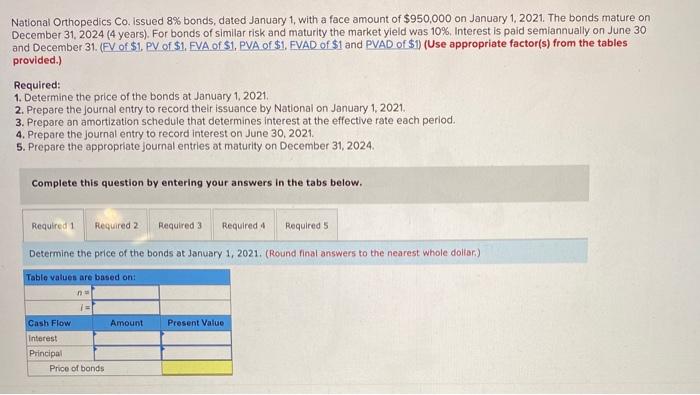

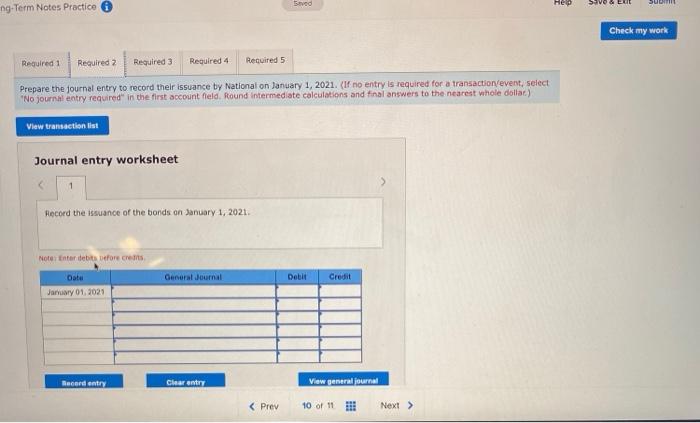

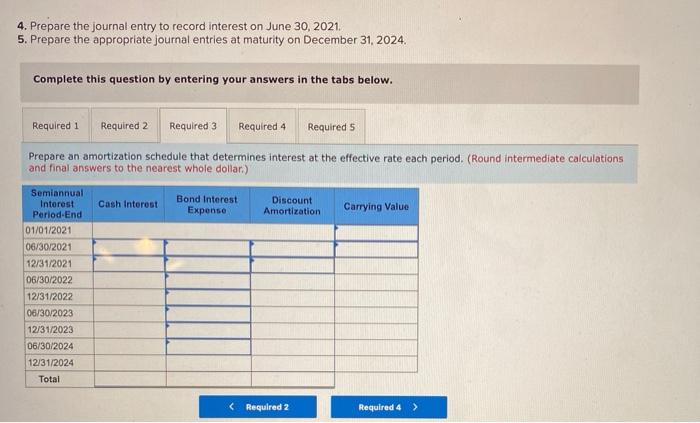

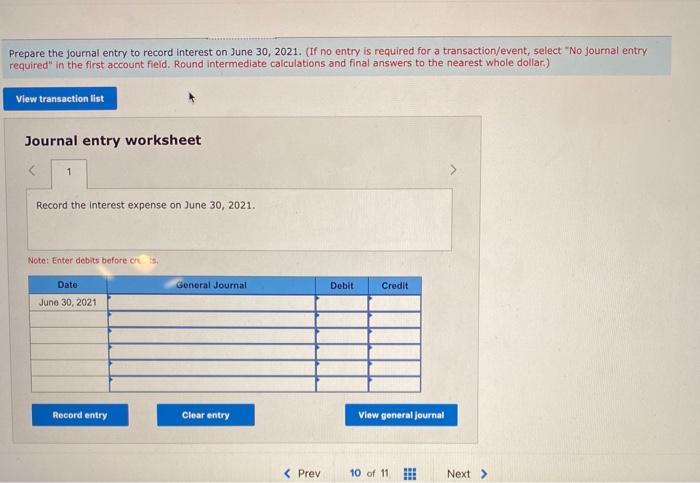

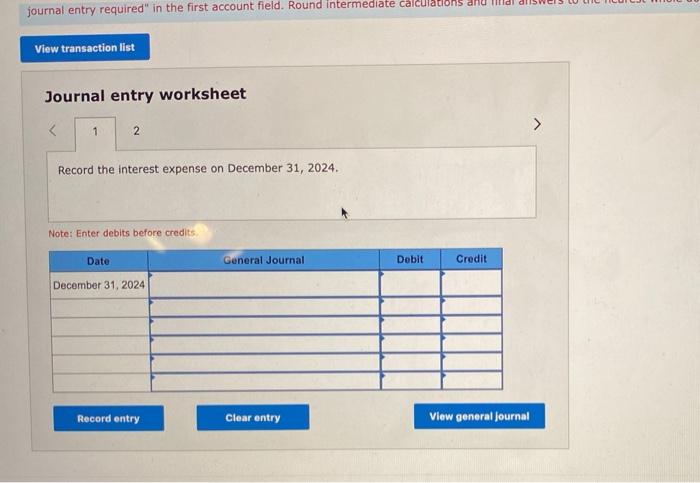

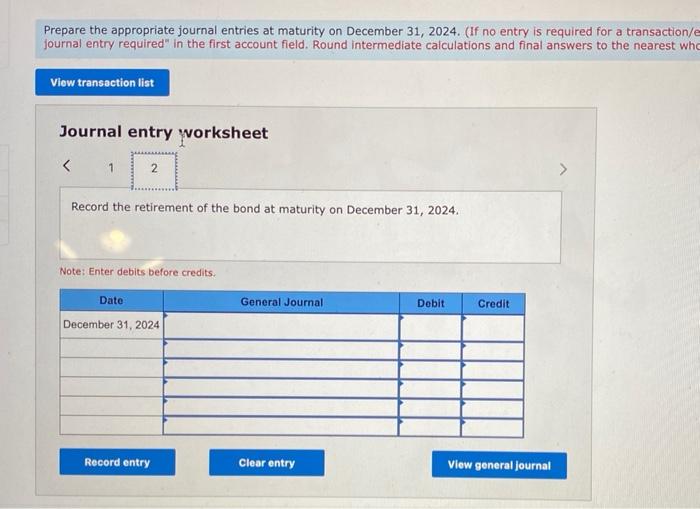

National Orthopedics Co. Issued 8% bonds, dated January 1, with a face amount of $950,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yleld was 10%, Interest is paid semiannually on June 30 and December 31. (FV of $1. PV of $1. EVA of S1, PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price of the bonds at January 1, 2021. 2. Prepare the Journal entry to record their issuance by National on January 1, 2021. 3. Prepare an amortization schedule that determines interest at the effective rate each period. 4. Prepare the journal entry to record interest on June 30, 2021. 5. Prepare the appropriate Journal entries at maturity on December 31, 2024 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Determine the price of the bonds at January 1, 2021. (Round Pinal answers to the nearest whole doltar.) Table values are based on: 1= Amount Present Value Cash Flow Interest Principal Price of bonds Seved Help SUB ng-Term Notes Practice i Check my work Required 1 Required 2 Required 3 Required 4 Required 5 Prepare the journal entry to record their issuance by National on January 1, 2021. (If no entry is required for a transaction/event, select "No journal entry required in the first account held: Round Intermediate calculations and final answers to the nearest whole dollar) View transaction ist Journal entry worksheet 1 Record the suance of the bonds on January 1, 2021. Notenter debita efore credits General Journal Debit Credit Date January 01, 2021 Record entry Clear entre View general journal 4. Prepare the journal entry to record interest on June 30, 2021. 5. Prepare the appropriate journal entries at maturity on December 31, 2024. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare an amortization schedule that determines interest at the effective rate each period. (Round intermediate calculations and final answers to the nearest whole dollar) Cash Interest Bond Interest Expense Discount Amortization Carrying Value Semiannual Interest Period-End 01/01/2021 06/30/2021 12/31/2021 06/30/2022 12/31/2022 06/30/2023 12/31/2023 06/30/2024 12/31/2024 Total Prepare the journal entry to record interest on June 30, 2021. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Round intermediate calculations and final answers to the nearest whole dollar.) View transaction list Journal entry worksheet 1 Record the interest expense on June 30, 2021. Note: Enter debits before che General Journal Debit Credit Date June 30, 2021 Record entry Clear entry View general Journal journal entry required" in the first account field. Round intermediate calculadons anu View transaction list Journal entry worksheet Record the retirement of the bond at maturity on December 31, 2024. Note: Enter debits before credits Date December 31, 2024 General Journal Debit Credit Record entry Clear entry View general Journal