Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nash Inc. reports the following incomes (losses) for both book and tax purposes: Year Accounting Income/ (Loss) Tax Rate 2023 211,000 30% 2024 81,000

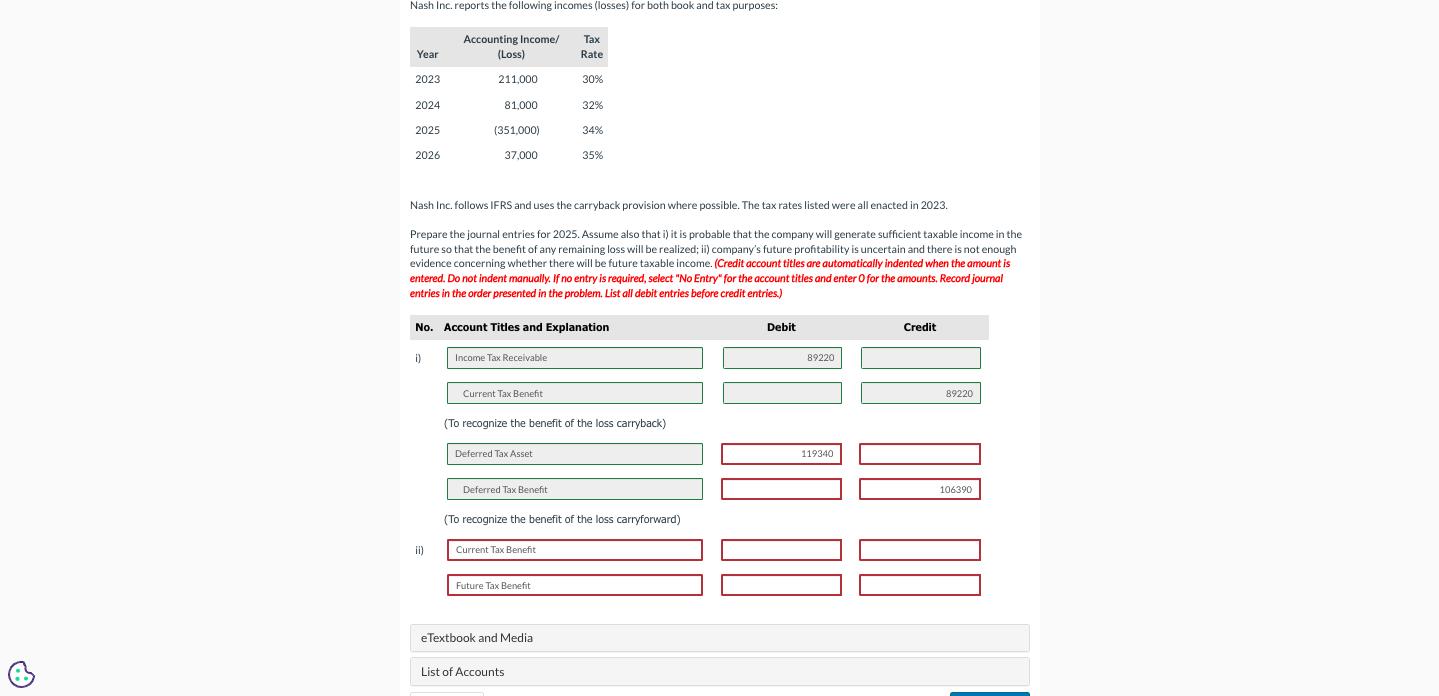

Nash Inc. reports the following incomes (losses) for both book and tax purposes: Year Accounting Income/ (Loss) Tax Rate 2023 211,000 30% 2024 81,000 32% 2025 (351,000) 34% 2026 37,000 35% Nash Inc. follows IFRS and uses the carryback provision where possible. The tax rates listed were all enacted in 2023. Prepare the journal entries for 2025. Assume also that i) it is probable that the company will generate sufficient taxable income in the future so that the benefit of any remaining loss will be realized; ii) company's future profitability is uncertain and there is not enough evidence concerning whether there will be future taxable income. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) No. Account Titles and Explanation i) Income Tax Receivable Current Tax Benefit (To recognize the benefit of the loss carryback) Deferred Tax Asset Deferred Tax Benefit (To recognize the benefit of the loss carryforward) Current Tax Benefit Future Tax Benefit eTextbook and Media List of Accounts Debit 89220 119340 Credit 89220 106390

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer Journal Entries for Nash Inc for the year 2025 1 To recognize the benefit of the loss carryb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started