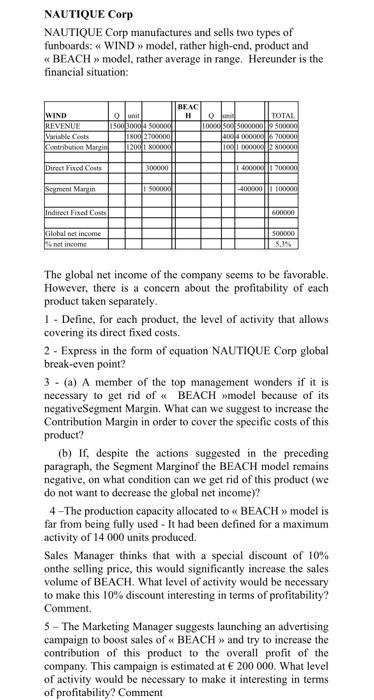

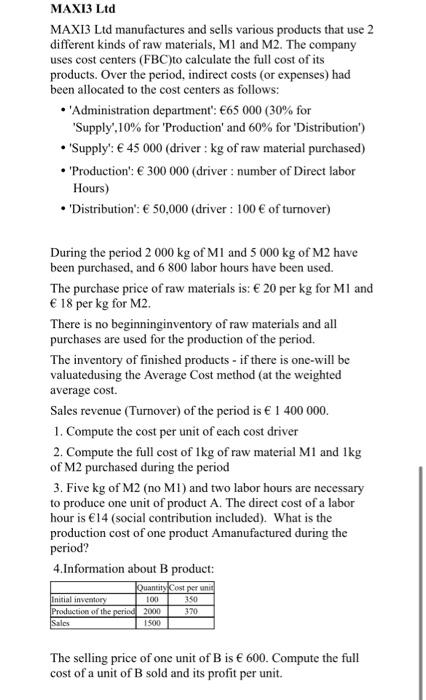

NAUTIQUE Corp NAUTIQUE Corp manufactures and sells two types of funboards: \& WIND w model, rather high-end, product and " BEACH model, rather average in range. Hereunder is the financial situation: The global net income of the company seems to be favorable. However, there is a concern about the profitability of each product taken separately. 1 - Define, for each product, the level of activity that allows covering its direct fixed costs. 2 - Express in the form of equation NAUTIQUE Corp global break-even point? 3 - (a) A member of the top management wonders if it is necessary to get rid of a BEACH mmodel because of its negativeSegment Margin. What can we suggest to increase the Contribution Margin in order to cover the specific costs of this product? (b) If, despite the actions suggested in the preceding paragraph, the Segment Marginof the BEACH model remains negative, on what condition can we get rid of this product (we do not want to decrease the global net income)? 4-The production capacity allocated to BEACH model is far from being fully used - It had been defined for a maximum activity of 14000 units produced. Sales Manager thinks that with a special discount of 10% onthe selling price, this would significantly increase the sales volume of BEACH. What level of activity would be necessary to make this 10% discount interesting in terms of profitability? Comment. 5 - The Marketing Manager suggests launching an advertising campaign to boost sales of a BEACHn and try to increase the contribution of this product to the overall profit of the company. This campaign is estimated at 200000. What level of activity would be necessary to make it interesting in terms of profitability? Comment The company's sharcholders are concerned with profitability problem and ask top management to set up a BSC dashboard. The company is positioned in a very competitive market but offering significant growth prospective Customers are not very loyal, looking above all for highquality equipment, and given the "passion buy" factor, they are willing to pay a high price. Taking into account the fact that this sporting activity has become very fashionable, the brand image of the manufacturer is very important in buying process. A balance must be found between a rate of return on equity of 15%, requested by shareholders, and the need to generate a sufficient operating margin to finance investments. In collaboration with the management control department, the production department is constantly looking for savings and is working particularly on optimising flows and looking for "areas of non-added value". In addition, productive investments are important because technologies are evolving rapidly due to the appearance of new composite materials that are more efficient, but require significant training of production teams in these new technologies. The training of teams being long and expensive, it appears that personnel management is taking an increasingly important place, especially in the management of tumover, teams being regularly contacted by competitors who try to poach them. Question: Build the BSC map MAXI3 Ltd MAXI3 Ltd manufactures and sells various products that use 2 different kinds of raw materials, M1 and M2. The company uses cost centers (FBC)to calculate the full cost of its products. Over the period, indirect costs (or expenses) had been allocated to the cost centers as follows: - 'Administration department': 65000 (30\% for 'Supply', 10% for 'Production' and 60% for 'Distribution') - 'Supply': 45000 (driver : kg of raw material purchased) - 'Production': 300000 (driver : number of Direct labor Hours) - 'Distribution': 50,000 (driver : 100 of turnover) MAXI3 Ltd MAXI3 Ltd manufactures and sells various products that use 2 different kinds of raw materials, M1 and M2. The company uses cost centers (FBC) to calculate the full cost of its products. Over the period, indirect costs (or expenses) had been allocated to the cost centers as follows: - 'Administration department': 65000 (30\% for 'Supply', 10% for 'Production' and 60% for 'Distribution') - 'Supply': 45000 (driver : kg of raw material purchased) - 'Production': 300000 (driver : number of Direct labor Hours) - 'Distribution': 50,000 (driver : 100 of turnover) During the period 2000kg of M1 and 5000kg of M2 have been purchased, and 6800 labor hours have been used. The purchase price of raw materials is: 20 per kg for MI and 18 per kg for M2. There is no beginninginventory of raw materials and all purchases are used for the production of the period. The inventory of finished products - if there is one-will be valuatedusing the Average Cost method (at the weighted average cost. Sales revenue (Turnover) of the period is 1400000. 1. Compute the cost per unit of each cost driver 2. Compute the full cost of 1kg of raw material M1 and 1kg of M2 purchased during the period 3. Five kg of M2 (no M1 ) and two labor hours are necessary to produce one unit of product A. The direct cost of a labor hour is 14 (social contribution included). What is the production cost of one product Amanufactured during the period? 4.Information about B product: The selling price of one unit of B is 600. Compute the full cost of a unit of B sold and its profit per unit. NAUTIQUE Corp NAUTIQUE Corp manufactures and sells two types of funboards: \& WIND w model, rather high-end, product and " BEACH model, rather average in range. Hereunder is the financial situation: The global net income of the company seems to be favorable. However, there is a concern about the profitability of each product taken separately. 1 - Define, for each product, the level of activity that allows covering its direct fixed costs. 2 - Express in the form of equation NAUTIQUE Corp global break-even point? 3 - (a) A member of the top management wonders if it is necessary to get rid of a BEACH mmodel because of its negativeSegment Margin. What can we suggest to increase the Contribution Margin in order to cover the specific costs of this product? (b) If, despite the actions suggested in the preceding paragraph, the Segment Marginof the BEACH model remains negative, on what condition can we get rid of this product (we do not want to decrease the global net income)? 4-The production capacity allocated to BEACH model is far from being fully used - It had been defined for a maximum activity of 14000 units produced. Sales Manager thinks that with a special discount of 10% onthe selling price, this would significantly increase the sales volume of BEACH. What level of activity would be necessary to make this 10% discount interesting in terms of profitability? Comment. 5 - The Marketing Manager suggests launching an advertising campaign to boost sales of a BEACHn and try to increase the contribution of this product to the overall profit of the company. This campaign is estimated at 200000. What level of activity would be necessary to make it interesting in terms of profitability? Comment The company's sharcholders are concerned with profitability problem and ask top management to set up a BSC dashboard. The company is positioned in a very competitive market but offering significant growth prospective Customers are not very loyal, looking above all for highquality equipment, and given the "passion buy" factor, they are willing to pay a high price. Taking into account the fact that this sporting activity has become very fashionable, the brand image of the manufacturer is very important in buying process. A balance must be found between a rate of return on equity of 15%, requested by shareholders, and the need to generate a sufficient operating margin to finance investments. In collaboration with the management control department, the production department is constantly looking for savings and is working particularly on optimising flows and looking for "areas of non-added value". In addition, productive investments are important because technologies are evolving rapidly due to the appearance of new composite materials that are more efficient, but require significant training of production teams in these new technologies. The training of teams being long and expensive, it appears that personnel management is taking an increasingly important place, especially in the management of tumover, teams being regularly contacted by competitors who try to poach them. Question: Build the BSC map MAXI3 Ltd MAXI3 Ltd manufactures and sells various products that use 2 different kinds of raw materials, M1 and M2. The company uses cost centers (FBC)to calculate the full cost of its products. Over the period, indirect costs (or expenses) had been allocated to the cost centers as follows: - 'Administration department': 65000 (30\% for 'Supply', 10% for 'Production' and 60% for 'Distribution') - 'Supply': 45000 (driver : kg of raw material purchased) - 'Production': 300000 (driver : number of Direct labor Hours) - 'Distribution': 50,000 (driver : 100 of turnover) MAXI3 Ltd MAXI3 Ltd manufactures and sells various products that use 2 different kinds of raw materials, M1 and M2. The company uses cost centers (FBC) to calculate the full cost of its products. Over the period, indirect costs (or expenses) had been allocated to the cost centers as follows: - 'Administration department': 65000 (30\% for 'Supply', 10% for 'Production' and 60% for 'Distribution') - 'Supply': 45000 (driver : kg of raw material purchased) - 'Production': 300000 (driver : number of Direct labor Hours) - 'Distribution': 50,000 (driver : 100 of turnover) During the period 2000kg of M1 and 5000kg of M2 have been purchased, and 6800 labor hours have been used. The purchase price of raw materials is: 20 per kg for MI and 18 per kg for M2. There is no beginninginventory of raw materials and all purchases are used for the production of the period. The inventory of finished products - if there is one-will be valuatedusing the Average Cost method (at the weighted average cost. Sales revenue (Turnover) of the period is 1400000. 1. Compute the cost per unit of each cost driver 2. Compute the full cost of 1kg of raw material M1 and 1kg of M2 purchased during the period 3. Five kg of M2 (no M1 ) and two labor hours are necessary to produce one unit of product A. The direct cost of a labor hour is 14 (social contribution included). What is the production cost of one product Amanufactured during the period? 4.Information about B product: The selling price of one unit of B is 600. Compute the full cost of a unit of B sold and its profit per unit