Answered step by step

Verified Expert Solution

Question

1 Approved Answer

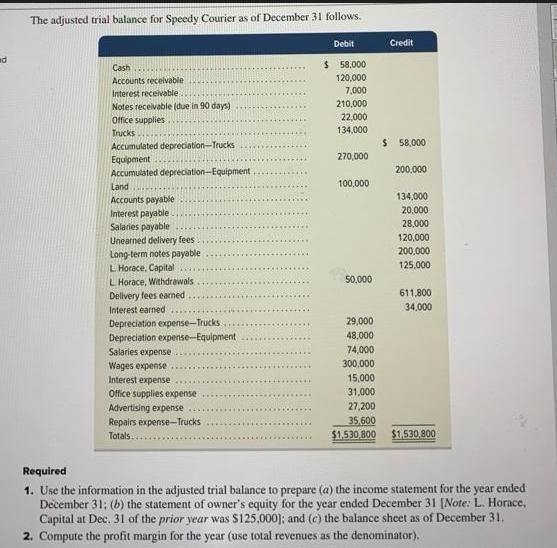

nd The adjusted trial balance for Speedy Courier as of December 31 follows. Debit Credit $ 58,000 Cash Accounts receivable Interest receivable Notes receivable

nd The adjusted trial balance for Speedy Courier as of December 31 follows. Debit Credit $ 58,000 Cash Accounts receivable Interest receivable Notes receivable (due in 90 days) Office supplies 120,000 7,000 210,000 22,000 Trucks 134,000 Accumulated depreciation-Trucks $ 58,000 Equipment 270,000 Accumulated depreciation-Equipment 200,000 Land 100,000 Accounts payable 134,000 Interest payable 20,000 Salaries payable 28,000 Unearned delivery fees 120,000 Long-term notes payable 200,000 L Horace, Capital 125,000 L Horace, Withdrawals - 50,000 Delivery fees earned 611,800 Interest earned 34,000 Depreciation expense-Trucks 29,000 Depreciation expense-Equipment 48.000 Salaries expense 74,000 Wages expense 300,000 Interest expense 15,000. Office supplies expense 31,000 Advertising expense 27,200 Repairs expense-Trucks 35,600 Totals.. $1,530,800 $1,530,800 Required 1. Use the information in the adjusted trial balance to prepare (a) the income statement for the year ended December 31; (b) the statement of owner's equity for the year ended December 31 [Note: L. Horace, Capital at Dec. 31 of the prior year was $125,000]; and (c) the balance sheet as of December 31. 2. Compute the profit margin for the year (use total revenues as the denominator).

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 a Income Statement for the year ended December 31 Revenue Amount Delivery fees earne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66427c2d9bc46_979894.pdf

180 KBs PDF File

66427c2d9bc46_979894.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started