Answered step by step

Verified Expert Solution

Question

1 Approved Answer

N.B, based on South Africa's laws Hi, please indicate what more information you need? QUESTION 9 1. Which of the following tequirements must be met

N.B, based on South Africa's laws

Hi, please indicate what more information you need?

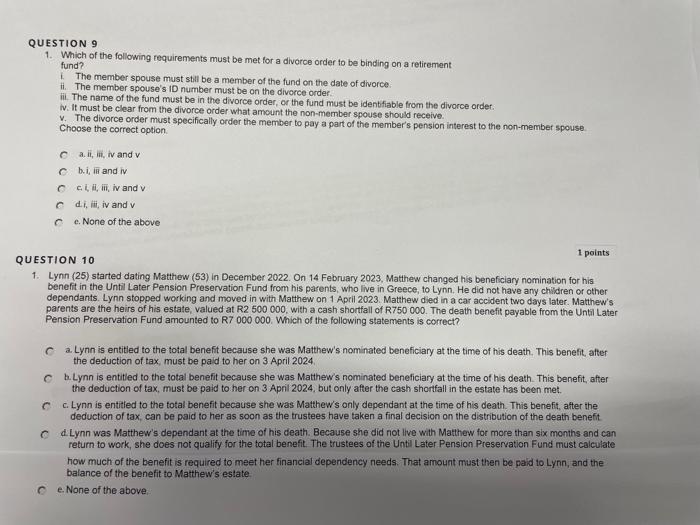

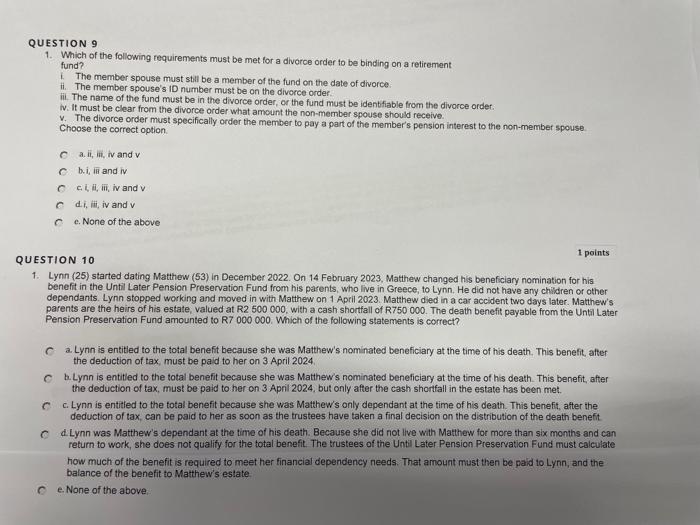

QUESTION 9 1. Which of the following tequirements must be met for a divorce order to be binding on a retirement fund? 1. The member spouse must still be a member of the fund on the date of divorce ii. The member spouse's ID number must be on the divorce order. iii. The name of the fund must be in the divorce order, or the fund must be identiable from the divorce order. I. It must be clear from the divorce order what amount the non-member spouse should receive. Y. The divorce order must specifically order the member to pay a part of the member's pension interest to the non-member spouse Choose the correct option. a. Ii, in, iv and v b. i in and iv c. i, ii, iii, iv and V d.i. iiii, iv and v e. None of the abcve QUESTION 10 1 points 1. Lynn (25) started dating Matthew (53) in December 2022. On 14 February 2023, Matthew changed his beneficiary nomination for his benefit in the Until Later Pension Preservation Fund from his parents, who live in Greece, to Lynn. He did not have any chidren or other dependants. Lynn stopped working and moved in with Matthew on 1 April 2023. Matthew died in a car accident two days later. Matthew's parents are the heirs of his estate, valued at R2 500000 , with a cash shortfall of R750 000 . The death benefit payable from the Until Later Pension Preservation Fund amounted to R7 000000 . Which of the following statements is correct? a. Lynn is entitled to the total benefit because she was Matthew's nominated beneficiary at the time of his death. This benefit, after the deduction of tax, must be paid to her on 3 April 2024. b. Lynn is entitied to the total benefit because she was Matthew's nominated beneficiary at the time of his death. This benefit, after the deduction of tax, must be paid to her on 3 April 2024, but only after the cash shortfall in the estate has been met. c. Lynn is entitled to the total benefit because she was Matthew's only dependant at the time of his death. This benefit, after the deduction of tax, can be paid to her as soon as the trustees have taken a final decision on the distribution of the death benefit d. Lynn was Matthew's dependant at the time of his death. Because she did not live with Matthew for more than six months and can return to work, she does not qualify for the total benefit. The trustees of the Until Later Pension Preservation Fund must calculate how much of the benefit is required to meet her financial dependency needs. That amount must then be paid to Lynn, and the balance of the benefit to Mathew's estate. e. None of the above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started