Answered step by step

Verified Expert Solution

Question

1 Approved Answer

National Corp. is an all-equity firm with 22,000 shares of stock outstanding with a market price of $27 a share. The current cost of

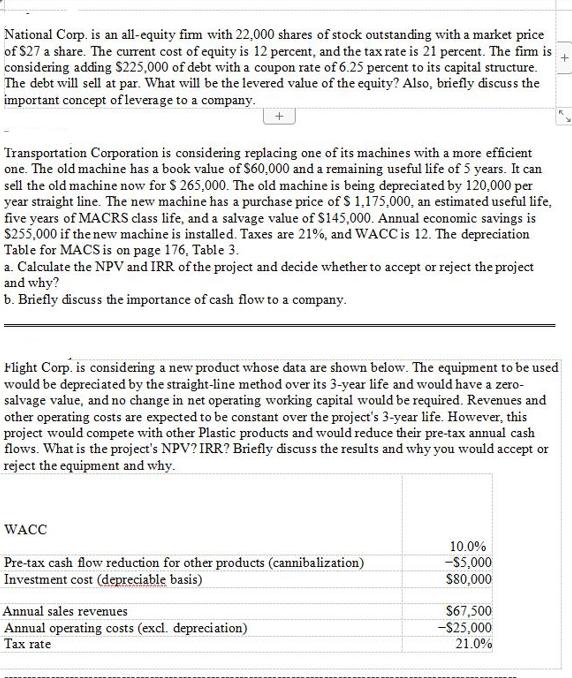

National Corp. is an all-equity firm with 22,000 shares of stock outstanding with a market price of $27 a share. The current cost of equity is 12 percent, and the tax rate is 21 percent. The firm is considering adding $225,000 of debt with a coupon rate of 6.25 percent to its capital structure. The debt will sell at par. What will be the levered value of the equity? Also, briefly discuss the important concept of leverage to a company. Transportation Corporation is considering replacing one of its machines with a more efficient one. The old machine has a book value of $60,000 and a remaining useful life of 5 years. It can sell the old machine now for $ 265,000. The old machine is being depreciated by 120,000 per year straight line. The new machine has a purchase price of $ 1,175,000, an estimated useful life, five years of MACRS class life, and a salvage value of $145,000. Annual economic savings is $255,000 if the new machine is installed. Taxes are 21%, and WACC is 12. The depreciation Table for MACS is on page 176, Table 3. a. Calculate the NPV and IRR of the project and decide whether to accept or reject the project and why? b. Briefly discuss the importance of cash flow to a company. Flight Corp. is considering a new product whose data are shown below. The equipment to be used would be depreciated by the straight-line method over its 3-year life and would have a zero- salvage value, and no change in net operating working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. However, this project would compete with other Plastic products and would reduce their pre-tax annual cash flows. What is the project's NPV? IRR? Briefly discuss the results and why you would accept or reject the equipment and why. WACC Pre-tax cash flow reduction for other products (cannibalization) Investment cost (depreciable basis) Annual sales revenues Annual operating costs (excl. depreciation) Tax rate 10.0% -$5,000 $80,000 $67,500 -$25,000 21.0% National Corp. is an all-equity firm with 22,000 shares of stock outstanding with a market price of $27 a share. The current cost of equity is 12 percent, and the tax rate is 21 percent. The firm is considering adding $225,000 of debt with a coupon rate of 6.25 percent to its capital structure. The debt will sell at par. What will be the levered value of the equity? Also, briefly discuss the important concept of leverage to a company. Transportation Corporation is considering replacing one of its machines with a more efficient one. The old machine has a book value of $60,000 and a remaining useful life of 5 years. It can sell the old machine now for $ 265,000. The old machine is being depreciated by 120,000 per year straight line. The new machine has a purchase price of $ 1,175,000, an estimated useful life, five years of MACRS class life, and a salvage value of $145,000. Annual economic savings is $255,000 if the new machine is installed. Taxes are 21%, and WACC is 12. The depreciation Table for MACS is on page 176, Table 3. a. Calculate the NPV and IRR of the project and decide whether to accept or reject the project and why? b. Briefly discuss the importance of cash flow to a company. Flight Corp. is considering a new product whose data are shown below. The equipment to be used would be depreciated by the straight-line method over its 3-year life and would have a zero- salvage value, and no change in net operating working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. However, this project would compete with other Plastic products and would reduce their pre-tax annual cash flows. What is the project's NPV? IRR? Briefly discuss the results and why you would accept or reject the equipment and why. WACC Pre-tax cash flow reduction for other products (cannibalization) Investment cost (depreciable basis) Annual sales revenues Annual operating costs (excl. depreciation) Tax rate 10.0% -$5,000 $80,000 $67,500 -$25,000 21.0%

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the levered value of equity for National Corp we first need to determine the value of the debt being added to the capital struct...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started