Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NASHORA Corporation is a company that focuses on development and manufacturing of technology. Five years ago, the company issued RM10,0000,000 of corporate bonds with a

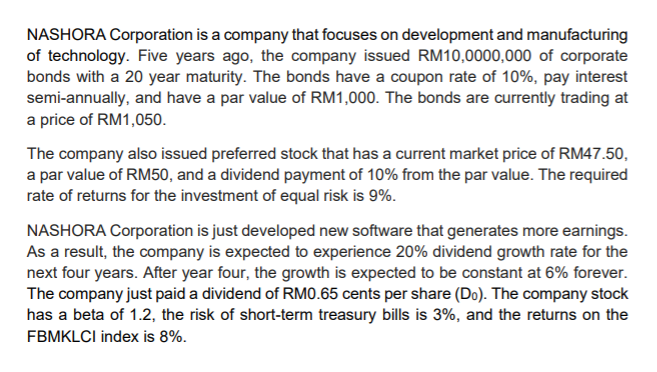

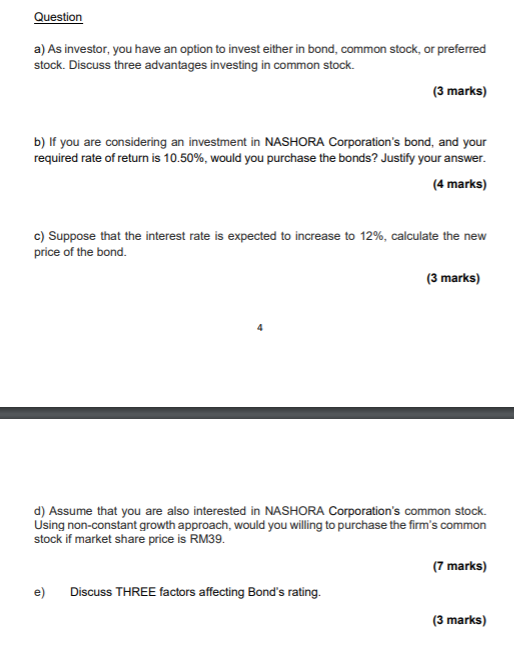

NASHORA Corporation is a company that focuses on development and manufacturing of technology. Five years ago, the company issued RM10,0000,000 of corporate bonds with a 20 year maturity. The bonds have a coupon rate of 10%, pay interest semi-annually, and have a par value of RM1,000. The bonds are currently trading at a price of RM1,050. The company also issued preferred stock that has a current market price of RM47.50, a par value of RM50, and a dividend payment of 10% from the par value. The required rate of returns for the investment of equal risk is 9%. NASHORA Corporation is just developed new software that generates more earnings. As a result, the company is expected to experience 20% dividend growth rate for the next four years. After year four, the growth is expected to be constant at 6% forever. The company just paid a dividend of RM0.65 cents per share (Do). The company stock has a beta of 1.2, the risk of short-term treasury bills is 3%, and the returns on the FBMKLCI index is 8%. Question a) As investor, you have an option to invest either in bond, common stock, or preferred stock. Discuss three advantages investing in common stock. (3 marks) b) If you are considering an investment in NASHORA Corporation's bond, and your required rate of return is 10.50%, would you purchase the bonds? Justify your answer. (4 marks) C) Suppose that the interest rate is expected to increase to 12%, calculate the new price of the bond. (3 marks) d) Assume that you are also interested in NASHORA Corporation's common stock Using non-constant growth approach, would you willing to purchase the firm's common stock if market share price is RM39. (7 marks) e) Discuss THREE factors affecting Bond's rating. (3 marks) NASHORA Corporation is a company that focuses on development and manufacturing of technology. Five years ago, the company issued RM10,0000,000 of corporate bonds with a 20 year maturity. The bonds have a coupon rate of 10%, pay interest semi-annually, and have a par value of RM1,000. The bonds are currently trading at a price of RM1,050. The company also issued preferred stock that has a current market price of RM47.50, a par value of RM50, and a dividend payment of 10% from the par value. The required rate of returns for the investment of equal risk is 9%. NASHORA Corporation is just developed new software that generates more earnings. As a result, the company is expected to experience 20% dividend growth rate for the next four years. After year four, the growth is expected to be constant at 6% forever. The company just paid a dividend of RM0.65 cents per share (Do). The company stock has a beta of 1.2, the risk of short-term treasury bills is 3%, and the returns on the FBMKLCI index is 8%. Question a) As investor, you have an option to invest either in bond, common stock, or preferred stock. Discuss three advantages investing in common stock. (3 marks) b) If you are considering an investment in NASHORA Corporation's bond, and your required rate of return is 10.50%, would you purchase the bonds? Justify your answer. (4 marks) C) Suppose that the interest rate is expected to increase to 12%, calculate the new price of the bond. (3 marks) d) Assume that you are also interested in NASHORA Corporation's common stock Using non-constant growth approach, would you willing to purchase the firm's common stock if market share price is RM39. (7 marks) e) Discuss THREE factors affecting Bond's rating

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started