Answered step by step

Verified Expert Solution

Question

1 Approved Answer

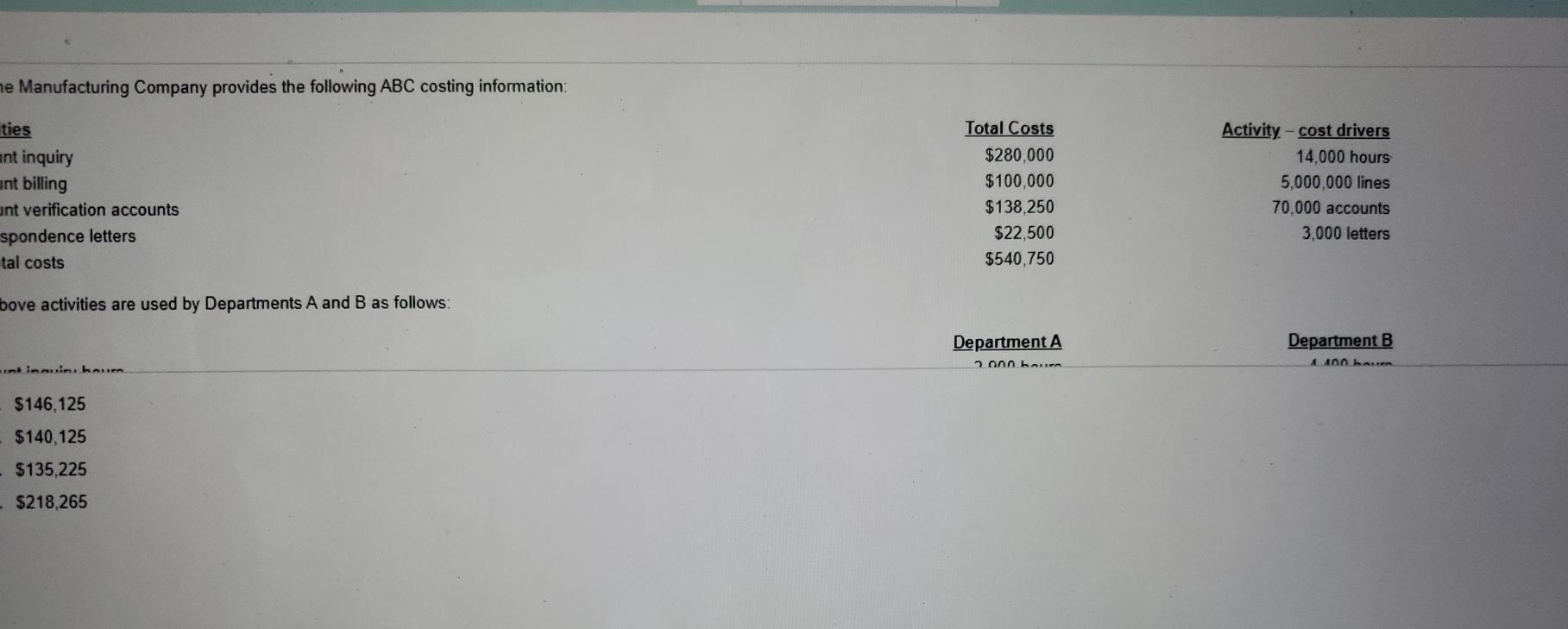

ne Manufacturing Company provides the following ABC costing information: ties ant inquiry ant billing unt verification accounts spondence letters tal costs Total Costs $280,000 $100,000

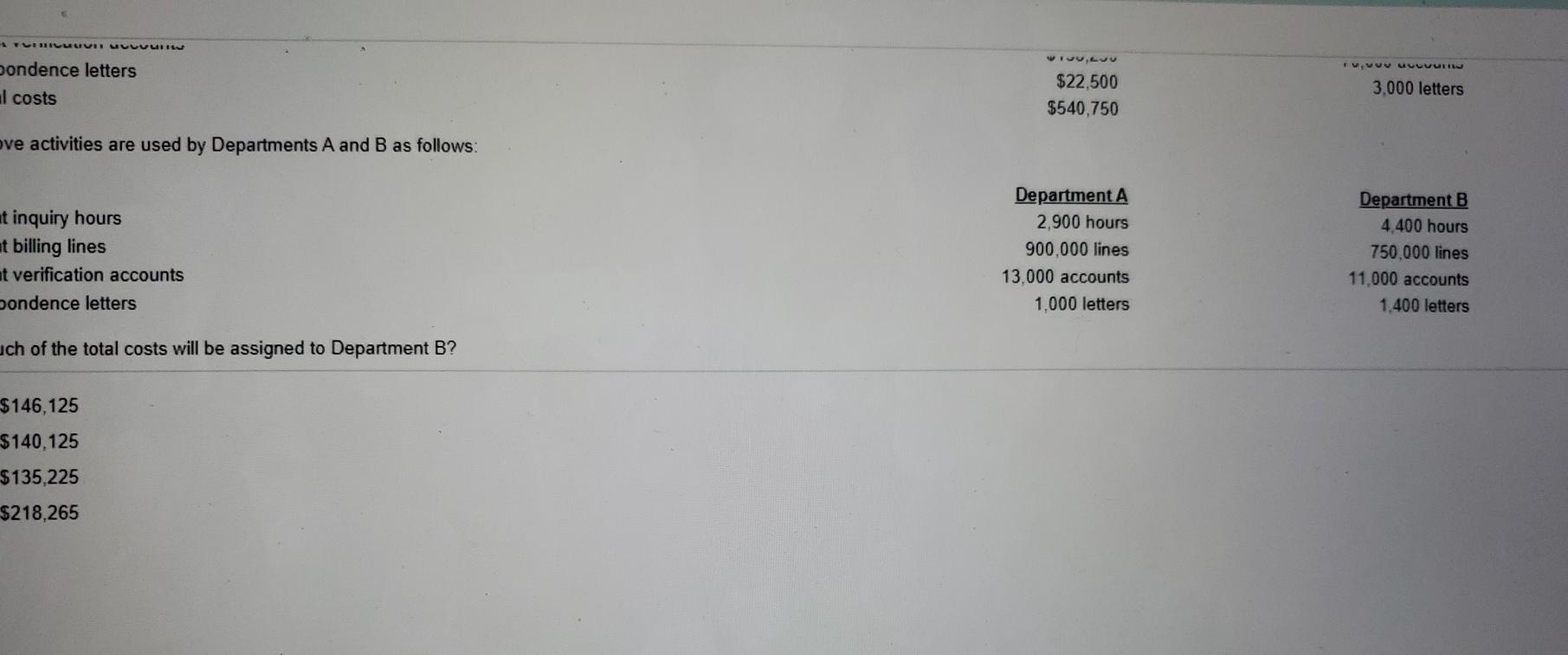

ne Manufacturing Company provides the following ABC costing information: ties ant inquiry ant billing unt verification accounts spondence letters tal costs Total Costs $280,000 $100,000 $138,250 $22,500 $540,750 Activity-cost drivers 14.000 hours 5,000,000 lines 70,000 accounts 3,000 letters bove activities are used by Departments A and B as follows: Department A Department B on har 440 bar $146,125 $140.125 $135,225 -$218.265 Vi vu vi vvvvvv pondence letters al costs $22.500 $540,750 3.000 letters ve activities are used by Departments A and B as follows: ut inquiry hours at billing lines at verification accounts pondence letters Department A 2,900 hours 900.000 lines 13,000 accounts 1.000 letters Department B 4.400 hours 750.000 lines 11.000 accounts 1.400 letters uch of the total costs will be assigned to Department B? $146,125 $140.125 $135,225 $218,265 ne Manufacturing Company provides the following ABC costing information: ties ant inquiry ant billing unt verification accounts spondence letters tal costs Total Costs $280,000 $100,000 $138,250 $22,500 $540,750 Activity-cost drivers 14.000 hours 5,000,000 lines 70,000 accounts 3,000 letters bove activities are used by Departments A and B as follows: Department A Department B on har 440 bar $146,125 $140.125 $135,225 -$218.265 Vi vu vi vvvvvv pondence letters al costs $22.500 $540,750 3.000 letters ve activities are used by Departments A and B as follows: ut inquiry hours at billing lines at verification accounts pondence letters Department A 2,900 hours 900.000 lines 13,000 accounts 1.000 letters Department B 4.400 hours 750.000 lines 11.000 accounts 1.400 letters uch of the total costs will be assigned to Department B? $146,125 $140.125 $135,225 $218,265

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started