Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ndoni & Daughters is a South African company that manufacturers over 400 household products. The company was established in the 1900's and offer a

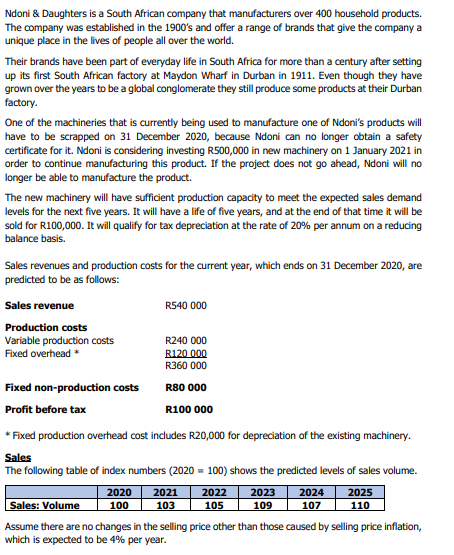

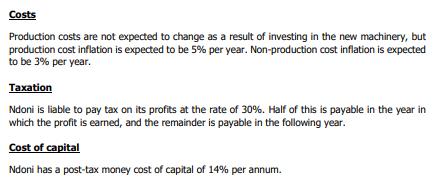

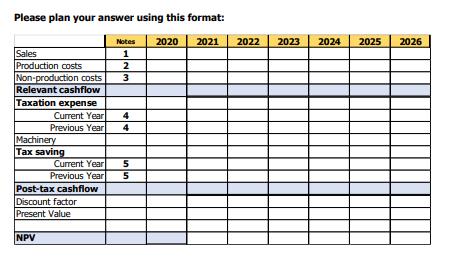

Ndoni & Daughters is a South African company that manufacturers over 400 household products. The company was established in the 1900's and offer a range of brands that give the company a unique place in the lives of people all over the world. Their brands have been part of everyday life in South Africa for more than a century after setting up its first South African factory at Maydon Wharf in Durban in 1911. Even though they have grown over the years to be a global conglomerate they still produce some products at their Durban factory. One of the machineries that is currently being used to manufacture one of Ndoni's products will have to be scrapped on 31 December 2020, because Ndoni can no longer obtain a safety certificate for it. Ndoni is considering investing R500,000 in new machinery on 1 January 2021 in order to continue manufacturing this product. If the project does not go ahead, Ndoni will no longer be able to manufacture the product. The new machinery will have sufficient production capacity to meet the expected sales demand levels for the next five years. It will have a life of five years, and at the end of that time it will be sold for R100,000. It will qualify for tax depreciation at the rate of 20% per annum on a reducing balance basis. Sales revenues and production costs for the current year, which ends on 31 December 2020, are predicted to be as follows: Sales revenue Production costs Variable production costs Fixed overhead * Fixed non-production costs Profit before tax R540 000 R240 000 R120 000 R360 000 R80 000 R100 000 *Fixed production overhead cost includes R20,000 for depreciation of the existing machinery. Sales The following table of index numbers (2020 = 100) shows the predicted levels of sales volume. 2020 2021 2022 2023 2024 100 103 105 109 107 2025 110 Sales: Volume Assume there are no changes in the selling price other than those caused by selling price inflation, which is expected to be 4% per year. Costs Production costs are not expected to change as a result of investing in the new machinery, but production cost inflation is expected to be 5% per year. Non-production cost inflation is expected to be 3% per year. Taxation Ndoni is liable to pay tax on its profits at the rate of 30%. Half of this is payable in the year in which the profit is earned, and the remainder is payable in the following year. Cost of capital Ndoni has a post-tax money cost of capital of 14% per annum. Please plan your answer using this format: Sales Production costs Non-production costs Relevant cashflow Taxation expense Current Year Previous Year Machinery Tax saving Current Year Previous Year Post-tax cashflow Discount factor Present Value NPV Notes 2020 1 2 3 4 4 55 2021 2022 2023 2024 2025 2026

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV of the investment in the new machinery we need to determine the relevant cash flows for each year calculate the tax savings calculate the posttax cash flows appl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started