Answered step by step

Verified Expert Solution

Question

1 Approved Answer

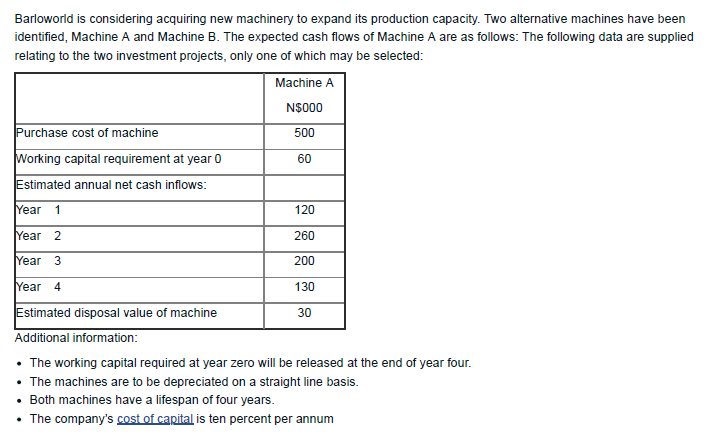

NB: Work with at least 4 decimal places throughout your calculations Requirements 1. Calculate the net present value of machine A to the nearest thousand

NB: Work with at least 4 decimal places throughout your calculations

Requirements

1. Calculate the net present value of machine A to the nearest thousand

2. Calculate the payback for machine A to the nearest whole number

3. Calculate the internal rate of return for machine A in percentage to two decimal places

4. Calculate the net present value of machine A at cost of capital of 15% to the nearest thousand

Barloworld is considering acquiring new machinery to expand its production capacity. Two alternative machines have been identified, Machine A and Machine B. The expected cash flows of Machine A are as follows: The following data are supplied relating to the two investment projects, only one of which may be selected: Machine A N$000 500 Purchase cost of machine Working capital requirement at year 0 Estimated annual net cash inflows: 60 Year 1 120 (Year 2 260 Year 3 200 Year 4 130 30 Estimated disposal value of machine Additional information: The working capital required at year zero will be released at the end of year four. The machines are to be depreciated on a straight line basis. Both machines have a lifespan of four years. The company's cost of capital is ten percent per annumStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started