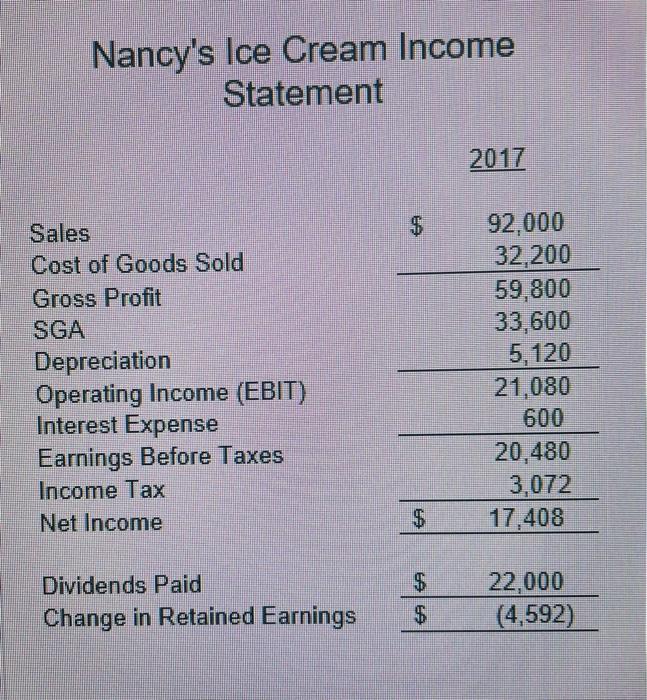

Nancy's Ice Cream business is struggling, and she is hoping that marketing new flavors will help her. For an additional one-time $2,000 in marketing costs,

Nancy's Ice Cream business is struggling, and she is hoping that marketing new flavors will help her. For an additional one-time $2,000 in marketing costs, Nancy is hoping for a boost in sales.

The new marketing should boost her sales by 7% next year, 15% in year 2, 7% in year 3, 3% in year 4, and be obsolete after 4 years. Nancy doesn't expect any salvage value from her marketing materials.

If Nancy pursues this plan, her current assets are projected to increase from $4,750 to $10,370 and her current liabilities are projected to decrease from $1,580 to $748.

Practice Cash Budgeting by:

1) Create a 4-year schedule of cash flows for Nancy.

Calculate the expected 2) NPV, 3) IRR, and 4) MIRR of this marketing plan if Nancy expects to pay for it using existing cash-on-hand (with a cost of capital of 7.7%)

Calculate the expected 5) NPV, 6) IRR, and 7) MIRR of this marketing plan if Nancy instead uses her line of credit at 3.5%

Does the source of financing change your recommendation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started