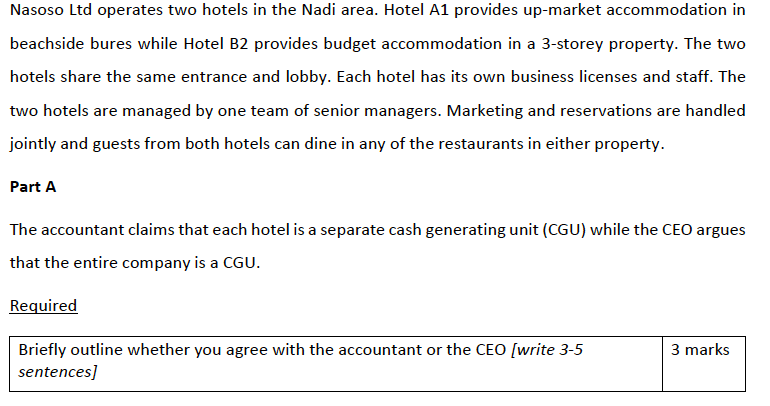

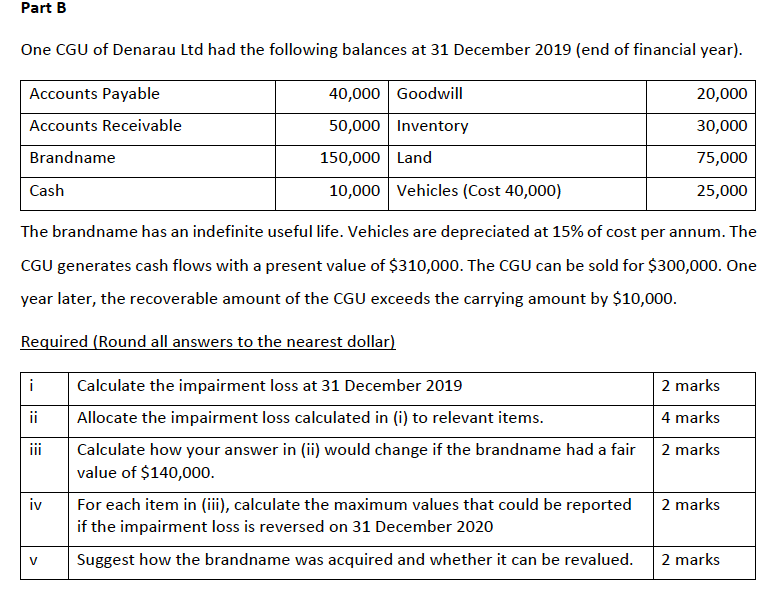

Nasoso Ltd operates two hotels in the Nadi area. Hotel A1 provides up-market accommodation in beachside bures while Hotel B2 provides budget accommodation in a 3-storey property. The two hotels share the same entrance and lobby. Each hotel has its own business licenses and staff. The two hotels are managed by one team of senior managers. Marketing and reservations are handled jointly and guests from both hotels can dine in any of the restaurants in either property. Part A The accountant claims that each hotel is a separate cash generating unit (CGU) while the CEO argues that the entire company is a CGU. Required 3 marks Briefly outline whether you agree with the accountant or the CEO [write 3-5 sentences] Part B One CGU of Denarau Ltd had the following balances at 31 December 2019 (end of financial year). Accounts Payable 40,000 Goodwill 20,000 Accounts Receivable 50,000 Inventory 30,000 Brandname 150,000 Land 75,000 Cash 10,000 Vehicles (Cost 40,000) 25,000 The brandname has an indefinite useful life. Vehicles are depreciated at 15% of cost per annum. The CGU generates cash flows with a present value of $310,000. The CGU can be sold for $300,000. One year later, the recoverable amount of the CGU exceeds the carrying amount by $10,000. Required (Round all answers to the nearest dollar) -. 2 marks ii 4 marks 2 marks Calculate the impairment loss at 31 December 2019 Allocate the impairment loss calculated in (i) to relevant items. Calculate how your answer in (ii) would change if the brandname had a fair value of $140,000. For each item in (iii), calculate the maximum values that could be reported if the impairment loss is reversed on 31 December 2020 Suggest how the brandname was acquired and whether it can be revalued. iv 2 marks V 2 marks Nasoso Ltd operates two hotels in the Nadi area. Hotel A1 provides up-market accommodation in beachside bures while Hotel B2 provides budget accommodation in a 3-storey property. The two hotels share the same entrance and lobby. Each hotel has its own business licenses and staff. The two hotels are managed by one team of senior managers. Marketing and reservations are handled jointly and guests from both hotels can dine in any of the restaurants in either property. Part A The accountant claims that each hotel is a separate cash generating unit (CGU) while the CEO argues that the entire company is a CGU. Required 3 marks Briefly outline whether you agree with the accountant or the CEO [write 3-5 sentences] Part B One CGU of Denarau Ltd had the following balances at 31 December 2019 (end of financial year). Accounts Payable 40,000 Goodwill 20,000 Accounts Receivable 50,000 Inventory 30,000 Brandname 150,000 Land 75,000 Cash 10,000 Vehicles (Cost 40,000) 25,000 The brandname has an indefinite useful life. Vehicles are depreciated at 15% of cost per annum. The CGU generates cash flows with a present value of $310,000. The CGU can be sold for $300,000. One year later, the recoverable amount of the CGU exceeds the carrying amount by $10,000. Required (Round all answers to the nearest dollar) -. 2 marks ii 4 marks 2 marks Calculate the impairment loss at 31 December 2019 Allocate the impairment loss calculated in (i) to relevant items. Calculate how your answer in (ii) would change if the brandname had a fair value of $140,000. For each item in (iii), calculate the maximum values that could be reported if the impairment loss is reversed on 31 December 2020 Suggest how the brandname was acquired and whether it can be revalued. iv 2 marks V 2 marks