Answered step by step

Verified Expert Solution

Question

1 Approved Answer

N.B this question is carrying a lot marks so Please make sure correction ------------------------------------------------------------------------------------------------------- ______________________________________________ N.B please (Show Working) ______________________________________________ Question 1 The Accounts Assistant

N.B this question is carrying a lot marks so Please make sure correction

-------------------------------------------------------------------------------------------------------

______________________________________________

N.B please (Show Working)

______________________________________________

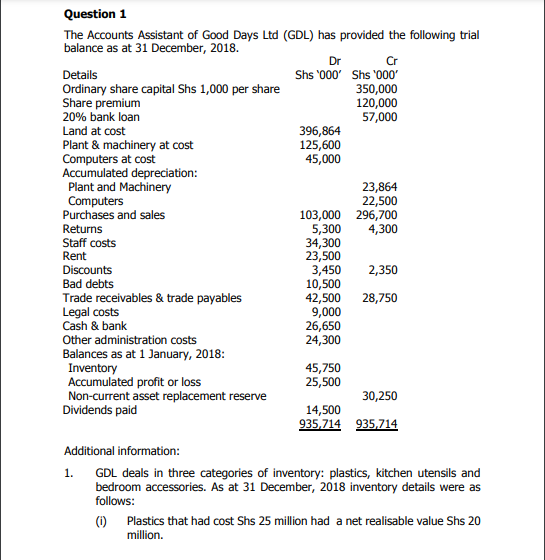

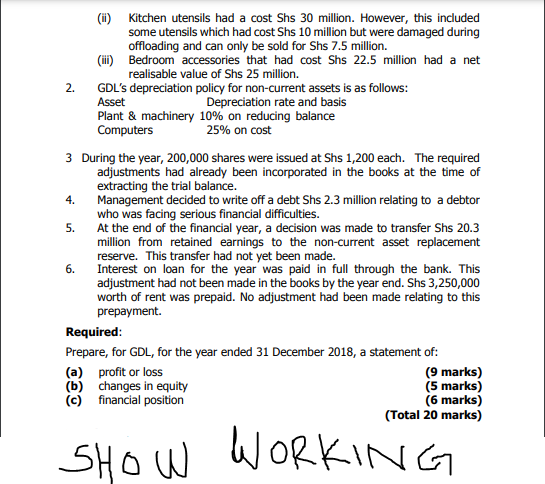

Question 1 The Accounts Assistant of Good Days Ltd (GDL) has provided the following trial balance as at 31 December, 2018. Dr Cr Details Shs '000' Shs '000' Ordinary share capital Shs 1,000 per share 350,000 Share premium 120,000 20% bank loan 57,000 Land at cost 396,864 Plant & machinery at cost 125,600 Computers at cost 45,000 Accumulated depreciation: Plant and Machinery 23,864 Computers 22,500 Purchases and sales 103,000 296,700 Returns 5,300 4,300 Staff costs 34,300 Rent 23,500 Discounts 3,450 2,350 Bad debts 10,500 Trade receivables & trade payables 42,500 28,750 Legal costs 9,000 Cash & bank 26,650 Other administration costs 24,300 Balances as at 1 January, 2018: Inventory 45,750 Accumulated profit or loss 25,500 Non-current asset replacement reserve 30,250 Dividends paid 14,500 935,714 935,714 Additional information: 1. GDL deals in three categories of inventory: plastics, kitchen utensils and bedroom accessories. As at 31 December, 2018 inventory details were as follows: 0 Plastics that had cost Shs 25 million had a net realisable value Shs 20 million. (i) Kitchen utensils had a cost Shs 30 million. However, this included some utensils which had cost Shs 10 million but were damaged during offloading and can only be sold for Shs 7.5 million. (ii) Bedroom accessories that had cost Shs 22.5 million had a net realisable value of Shs 25 million. 2. GDL's depreciation policy for non-current assets is as follows: Asset Depreciation rate and basis Plant & machinery 10% on reducing balance Computers 25% on cost 3 During the year, 200,000 shares were issued at Shs 1,200 each. The required adjustments had already been incorporated in the books at the time of extracting the trial balance. 4. Management decided to write off a debt Shs 2.3 million relating to a debtor who was facing serious financial difficulties. 5. At the end of the financial year, a decision was made to transfer Shs 20.3 million from retained earnings to the non-current asset replacement reserve. This transfer had not yet been made. Interest on loan for the year was paid in full through the bank. This adjustment had not been made in the books by the year end. Shs 3,250,000 worth of rent was prepaid. No adjustment had been made relating to this prepayment. Required: Prepare, for GDL, for the year ended 31 December 2018, a statement of: (a) profit or loss (9 marks) (b) changes in equity (5 marks) (c) financial position (6 marks) (Total 20 marks) 6. SHOW WORKING

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started