Answered step by step

Verified Expert Solution

Question

1 Approved Answer

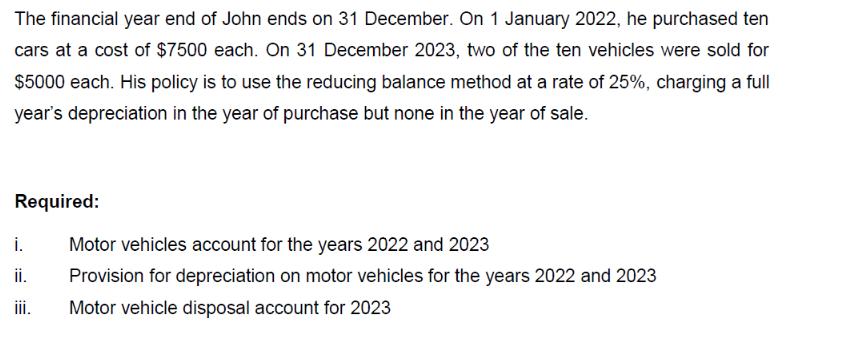

The financial year end of John ends on 31 December. On 1 January 2022, he purchased ten cars at a cost of $7500 each.

The financial year end of John ends on 31 December. On 1 January 2022, he purchased ten cars at a cost of $7500 each. On 31 December 2023, two of the ten vehicles were sold for $5000 each. His policy is to use the reducing balance method at a rate of 25%, charging a full year's depreciation in the year of purchase but none in the year of sale. Required: i. Motor vehicles account for the years 2022 and 2023 ii. Provision for depreciation on motor vehicles for the years 2022 and 2023 Motor vehicle disposal account for 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Motor vehicles account for the years 2022 and 2023 Year 2022 Opening balance 10 cars at 7500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started