Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After extensive project appraisal analysis, McCoy Plc has decided to go ahead with the launch of a new gaming platform. The new project will

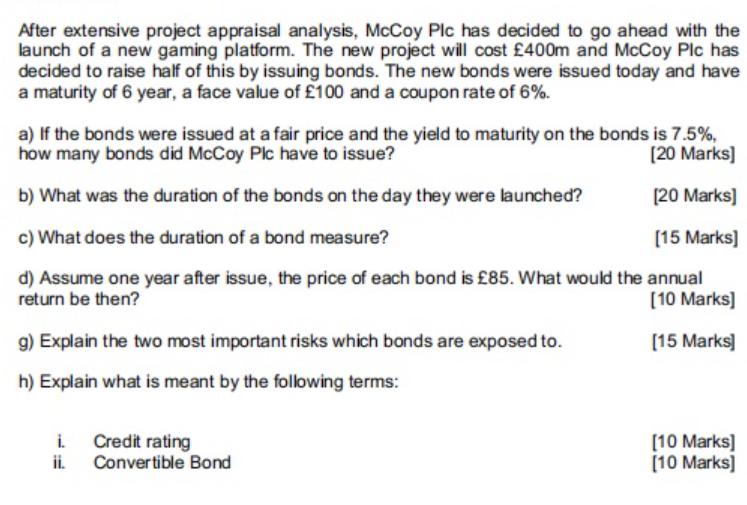

After extensive project appraisal analysis, McCoy Plc has decided to go ahead with the launch of a new gaming platform. The new project will cost 400m and McCoy Plc has decided to raise half of this by issuing bonds. The new bonds were issued today and have a maturity of 6 year, a face value of 100 and a coupon rate of 6%. a) If the bonds were issued at a fair price and the yield to maturity on the bonds is 7.5%, how many bonds did McCoy Plc have to issue? [20 Marks] b) What was the duration of the bonds on the day they were launched? [20 Marks] c) What does the duration of a bond measure? [15 Marks] d) Assume one year after issue, the price of each bond is 85. What would the annual return be then? [10 Marks] g) Explain the two most important risks which bonds are exposed to. [15 Marks] h) Explain what is meant by the following terms: i. ii. Credit rating Convertible Bond [10 Marks] [10 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the number of bonds McCoy plc had to issue we can use the formula Number of bonds Total project cost Face value of each bond Given that the total project cost is 400 million and the fac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started