Question

Nazarick Agency is a company dealing with issues with the asymmetric information problem. The following is the model that they want to analyze: (Note: this

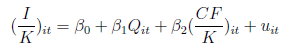

Nazarick Agency is a company dealing with issues with the asymmetric information problem. The following is the model that they want to analyze:

(Note: this is the empirical model presented from the research of Fazzari, Hubbard and Petersen (1988)

This model was presented by a client company known as Magala Corp. They said that this was from a certain research they found from Fazzari, Hubbard and Petersen (1988).

Q refers to the average q value (tobin's q) at the period's beginning

CF refers to the internal fund availability where it's equal income after interest+taxes+noncash deductions from income (dividends not deducted from CF)

The Beta coefficient is the sensitivity of investment to the fluctuations on CF (this is after investment opportunities are controlled)

As per request, Magala Corp. wants to know that within the capital market, when THERE IS asymmetric information, what should the sign (positiveegativeeutral) of the coefficient Beta2 or 2 as shown in the model be? Explain thoroughly. (Note: Neutral means zero)

()it CF. 2(K) it + Uit =) it = Bo + BQit + B (- ()it CF. 2(K) it + Uit =) it = Bo + BQit + B (Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started