Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Napanee Construction Company (NCC) has entered into a non-cancellable contract with Raglan Company to construct a building for $2,100,000. NCC is a public company

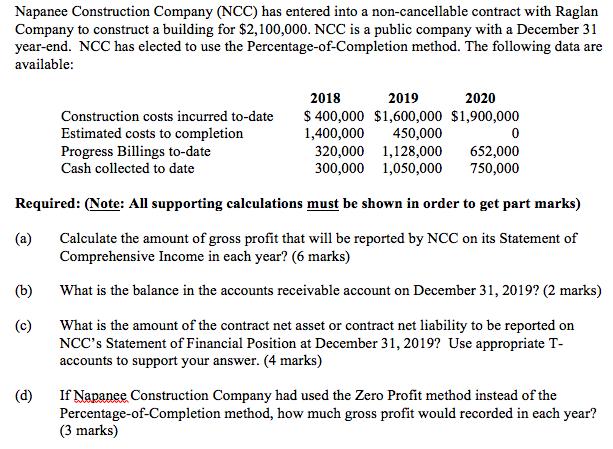

Napanee Construction Company (NCC) has entered into a non-cancellable contract with Raglan Company to construct a building for $2,100,000. NCC is a public company with a December 31 year-end. NCC has elected to use the Percentage-of-Completion method. The following data are available: 2018 2019 2020 $ 400,000 $1,600,000 $1,900,000 1,400,000 320,000 1,128,000 300,000 1,050,000 Construction costs incurred to-date Estimated costs to completion Progress Billings to-date 450,000 652,000 750,000 Cash collected to date Required: (Note: All supporting calculations must be shown in order to get part marks) (a) Calculate the amount of gross profit that will be reported by NCC on its Statement of Comprehensive Income in each year? (6 marks) (b) What is the balance in the accounts receivable account on December 31, 2019? (2 marks) (c) What is the amount of the contract net asset or contract net liability to be reported on NCC's Statement of Financial Position at December 31, 2019? Use appropriate T- accounts to support your answer. (4 marks) (d) If Napanee Construction Company had used the Zero Profit method instead of the Percentage-of-Completion method, how much gross profit would recorded in each year? (3 marks)

Step by Step Solution

★★★★★

3.57 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Napanee Construction Company NCC Percentage of completion Method Year 2018 Year 2019 Year 2020 Total ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started