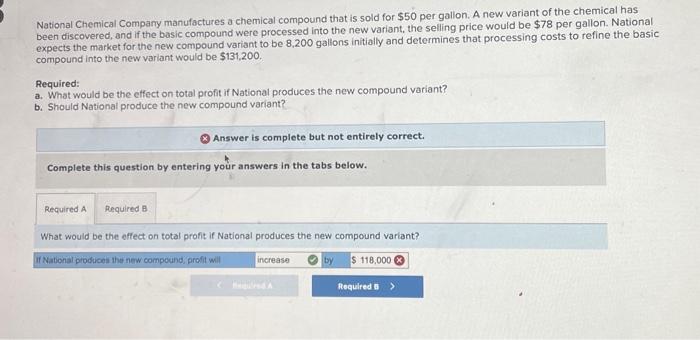

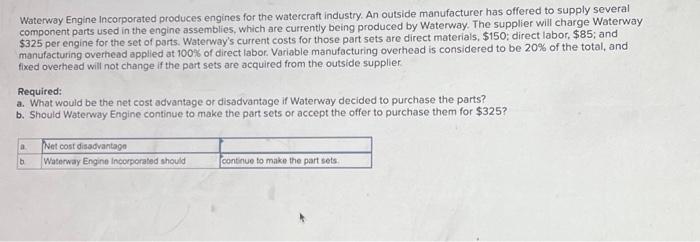

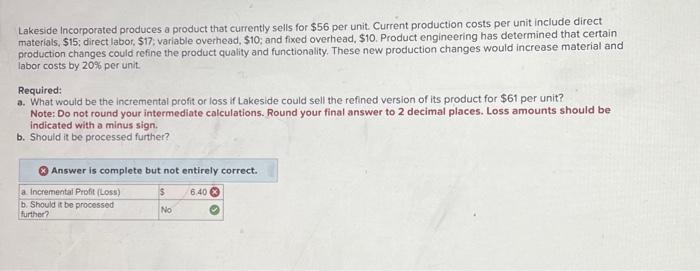

National Chemical Company manufactures a chemical compound that is sold for $50 per gallon. A new variant of the chemical has been discovered, and if the basic compound were processed into the new variant, the selling price would be $78 per gallon. National expects the market for the new compound variant to be 8,200 gallons initially and determines that processing costs to refine the basic compound into the new variant would be $131,200. Required: a. What would be the effect on total profit if National produces the new compound variant? b. Should National produce the new compound variant? \& Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What would be the effect on total profit if National produces the new compound variant? Waterway Engine Incorporated produces engines for the watercraft industry. An outside manufacturer has offered to supply several component parts used in the engine assemblies, which are currently being produced by Waterway. The supplier will charge Waterway $325 per engine for the set of parts. Waterway's current costs for those part sets are direct materials, $150; direct labor, $85; and manufacturing overhead applied at 100% of direct labor. Variable manufacturing overhead is considered to be 20% of the total, and fixed overhead will not change if the part sets are acquired from the outside supplier Required: a. What would be the net cost advantage or disadvantage if Waterway decided to purchase the parts? b. Should Waterway Engine continue to make the part sets or accept the offer to purchase them for $325 ? Lakeside Incorporated produces a product that currently sells for $56 per unit. Current production costs per unit include direct materials, \$15; direct labor, \$17; variable overhead, \$10; and fixed overhead, \$10. Product engineering has determined that certain production changes could refine the product quality and functionality. These new production changes would increase material and labor costs by 20% per unit. Required: a. What would be the incremental profit or loss if Lakeside could sell the refined version of its product for $61 per unit? Note: Do not round your intermediate calculations. Round your final answer to 2 decimal places. Loss amounts should be indicated with a minus sign. b. Should it be processed further? Answer is complete but not entirely correct