Answered step by step

Verified Expert Solution

Question

1 Approved Answer

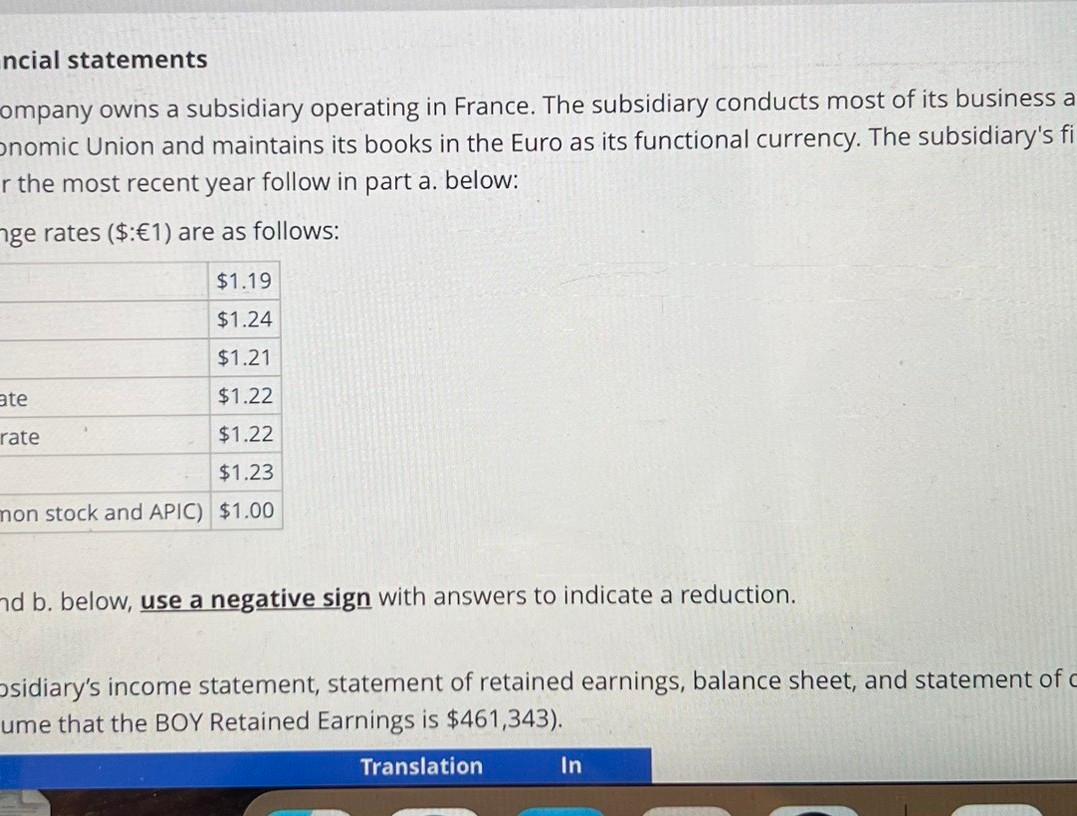

ncial statements ompany owns a subsidiary operating in France. The subsidiary conducts most of its business a nomic Union and maintains its books in the

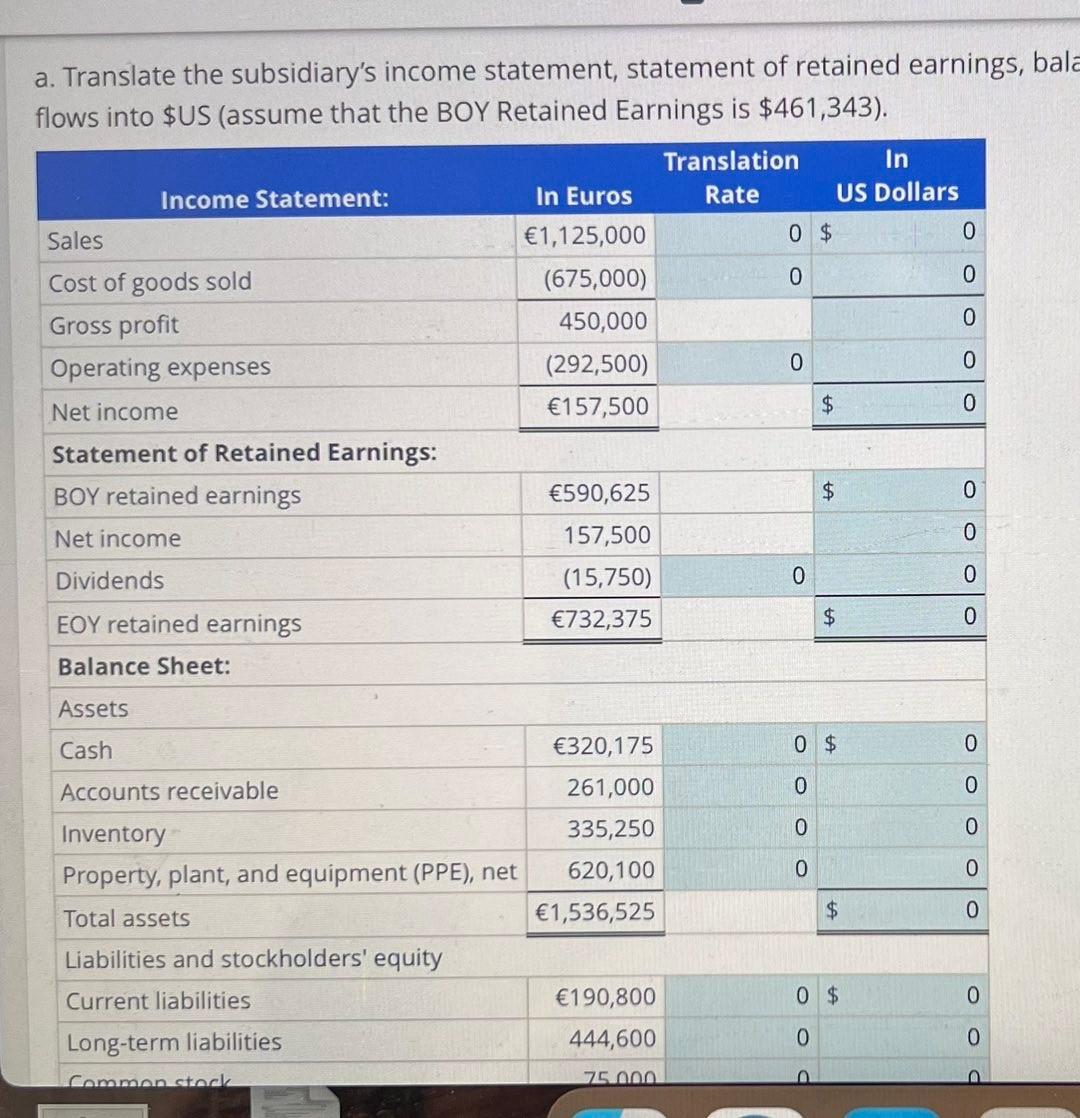

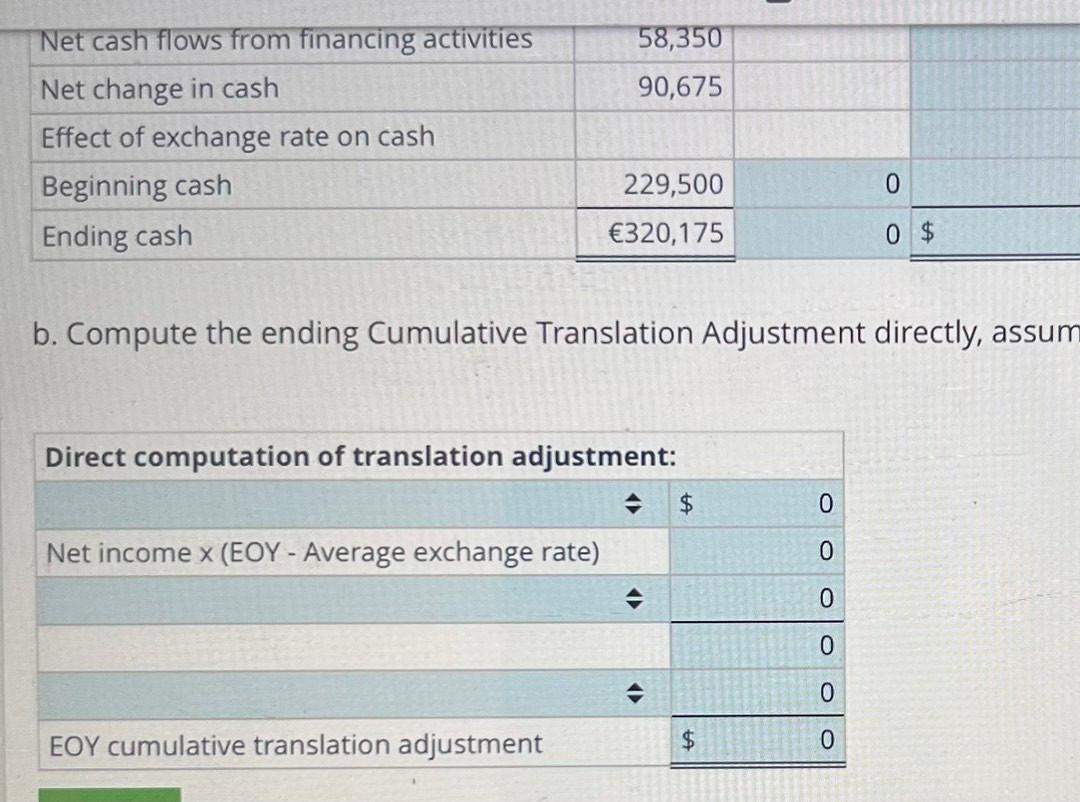

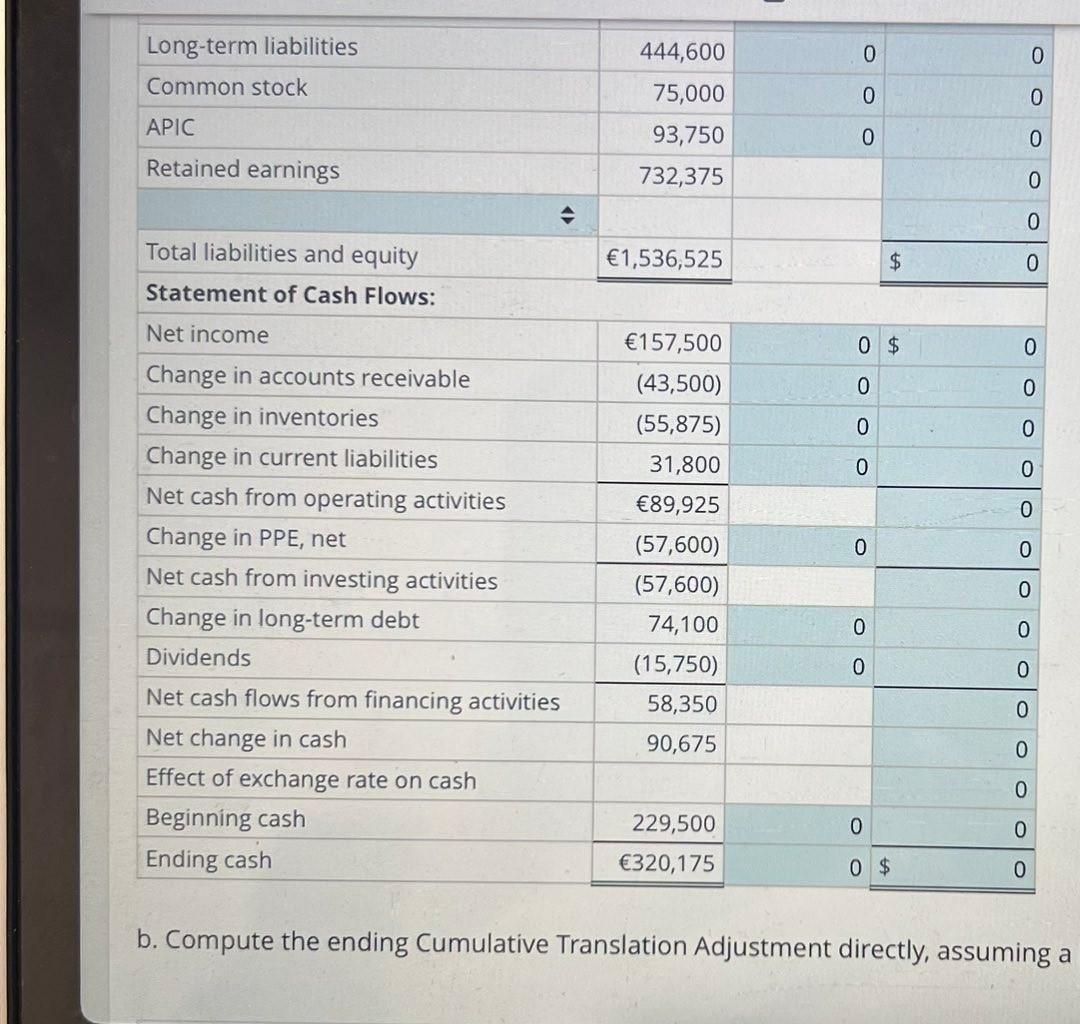

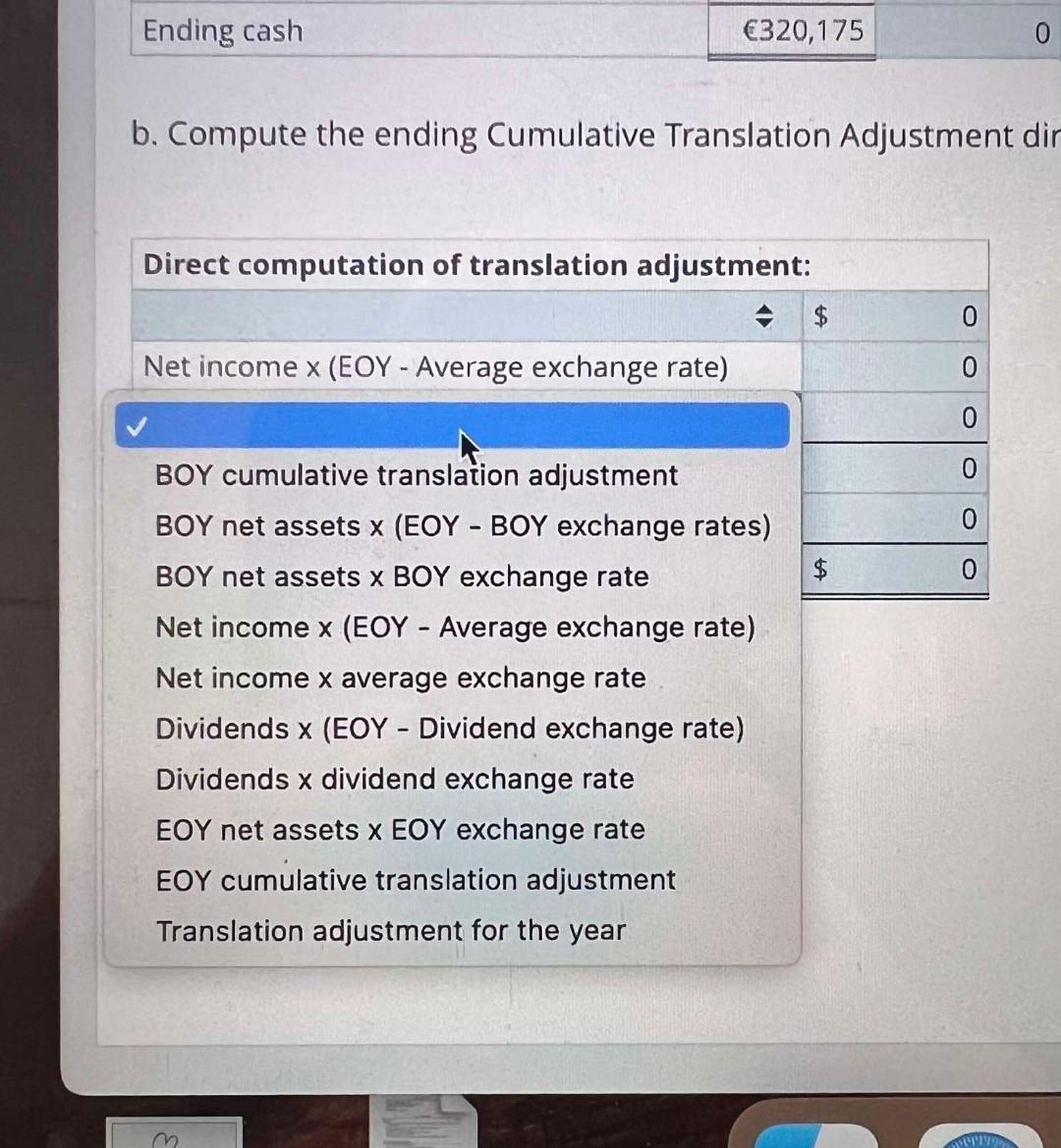

ncial statements ompany owns a subsidiary operating in France. The subsidiary conducts most of its business a nomic Union and maintains its books in the Euro as its functional currency. The subsidiary's fi the most recent year follow in part a. below: ge rates (\$:1) are as follows: d b. below, use a negative sign with answers to indicate a reduction. sidiary's income statement, statement of retained earnings, balance sheet, and statement of c ume that the BOY Retained Earnings is $461,343 ). \begin{tabular}{|c|c|c|c|} \hline Long-term liabilities & 444,600 & 0 & 0 \\ \hline Common stock & 75,000 & 0 & 0 \\ \hline APIC & 93,750 & 0 & U \\ \hline Retained earnings & 732,375 & & 0 \\ \hline^ & & & 0 \\ \hline Total liabilities and equity & 1,536,525 & & $ \\ \hline \multicolumn{4}{|l|}{ Statement of Cash Flows: } \\ \hline Net income & 157,500 & 0 & $ \\ \hline Change in accounts receivable & (43,500) & 0 & 0 \\ \hline Change in inventories & (55,875) & 0 & 0 \\ \hline Change in current liabilities & 31,800 & 0 & 0 \\ \hline Net cash from operating activities & 89,925 & & 0 \\ \hline Change in PPE, net & (57,600) & 0 & 0 \\ \hline Net cash from investing activities & (57,600) & & 0 \\ \hline Change in long-term debt & 74,100 & 0 & 0 \\ \hline Dividends & (15,750) & 0 & 0 \\ \hline Net cash flows from financing activities & 58,350 & & 0 \\ \hline Net change in cash & 90,675 & & 0 \\ \hline Effect of exchange rate on cash & & & 0 \\ \hline Beginning cash & 229,500 & 0 & 0 \\ \hline Ending cash & 320,175 & 0 & $ \\ \hline \end{tabular} b. Compute the ending Cumulative Translation Adjustment directly, assuming a b. Compute the ending Cumulative Translation Adjustment directly, assum b. Compute the ending Cumulative Translation Adjustment di bal ncial statements ompany owns a subsidiary operating in France. The subsidiary conducts most of its business a nomic Union and maintains its books in the Euro as its functional currency. The subsidiary's fi the most recent year follow in part a. below: ge rates (\$:1) are as follows: d b. below, use a negative sign with answers to indicate a reduction. sidiary's income statement, statement of retained earnings, balance sheet, and statement of c ume that the BOY Retained Earnings is $461,343 ). \begin{tabular}{|c|c|c|c|} \hline Long-term liabilities & 444,600 & 0 & 0 \\ \hline Common stock & 75,000 & 0 & 0 \\ \hline APIC & 93,750 & 0 & U \\ \hline Retained earnings & 732,375 & & 0 \\ \hline^ & & & 0 \\ \hline Total liabilities and equity & 1,536,525 & & $ \\ \hline \multicolumn{4}{|l|}{ Statement of Cash Flows: } \\ \hline Net income & 157,500 & 0 & $ \\ \hline Change in accounts receivable & (43,500) & 0 & 0 \\ \hline Change in inventories & (55,875) & 0 & 0 \\ \hline Change in current liabilities & 31,800 & 0 & 0 \\ \hline Net cash from operating activities & 89,925 & & 0 \\ \hline Change in PPE, net & (57,600) & 0 & 0 \\ \hline Net cash from investing activities & (57,600) & & 0 \\ \hline Change in long-term debt & 74,100 & 0 & 0 \\ \hline Dividends & (15,750) & 0 & 0 \\ \hline Net cash flows from financing activities & 58,350 & & 0 \\ \hline Net change in cash & 90,675 & & 0 \\ \hline Effect of exchange rate on cash & & & 0 \\ \hline Beginning cash & 229,500 & 0 & 0 \\ \hline Ending cash & 320,175 & 0 & $ \\ \hline \end{tabular} b. Compute the ending Cumulative Translation Adjustment directly, assuming a b. Compute the ending Cumulative Translation Adjustment directly, assum b. Compute the ending Cumulative Translation Adjustment di bal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started