Answered step by step

Verified Expert Solution

Question

1 Approved Answer

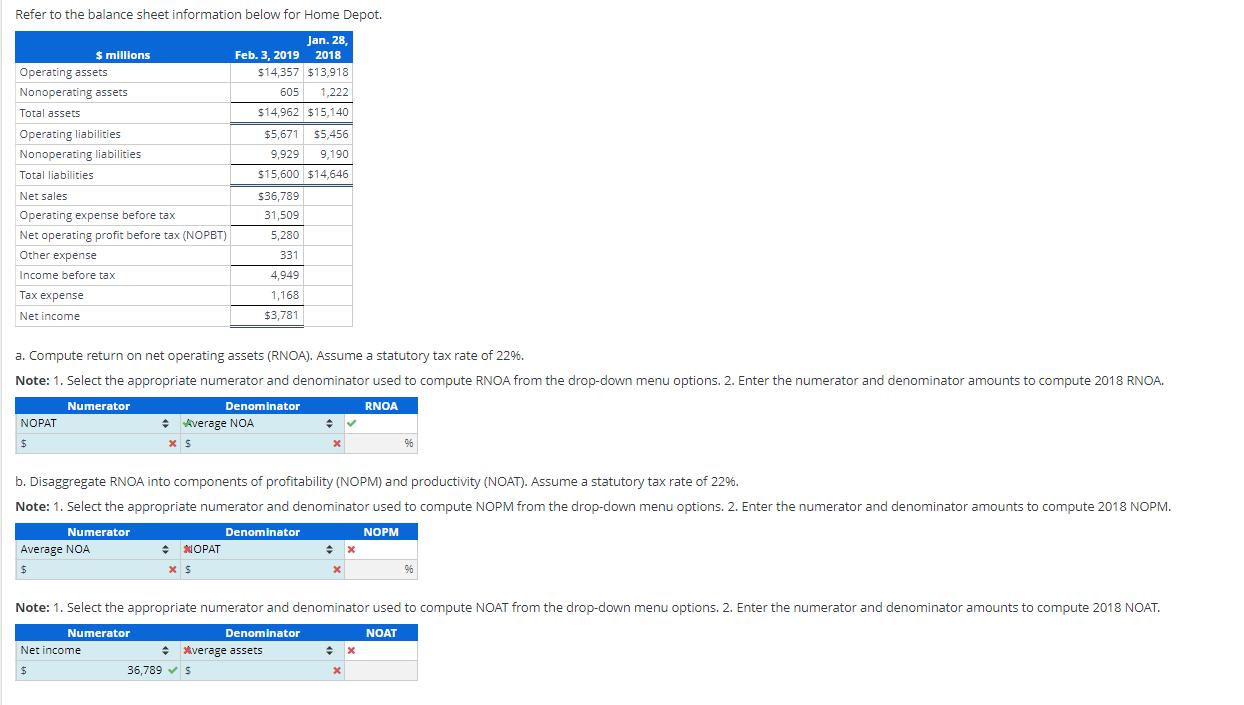

Refer to the balance sheet information below for Home Depot. $ millions Operating assets Nonoperating assets Total assets Operating liabilities Nonoperating liabilities Total liabilities

Refer to the balance sheet information below for Home Depot. $ millions Operating assets Nonoperating assets Total assets Operating liabilities Nonoperating liabilities Total liabilities Net sales Feb. 3, 2019 Jan. 28, 2018 $14,357 $13,918 605 1,222 $14,962 $15,140 $5,671 $5,456 9,929 9,190 $15,600 $14,646 $36,789 Operating expense before tax 31,509 Net operating profit before tax (NOPBT) 5,280 Other expense 331 Income before tax 4,949 Tax expense Net income 1,168 $3,781 a. Compute return on net operating assets (RNOA). Assume a statutory tax rate of 22%. Note: 1. Select the appropriate numerator and denominator used to compute RNOA from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute 2018 RNOA. Numerator Denominator NOPAT Average NOA RNOA b. Disaggregate RNOA into components of profitability (NOPM) and productivity (NOAT). Assume a statutory tax rate of 22%. Note: 1. Select the appropriate numerator and denominator used to compute NOPM from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute 2018 NOPM. Numerator NOPM Average NOA Denominator NOPAT S Note: 1. Select the appropriate numerator and denominator used to compute NOAT from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute 2018 NOAT. NOAT Numerator Net income Denominator verage assets 36,789 $ x x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To compute the return on net operating assets RNOA for Home Depot we can use the following fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started