Answered step by step

Verified Expert Solution

Question

1 Approved Answer

nd Report ptable if lease i deprecia method, xcept on ement. basis, ARUTO e year: 0700 asis ,000 000 000 000 000 EO Selling

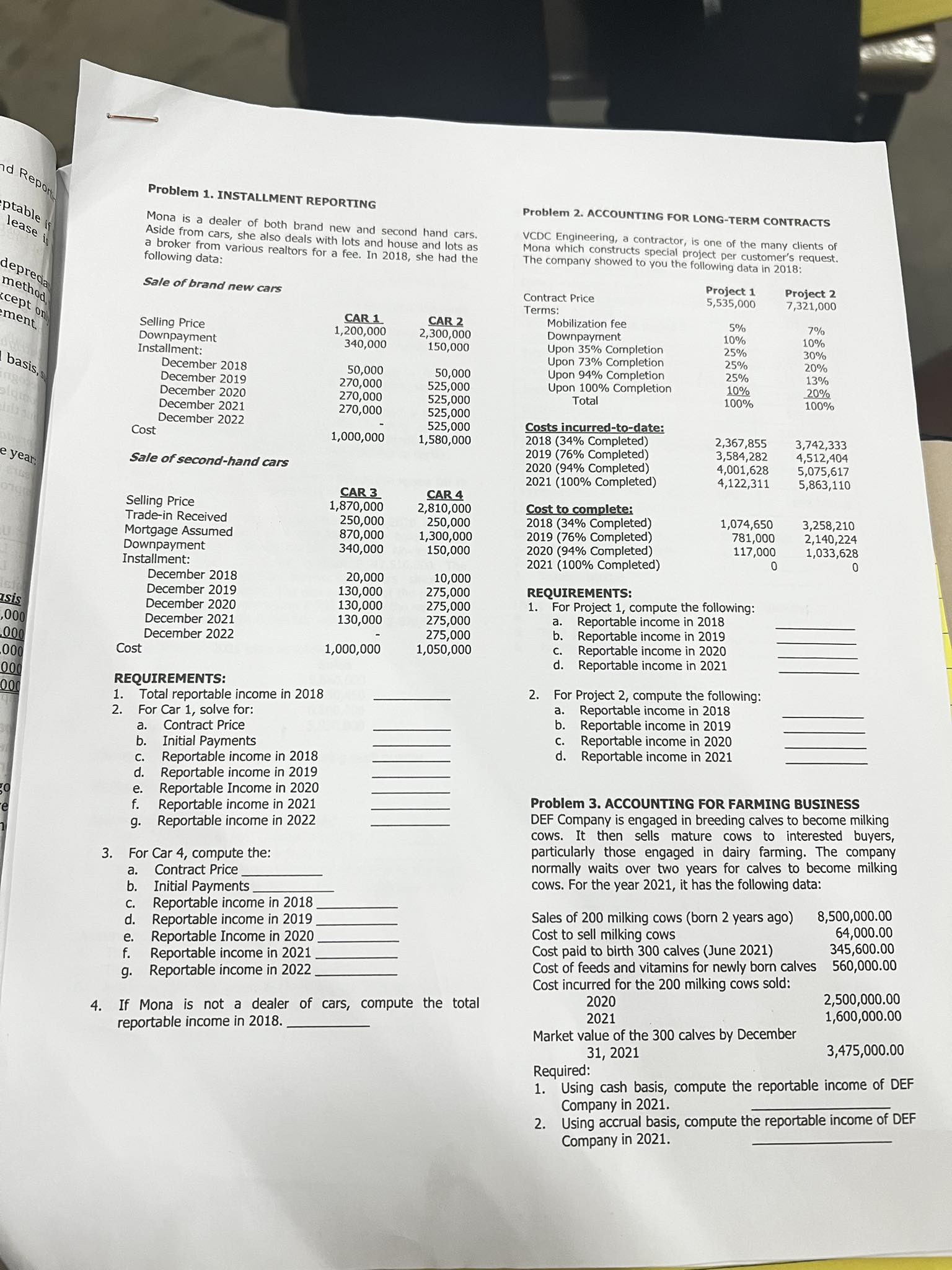

nd Report ptable if lease i deprecia method, xcept on ement. basis, ARUTO e year: 0700 asis ,000 000 000 000 000 EO Selling Price Downpayment Installment: Problem 1. INSTALLMENT REPORTING Mona is a dealer of both brand new and second hand cars. Aside from cars, she also deals with lots and house and lots as a broker from various realtors for a fee. In 2018, she had the following data: Sale of brand new cars Cost Sale of second-hand cars December 2018 December 2019 December 2020 December 2021 December 2022 Selling Price Trade-in Received Mortgage Assumed Cost Downpayment Installment: December 2018 December 2019 December 2020 December 2021 December 2022 a. b. REQUIREMENTS: 1. Total reportable income in 2018 2. For Car 1, solve for: Contract Price Initial Payments C. Reportable income in 2018 d. Reportable income in 2019 e. Reportable Income in 2020 f. Reportable income in 2021 g. Reportable income in 2022 3. For Car 4, compute the: Contract Price a. b. Initial Payments C. Reportable income in 2018 d. Reportable income in 2019 Reportable Income in 2020 e. f. Reportable income in 2021 g. Reportable income in 2022 CAR 1 1,200,000 340,000 50,000 270,000 270,000 270,000 1,000,000 CAR 3 1,870,000 250,000 870,000 340,000 20,000 130,000 130,000 130,000 1,000,000 CAR 2 2,300,000 150,000 50,000 525,000 525,000 525,000 525,000 1,580,000 CAR 4 2,810,000 250,000 1,300,000 150,000 10,000 275,000 275,000 275,000 275,000 1,050,000 4. If Mona is not a dealer of cars, compute the total reportable income in 2018. Problem 2. ACCOUNTING FOR LONG-TERM CONTRACTS VCDC Engineering, a contractor, is one of the many clients of Mona which constructs special project per customer's request. The company showed to you the following data in 2018: Contract Price Terms: Mobilization fee Downpayment Upon 35% Completion Upon 73% Completion Upon 94% Completion Upon 100% Completion Total Costs incurred-to-date: 2018 (34% Completed) 2019 (76% Completed) 2020 (94% Completed) 2021 (100% Completed) Cost to complete: 2018 (34% Completed) 2019 (76% Completed) 2020 (94% Completed) 2021 (100% Completed) Project 1 5,535,000 5% 10% 25% 25% 25% 10% 100% 2,367,855 3,584,282 4,001,628 4,122,311 1,074,650 781,000 117,000 REQUIREMENTS: 1. For Project 1, compute the following: Reportable income in 2018 a. b. Reportable income in 2019 C. Reportable income in 2020 d. Reportable income in 2021 2020 2021 2. For Project 2, compute the following: a. Reportable income in 2018 b. Reportable income in 2019 c. Reportable income in 2020 d. Reportable income in 2021 Project 2 7,321,000 7% 10% 30% 20% 13% 20% 100% 3,742,333 4,512,404 5,075,617 5,863,110 3,258,210 2,140,224 1,033,628 Problem 3. ACCOUNTING FOR FARMING BUSINESS DEF Company is engaged in breeding calves to become milking cows. It then sells mature cows to interested buyers, particularly those engaged in dairy farming. The company normally waits over two years for calves to become milking cows. For the year 2021, it has the following data: Sales of 200 milking cows (born 2 years ago) Cost to sell milking cows Cost paid to birth 300 calves (June 2021) Cost of feeds and vitamins for newly born calves Cost incurred for the 200 milking cows sold: Market value of the 300 calves by December 31, 2021 0 2,500,000.00 1,600,000.00 3,475,000.00 Required: 1. Using cash basis, compute the reportable income of DEF Company in 2021. 8,500,000.00 64,000.00 345,600.00 560,000.00 2. Using accrual basis, compute the reportable income of DEF Company in 2021.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Problem 1 Total Reportable Income in 2018 To calculate the total reportable income in 2018 we need to sum up the income from all sources reported in t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started