Question

Nash Corporation is a publicly owned company that follows IFRS. On December 31, 2019, Nashs financial records indicated the following information related to the companys

Nash Corporation is a publicly owned company that follows IFRS. On December 31, 2019, Nashs financial records indicated the following information related to the companys defined benefit pension plan:

| Defined Benefit Obligation | $7,576,000 | |

| Pension Plan Assets | 7,273,900 |

On January 1, 2020, Nash acquired the operations of AMX Ltd. As one of the conditions of the purchase, Nash agreed that AMXs employees would be included in Nashs defined benefit pension plan, and would be granted credit for the past service of AMXs employees. The actuary estimated the value of the prior service amount granted on January 1, 2020 to be $328,200. Nashs actuary provided the following information on December 31, 2020:

| Current year service cost | $363,900 | |

| Employer contributions for the year | 421,300 | |

| Benefits paid to retirees | 165,700 | |

| Actuarial increase in pension obligations | 125,100 | |

| Expected return on assets | 6% | |

| Actual return on assets | 5% | |

| Discount rate | 6% |

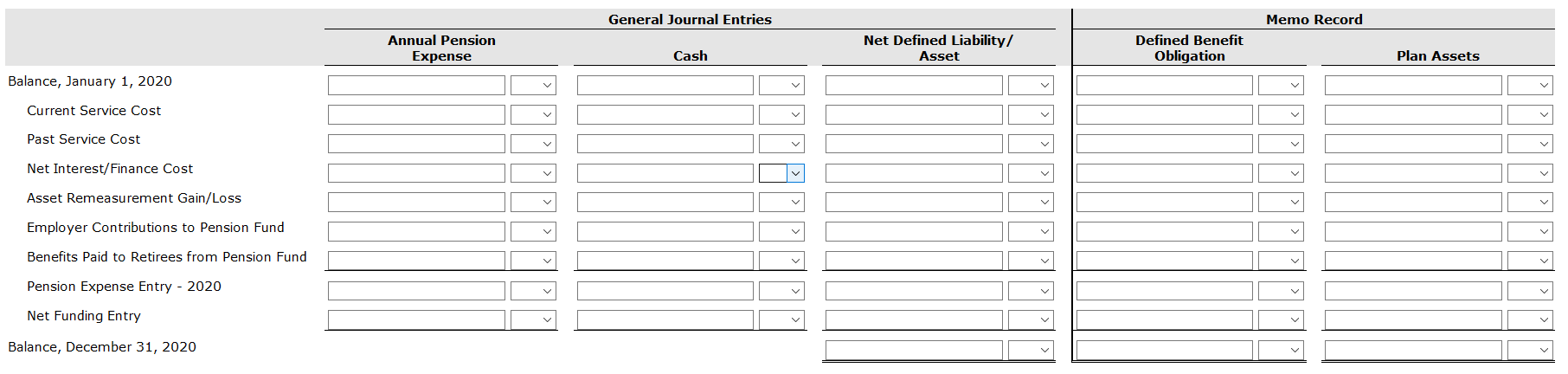

1) Prepare a pension worksheet for Nash Corporation for the year ending December 31, 2020.

2) Prepare the journal entry to record the pension expense for 2020.

2) Prepare the journal entry to record the pension expense for 2020.

3) What is Nashs funded status at December 31, 2020?

Nash pension plan is overfunded/underfunded by $ on December 31, 2020.

General Journal Entries Memo Record Annual Pension Expense Net Defined Liability/ Asset Defined Benefit Obligation Cash Plan Assets Balance, January 1, 2020 Current Service Cost Past Service Cost Net Interest/Finance Cost Asset Remeasurement Gain/Loss Employer Contributions to Pension Fund Benefits Paid to Retirees from Pension Fund Pension Expense Entry - 2020 Net Funding Entry Balance, December 31, 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started