Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ncial company, ABC Inx You want to buy a 1-Bed Ro FNCE 623 June 2020 Mid Ter X G The common stock of Yoyo C

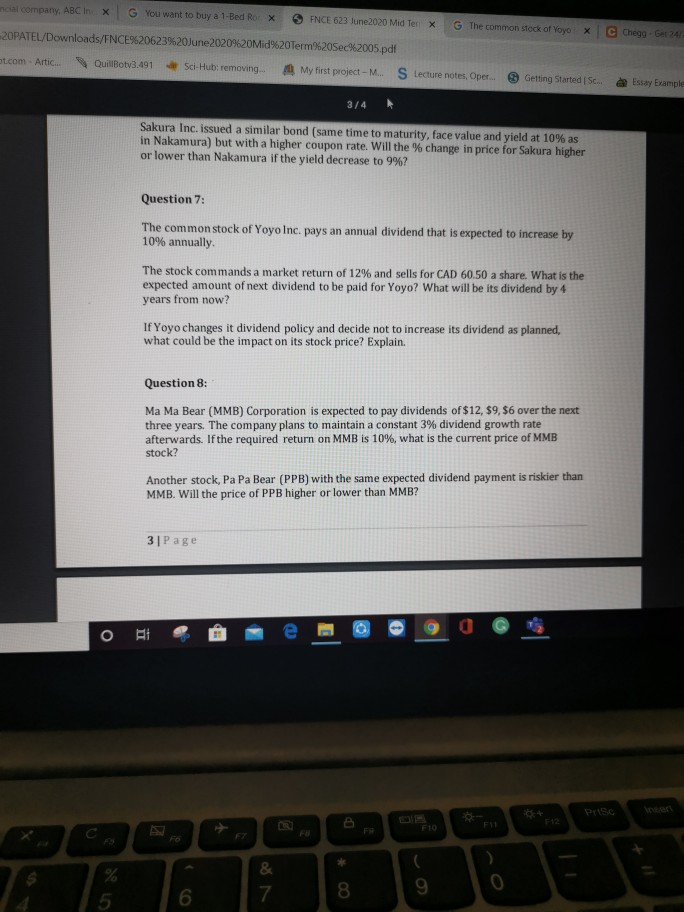

ncial company, ABC Inx You want to buy a 1-Bed Ro FNCE 623 June 2020 Mid Ter X G The common stock of Yoyo C Chegg. Get 24 -20PATEL/Downloads/FNCE%20623%20June2020%20Mid%20Term%20%ec%2005.pdf t.com - Artic. Quillotv3.491 Sci-Hub: removing My first project -M. S lecture notes, Oper Getting Started Sc. Essay Example 3/4 Sakura Inc. issued a similar bond (same time to maturity, face value and yield at 10% as in Nakamura) but with a higher coupon rate. Will the % change in price for Sakura higher or lower than Nakamura if the yield decrease to 9%? Question 7: The common stock of Yoyo Inc. pays an annual dividend that is expected to increase by 10% annually The stock commands a market return of 12% and sells for CAD 60.50 a share. What is the expected amount of next dividend to be paid for Yoyo? What will be its dividend by 4 years from now? If Yoyo changes it dividend policy and decide not to increase its dividend as planned, what could be the impact on its stock price? Explain. Question 8: Ma Ma Bear (MMB) Corporation is expected to pay dividends of $12, $9, $6 over the next three years. The company plans to maintain a constant 3% dividend growth rate afterwards. If the required return on MMB is 10%, what is the current price of MMB stock? Another stock, Pa Pa Bear (PPB) with the same expected dividend payment is riskier than MMB. Will the price of PPB higher or lower than MMB? 3| Page 0 1 e O I 2 + F Fio & 7 8 9 0 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started