Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NBCC Ltd. directors are contemplating to choose the best modern asset from the following two. The management have decided to invest $100 million for

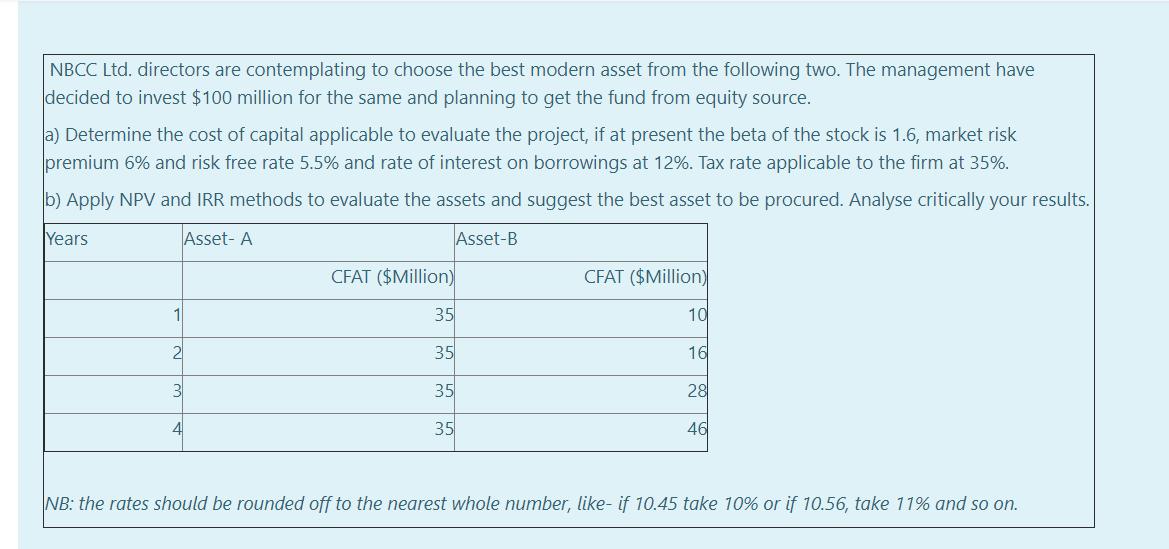

NBCC Ltd. directors are contemplating to choose the best modern asset from the following two. The management have decided to invest $100 million for the same and planning to get the fund from equity source. a) Determine the cost of capital applicable to evaluate the project, if at present the beta of the stock is 1.6, market risk premium 6% and risk free rate 5.5% and rate of interest on borrowings at 12%. Tax rate applicable to the firm at 35%. b) Apply NPV and IRR methods to evaluate the assets and suggest the best asset to be procured. Analyse critically your results. Years Asset- A Asset-B 11 2 3 4 CFAT ($Million) 35 35 35 35 CFAT ($Million) 10 16 28 46 NB: the rates should be rounded off to the nearest whole number, like- if 10.45 take 10% or if 10.56, take 11% and so on.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the cost of capital applicable to evaluate the project we need to calculate the cost of equity and the cost of debt Then we can calcula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started