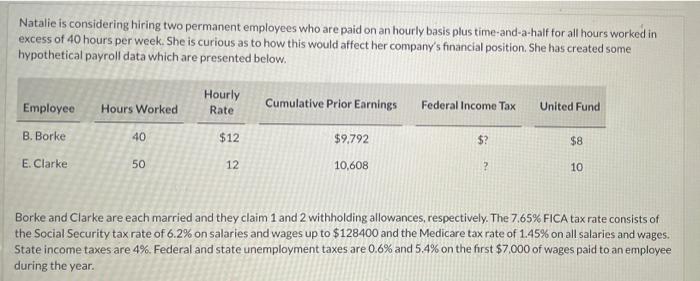

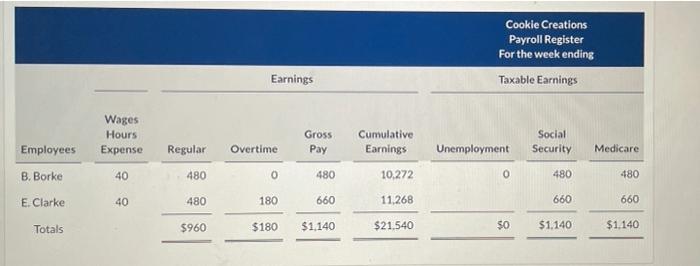

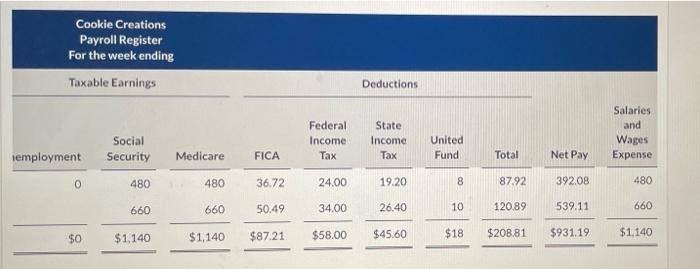

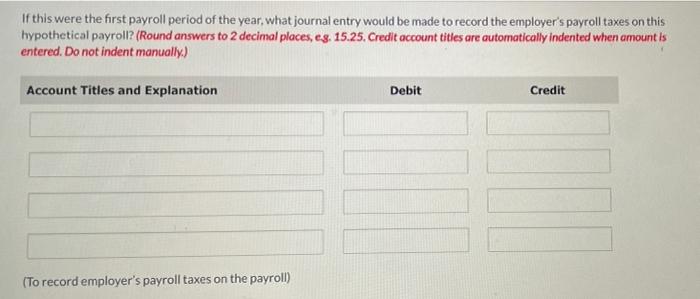

Natalie is considering hiring two permanent employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 hours per week. She is curious as to how this would affect her company's financial position. She has created some hypothetical payroll data which are presented below. Employee Hours Worked Hourly Rate Cumulative Prior Earnings Federal Income Tax United Fund B. Borke 40 $12 $9,792 $? $8 E. Clarke 50 12 10,608 ? 10 Borke and Clarke are each married and they claim 1 and 2 withholding allowances, respectively. The 7.65% FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and wages up to $128400 and the Medicare tax rate of 1.45% on all salaries and wages. State income taxes are 4%. Federal and state unemployment taxes are 0.6% and 5.4% on the first $7,000 of wages paid to an employee during the year. Cookie Creations Payroll Register For the week ending Taxable Earnings Earnings Wages Hours Expense Employees Gross Pay Overtime Cumulative Earnings Regular Social Security Unemployment Medicare B. Borke 40 480 0 480 10,272 0 480 480 E. Clarke 40 480 180 660 11.268 660 660 Totals $960 $180 $1.140 $21.540 $0 $1,140 $1.140 Cookie Creations Payroll Register For the week ending Taxable Earnings Deductions Federal Income Tax Social Security Salaries and Wages Expense State Income Tax United Fund Medicare FICA Total Net Pay employment 0 480 480 36.72 24.00 19.20 8 87.92 392.08 480 660 660 50.49 34.00 26.40 10 120.89 660 539.11 $0 $1,140 $1,140 $87.21 $58.00 $45.60 $18 $1.140 $208.81 $931.19 What journal entry should be prepared to record the employer's payroll taxes on this hypothetical payroll? (Round answers to 2 decimal places, eg. 15.25. Credit account titles are automatically indented when amount is eentered. Do not indent manually.) Account Titles and Explanation Debit Credit (To record employer's payroll taxes on the payroll) If this were the first payroll period of the year, what journal entry would be made to record the employer's payroll taxes on this hypothetical payroll? (Round answers to 2 decimal places, eg. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit (To record employer's payroll taxes on the payroll)