Answered step by step

Verified Expert Solution

Question

1 Approved Answer

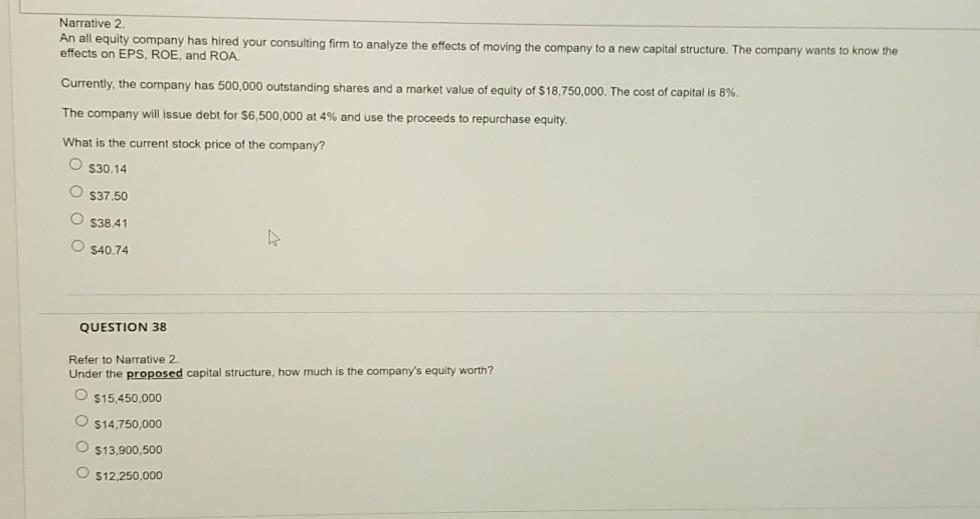

Narrative 2 An all equity company has hired your consulting firm to analyze the effects of moving the company to a new capital structure. The

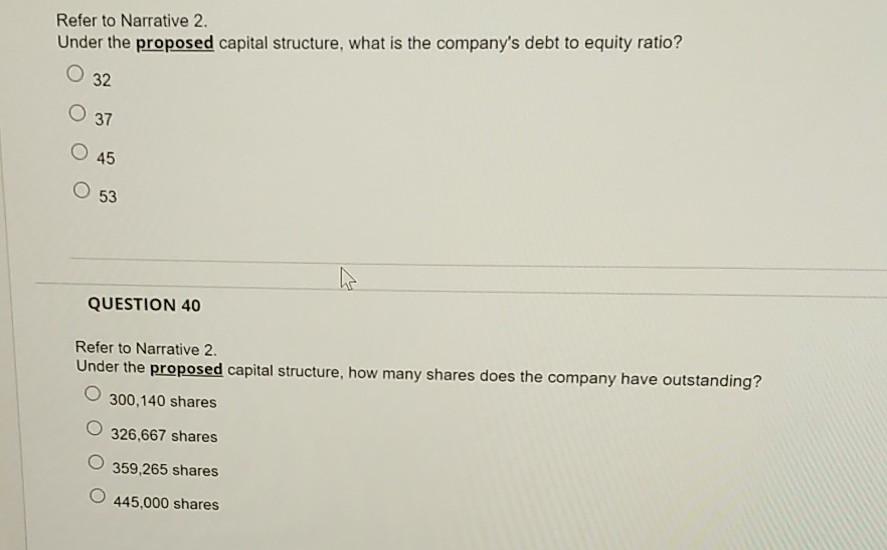

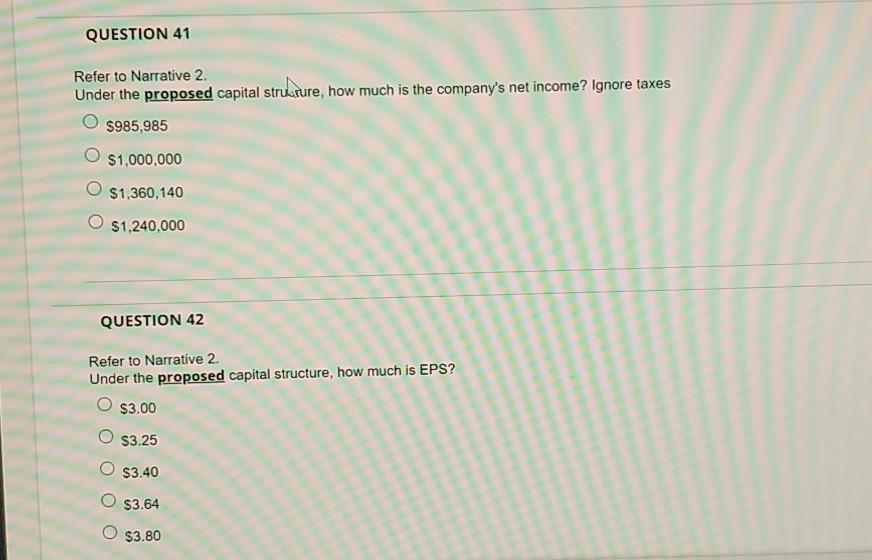

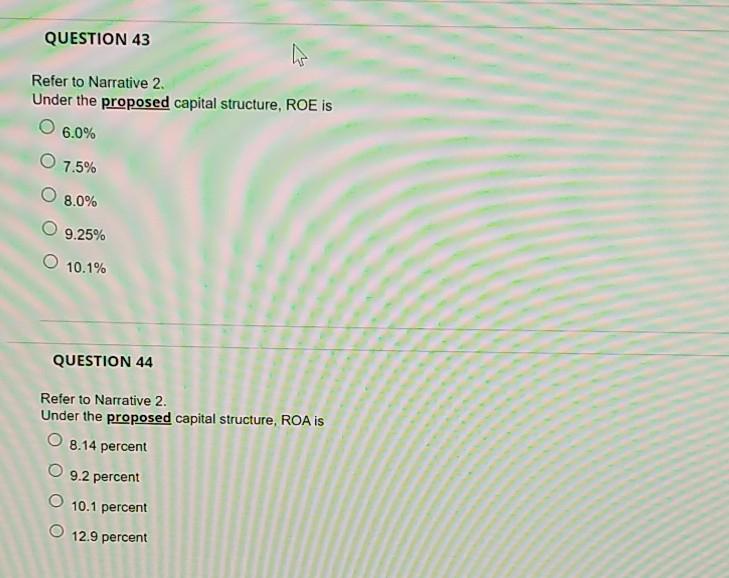

Narrative 2 An all equity company has hired your consulting firm to analyze the effects of moving the company to a new capital structure. The company wants to know the effects on EPS, ROE, and ROA. Currently, the company has 500,000 outstanding shares and a market value of equity of $18.750,000. The cost of capital is 8% The company will issue debt for $6,500,000 at 4% and use the proceeds to repurchase equity. What is the current stock price of the company? O $30.14 $37.50 $38.41 O $40.74 QUESTION 38 Refer to Narrative 2. Under the proposed capital structure, how much is the company's equity worth? O $15,450,000 $14,750,000 $13,900,500 $12,250,000 Refer to Narrative 2. Under the proposed capital structure, what is the company's debt to equity ratio? O 32 O 37 45 53 QUESTION 40 Refer to Narrative 2. Under the proposed capital structure, how many shares does the company have outstanding? 300,140 shares 326,667 shares 359,265 shares 445,000 shares QUESTION 41 Refer to Narrative 2. Under the proposed capital structure, how much is the company's net income? Ignore taxes $985,985 $1,000,000 O $1,360,140 $1.240,000 QUESTION 42 Refer to Narrative 2. Under the proposed capital structure, how much is EPS? O $3.00 O $3.25 $3.40 $3.64 $3.80 QUESTION 43 Refer to Narrative 2. Under the proposed capital structure, ROE is O 6.0% O 7.5% O 8.0% O 9.25% 10.1% QUESTION 44 Refer to Narrative 2. Under the proposed capital structure, ROA is o 8.14 percent O 9.2 percent O 10.1 percent O 12.9 percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started