Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NB THE QUESTION IS THE QUESTION IS COMPLETE AS IT IS. PLEASE ASSIST Part b Limpopo Ltd is a Listed Company packaging and distributing tea.

NB THE QUESTION IS

THE QUESTION IS COMPLETE AS IT IS. PLEASE ASSIST

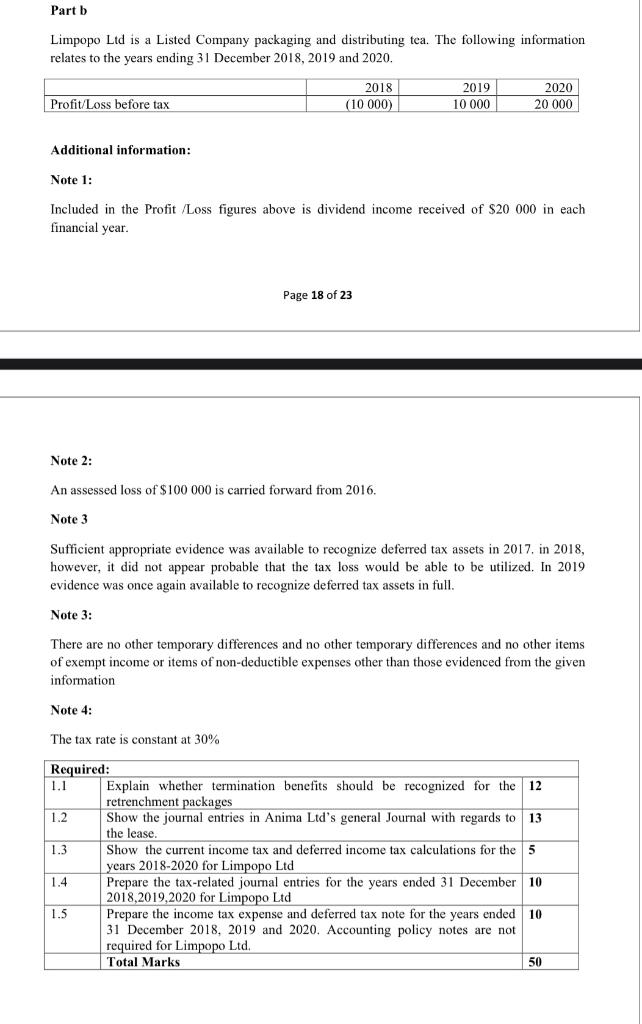

Part b Limpopo Ltd is a Listed Company packaging and distributing tea. The following information relates to the years ending 31 December 2018, 2019 and 2020, 2018 (10 000) 2019 10 000 2020 20 000 Profit/Loss before tax Additional information: Note 1: Included in the Profit /Loss figures above is dividend income received of $20 000 in each financial year. Page 18 of 23 Note 2: An assessed loss of $100 000 is carried forward from 2016. Note 3 Sufficient appropriate evidence was available to recognize deferred tax assets in 2017. in 2018, however, it did not appear probable that the tax loss would be able to be utilized. In 2019 evidence was once again available to recognize deferred tax assets in full. Note 3: There are no other temporary differences and no other temporary differences and no other items of exempt income or items of non-deductible expenses other than those evidenced from the given information Note 4: The tax rate is constant at 30% Required: 1.1 Explain whether termination benefits should be recognized for the 12 retrenchment packages 1.2 Show the journal entries in Anima Ltd's general Journal with regards to 13 the lease 1.3 Show the current income tax and deferred income tax calculations for the 5 years 2018-2020 for Limpopo Ltd 1.4 Prepare the tax-related journal entries for the years ended 31 December 10 2018,2019,2020 for Limpopo Ltd 1.5 Prepare the income tax expense and deferred tax note for the years ended 10 31 December 2018, 2019 and 2020. Accounting policy notes are not required for Limpopo Ltd, Total Marks 50 Part b Limpopo Ltd is a Listed Company packaging and distributing tea. The following information relates to the years ending 31 December 2018, 2019 and 2020, 2018 (10 000) 2019 10 000 2020 20 000 Profit/Loss before tax Additional information: Note 1: Included in the Profit /Loss figures above is dividend income received of $20 000 in each financial year. Page 18 of 23 Note 2: An assessed loss of $100 000 is carried forward from 2016. Note 3 Sufficient appropriate evidence was available to recognize deferred tax assets in 2017. in 2018, however, it did not appear probable that the tax loss would be able to be utilized. In 2019 evidence was once again available to recognize deferred tax assets in full. Note 3: There are no other temporary differences and no other temporary differences and no other items of exempt income or items of non-deductible expenses other than those evidenced from the given information Note 4: The tax rate is constant at 30% Required: 1.1 Explain whether termination benefits should be recognized for the 12 retrenchment packages 1.2 Show the journal entries in Anima Ltd's general Journal with regards to 13 the lease 1.3 Show the current income tax and deferred income tax calculations for the 5 years 2018-2020 for Limpopo Ltd 1.4 Prepare the tax-related journal entries for the years ended 31 December 10 2018,2019,2020 for Limpopo Ltd 1.5 Prepare the income tax expense and deferred tax note for the years ended 10 31 December 2018, 2019 and 2020. Accounting policy notes are not required for Limpopo Ltd, Total Marks 50Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started