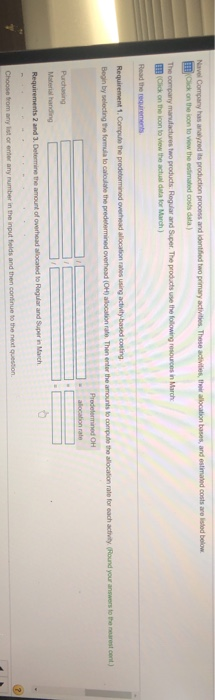

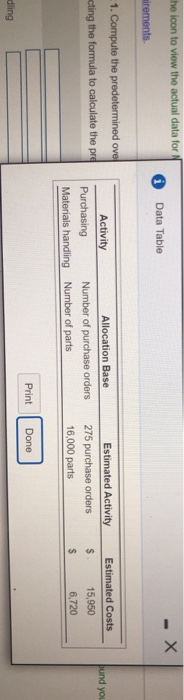

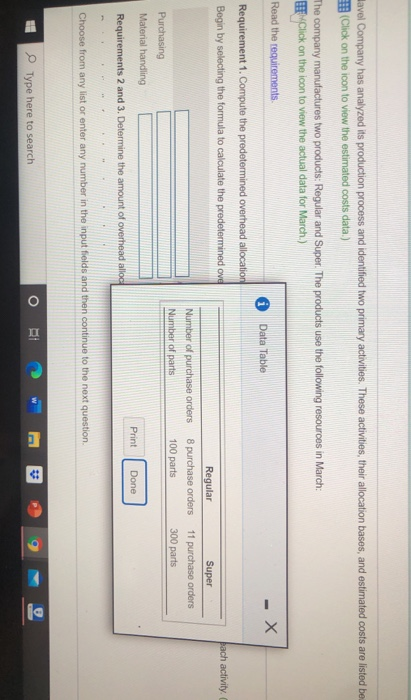

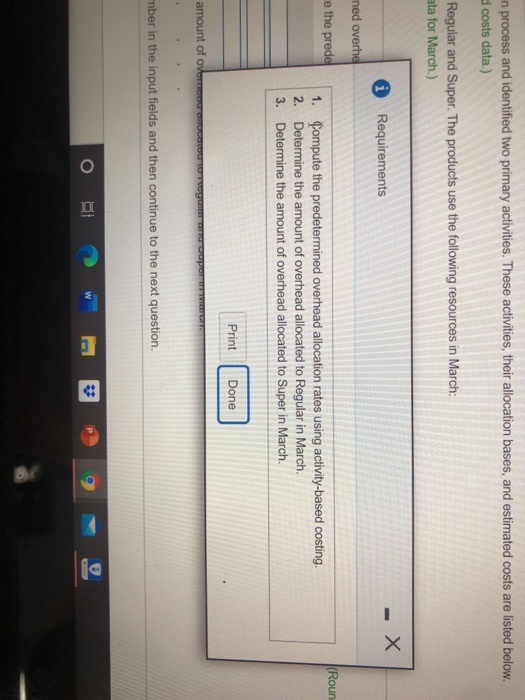

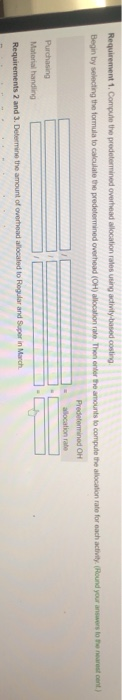

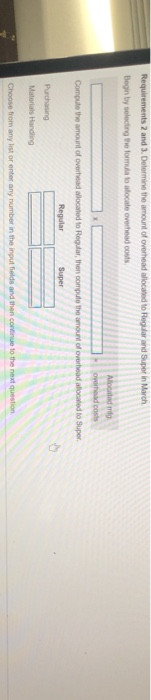

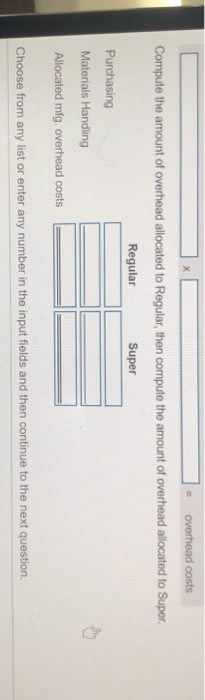

Navel Company has analyzed its production process and identified two primary activities. These activities, their allocation bases, and estimated costs are listed below. Click on the icon to view the estimated costs data) The company manufactures to products. Regular and Super. The products use the following resources in March Click on the toon to view the actual data for March) Read the requirements Requirement 1. Compute the predetermined overhead allocations using activity-based costing Begin by selecting the formula to calculate the predetermined overhead (OH) allocation. Then enter the amounts to compute the allocation rate for each activity. (Round your answers to the nearest cont) Predam OH allocation rate Purchasing Material handling Requirements 2 and 3. Determine the amount of overhead allocated to regular and Super in March Choose from any lost or enter any number in the input fields and then continue to the next question he icon to view the actual data for N - X Data Table mirements 1. Compute the predetermined ove acting the formula to calculate the pre Estimated Costs bund you Activity Allocation Base Purchasing Number of purchase orders Materials handling Number of parts Estimated Activity 275 purchase orders 16,000 parts $ $ 15,950 6,720 Print Done diing Havel Company has analyzed its production process and identified two primary activities. These activities, their allocation bases, and estimated costs are listed be (Click on the icon to view the estimated costs data.) The company manufactures two products: Regular and Super. The products use the following resources in March: Click on the icon to view the actual data for March.) Read the requirements i Data Table - X Requirement 1. Compute the predetermined overhead allocation Begin by selecting the formula to calculate the predetermined ove pach activity Regular Super Number of purchase orders 8 purchase orders 11 purchase orders Number of parts 100 parts Purchasing 300 parts Material handling Print Done Requirements 2 and 3. Determine the amount of overhead alloc Choose from any list or enter any number in the input fields and then continue to the next question o Type here to search > n process and identified two primary activities. These activities, their allocation bases, and estimated costs are listed below. costs data.) Regular and Super. The products use the following resources in March: ata for March.) - X Requirements ned overhe ce the prede (Roun 1. Compute the predetermined overhead allocation rates using activity-based costing. 2. Determine the amount of overhead allocated to Regular in March. 3. Determine the amount of overhead allocated to Super in March. Print Done amount of Ovemo mber in the input fields and then continue to the next question. o BI Requirement 1. Compute the predetermined overhead allocation rates using activity based costing Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate Then enter the amounts to compute the allocation rate for each activity. (Round your answers to the nearest cent) Predetermined OH allocation rate Purchasing Material handling Requirements 2 and 3. Determine the amount of overhead allocated to Regular and Super in March Requirements 2 and 3. Determine the amount of overhead allocated to Regular and Super in March Begin by selecting the formula fotocate overhead could Alte mo oorhead costs Compute the amount of overhead waled to Regular, then compute the amount of overhead allocated to Super Regular Super Purchasing Material Handling Choose from any list or enter any number in the input fields and then continue to the next question overhead costs Compute the amount of overhead allocated to Regular, then compute the amount of overhead allocated to Super. Regular Super Purchasing Materials Handling Allocated mig, overhead costs Choose from any list or enter any number in the input fields and then continue to the next