Question

Naruto is an investor in Hokage Corporation. In 2019 he has 1,000 share holdings acquired at P120 per share or a total investment cost

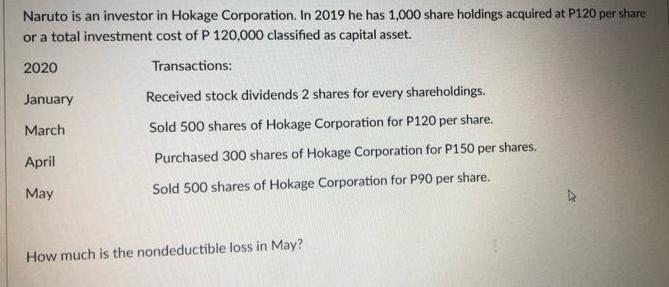

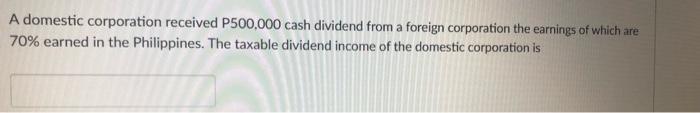

Naruto is an investor in Hokage Corporation. In 2019 he has 1,000 share holdings acquired at P120 per share or a total investment cost of P 120,000 classified as capital asset. 2020 Transactions: January March April May Received stock dividends 2 shares for every shareholdings. Sold 500 shares of Hokage Corporation for P120 per share. Purchased 300 shares of Hokage Corporation for P150 per shares. Sold 500 shares of Hokage Corporation for P90 per share. How much is the nondeductible loss in May? A domestic corporation received P500,000 cash dividend from a foreign corporation the earnings of which are 70% earned in the Philippines. The taxable dividend income of the domestic corporation is

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Question Solution ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Financial Management

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

10th Canadian edition

1259261018, 1259261015, 978-1259024979

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App