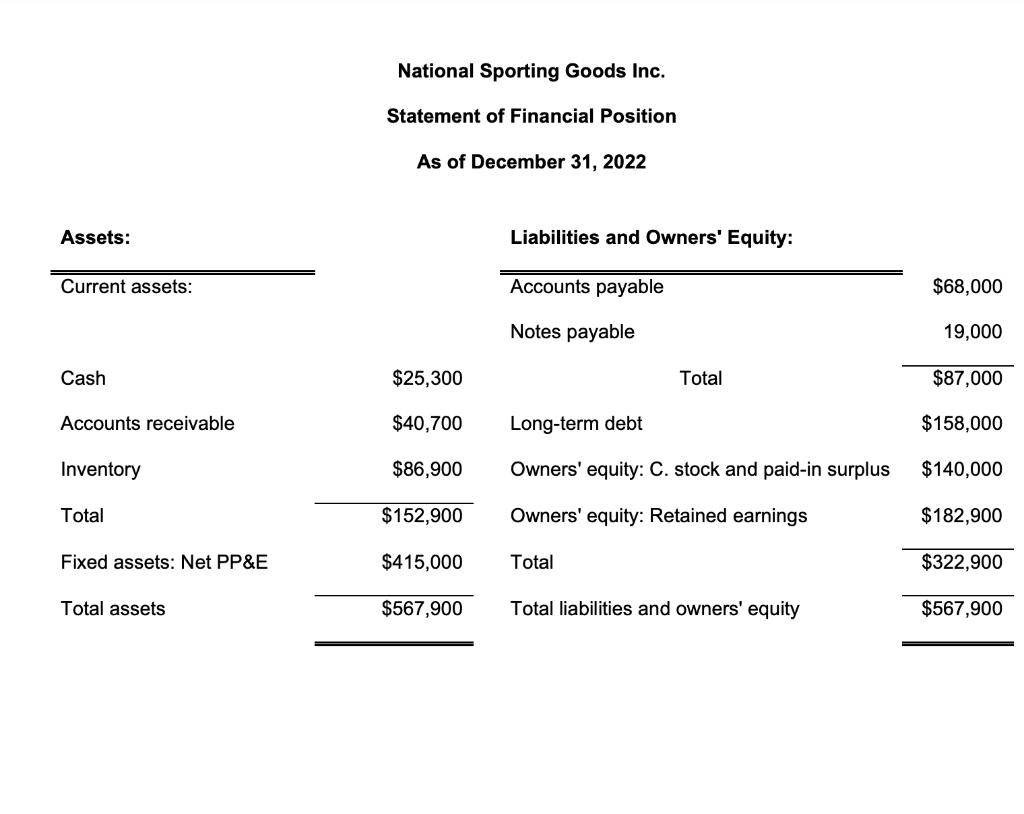

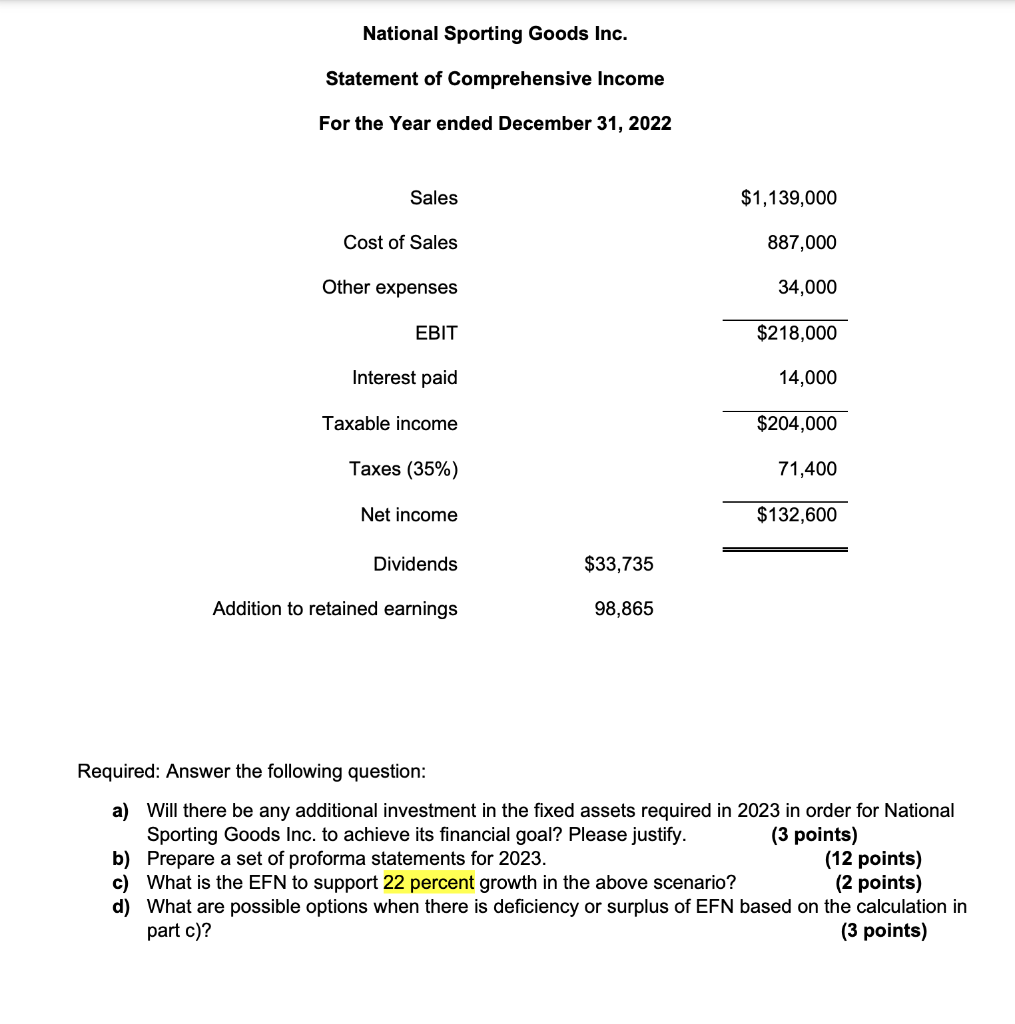

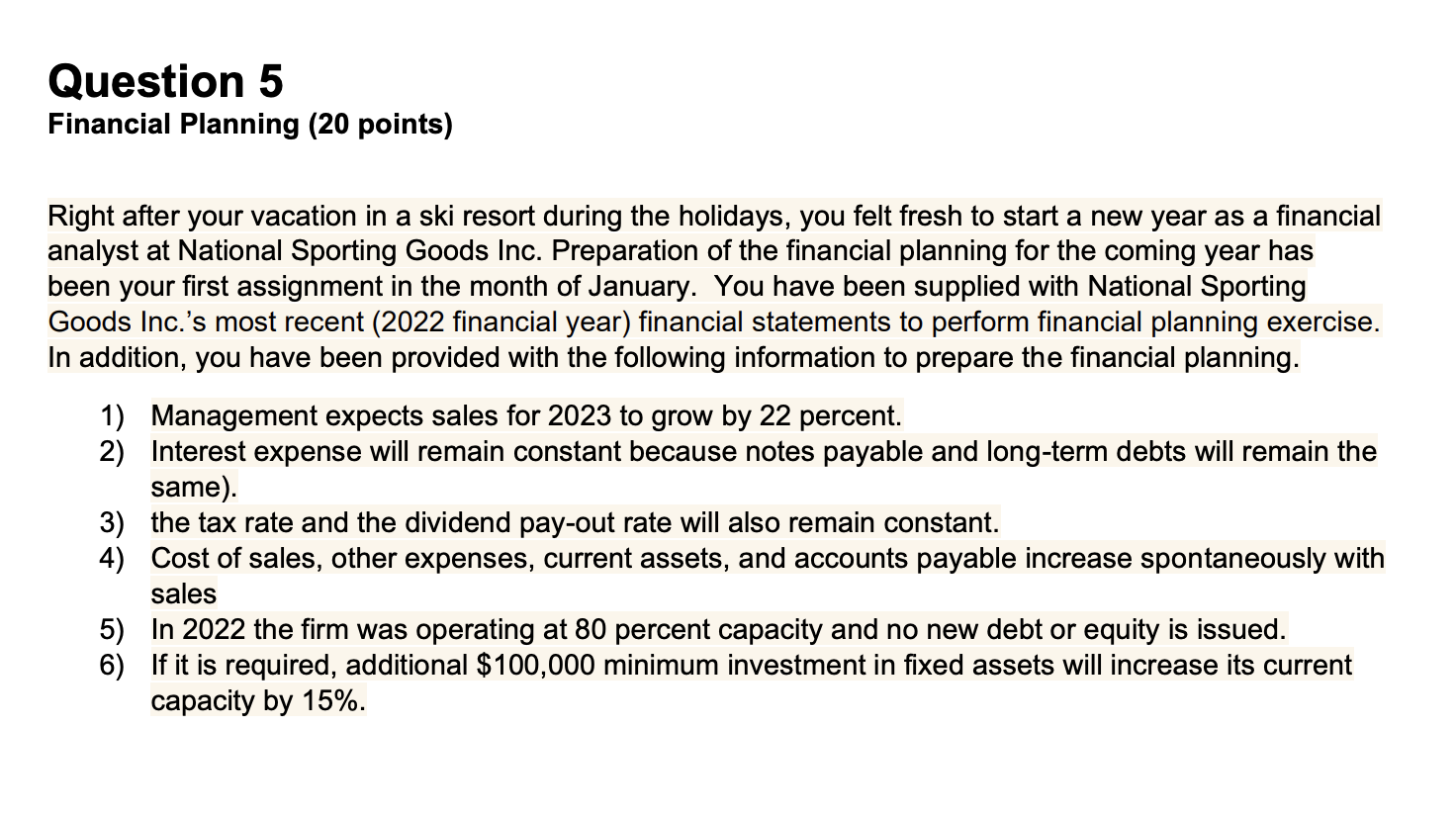

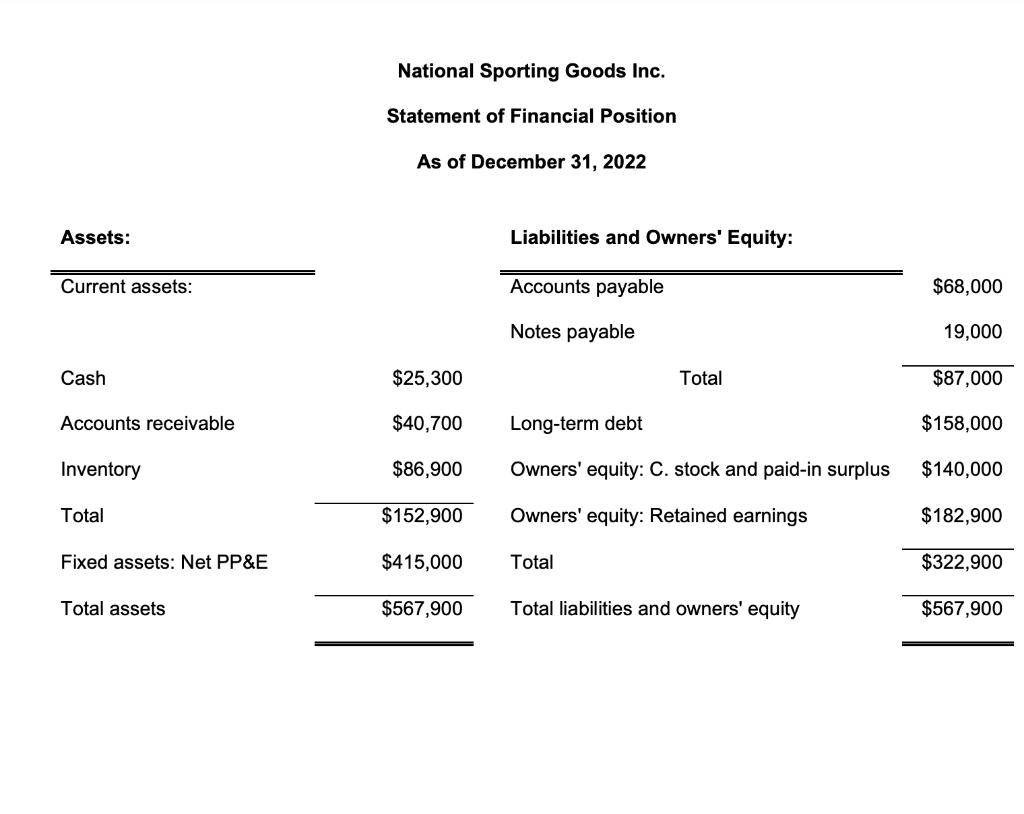

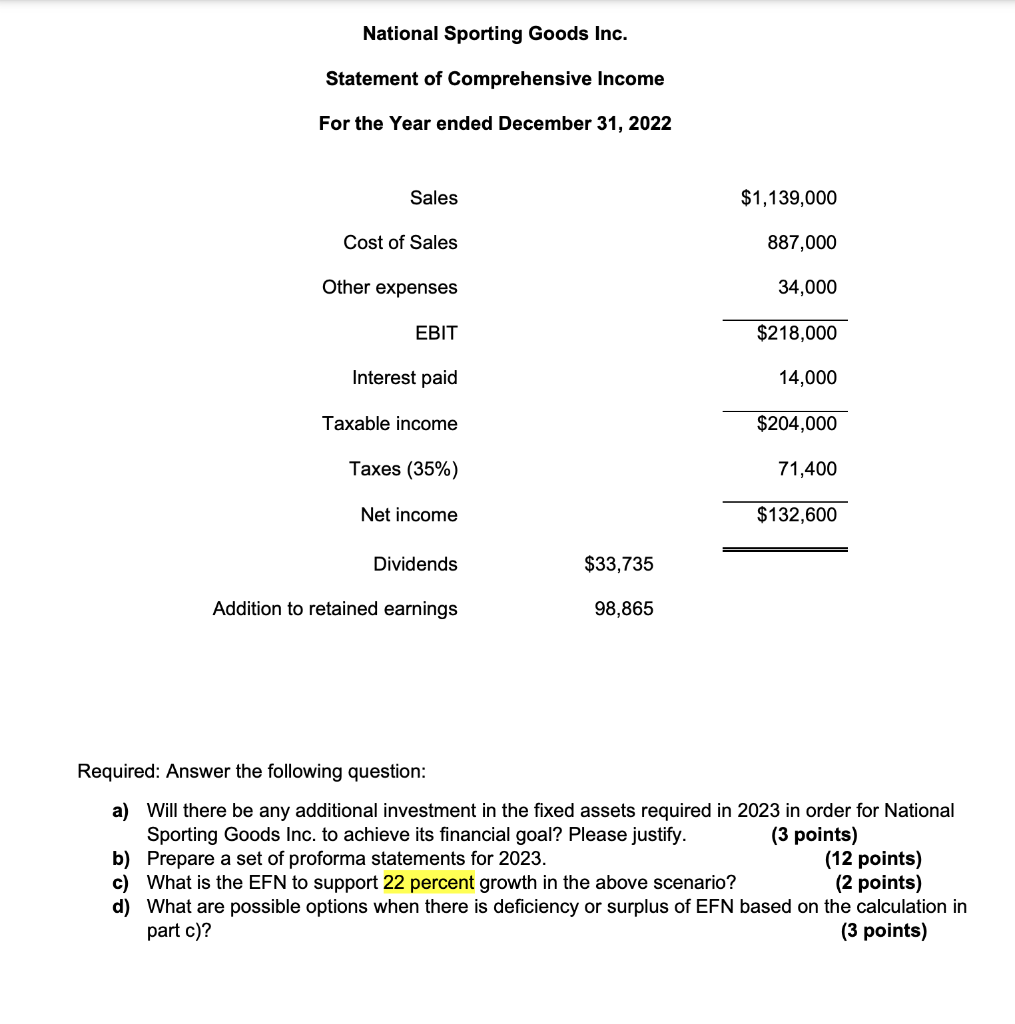

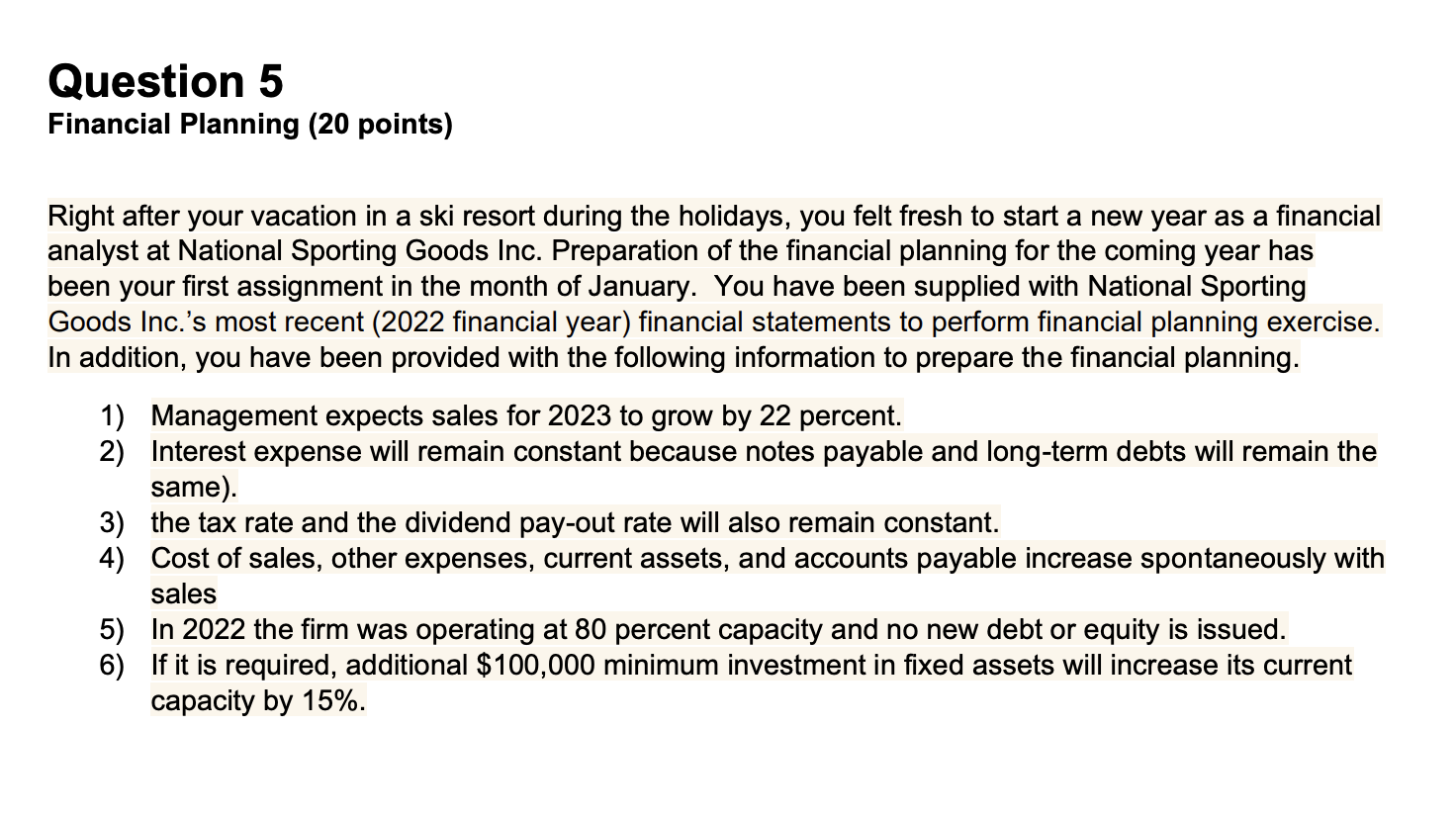

National Sporting Goods Inc. Statement of Financial Position As of December 31, 2022 National Sporting Goods Inc. Statement of Comprehensive Income For the Year ended December 31, 2022 Addition t Required: Answer the following question: a) Will there be any additional investment in the fixed assets required in 2023 in order for National Sporting Goods Inc. to achieve its financial goal? Please justify. (3 points) b) Prepare a set of proforma statements for 2023. (12 points) c) What is the EFN to support 22 percent growth in the above scenario? (2 points) d) What are possible options when there is deficiency or surplus of EFN based on the calculation in part c)? (3 points) Right after your vacation in a ski resort during the holidays, you felt fresh to start a new year as a financial analyst at National Sporting Goods Inc. Preparation of the financial planning for the coming year has been your first assignment in the month of January. You have been supplied with National Sporting Goods Inc.'s most recent (2022 financial year) financial statements to perform financial planning exercise. In addition, you have been provided with the following information to prepare the financial planning. 1) Management expects sales for 2023 to grow by 22 percent. 2) Interest expense will remain constant because notes payable and long-term debts will remain the same). 3) the tax rate and the dividend pay-out rate will also remain constant. 4) Cost of sales, other expenses, current assets, and accounts payable increase spontaneously with sales 5) In 2022 the firm was operating at 80 percent capacity and no new debt or equity is issued. 6) If it is required, additional $100,000 minimum investment in fixed assets will increase its current capacity by 15%. National Sporting Goods Inc. Statement of Financial Position As of December 31, 2022 National Sporting Goods Inc. Statement of Comprehensive Income For the Year ended December 31, 2022 Addition t Required: Answer the following question: a) Will there be any additional investment in the fixed assets required in 2023 in order for National Sporting Goods Inc. to achieve its financial goal? Please justify. (3 points) b) Prepare a set of proforma statements for 2023. (12 points) c) What is the EFN to support 22 percent growth in the above scenario? (2 points) d) What are possible options when there is deficiency or surplus of EFN based on the calculation in part c)? (3 points) Right after your vacation in a ski resort during the holidays, you felt fresh to start a new year as a financial analyst at National Sporting Goods Inc. Preparation of the financial planning for the coming year has been your first assignment in the month of January. You have been supplied with National Sporting Goods Inc.'s most recent (2022 financial year) financial statements to perform financial planning exercise. In addition, you have been provided with the following information to prepare the financial planning. 1) Management expects sales for 2023 to grow by 22 percent. 2) Interest expense will remain constant because notes payable and long-term debts will remain the same). 3) the tax rate and the dividend pay-out rate will also remain constant. 4) Cost of sales, other expenses, current assets, and accounts payable increase spontaneously with sales 5) In 2022 the firm was operating at 80 percent capacity and no new debt or equity is issued. 6) If it is required, additional $100,000 minimum investment in fixed assets will increase its current capacity by 15%