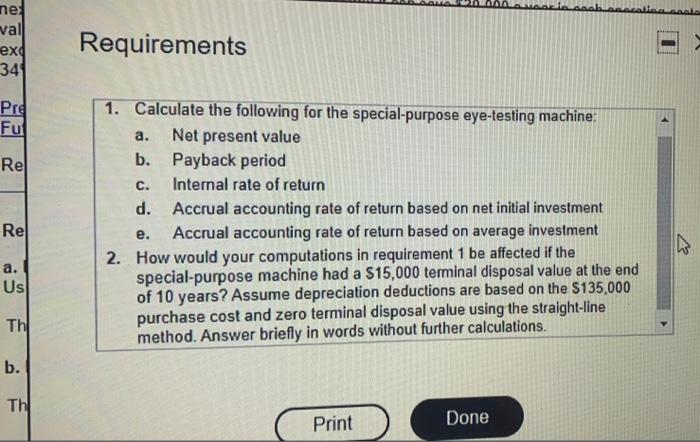

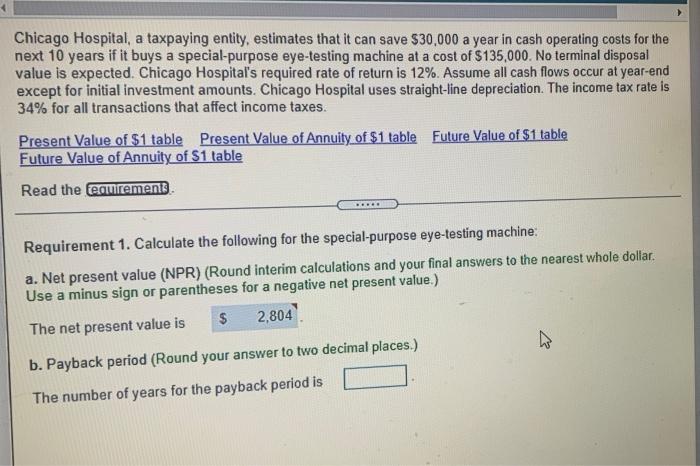

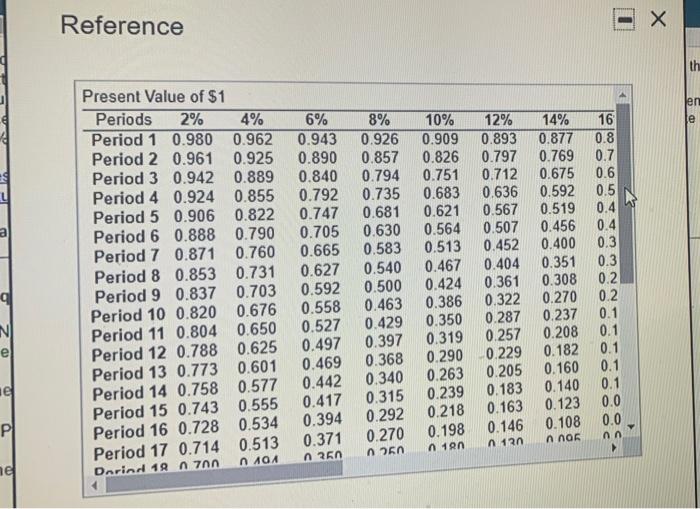

ne: val exd 341 Requirements Pre Fu Rel C. Re 1. Calculate the following for the special-purpose eye-testing machine: a. Net present value b. Payback period Internal rate of return d. Accrual accounting rate of return based on net initial investment Accrual accounting rate return based on average investment 2. How would your computations in requirement 1 be affected if the special-purpose machine had a $15,000 terminal disposal value at the end of 10 years? Assume depreciation deductions are based on the $135,000 purchase cost and zero terminal disposal value using the straight-line method. Answer briefly in words without further calculations. e. a. Us Thl E b. Th Print Done Chicago Hospital, a taxpaying entity, estimates that it can save $30,000 a year in cash operating costs for the next 10 years if it buys a special-purpose eye-testing machine at a cost of $135,000. No terminal disposal value is expected. Chicago Hospital's required rate of return is 12%. Assume all cash flows occur at year-end except for initial investment amounts. Chicago Hospital uses straight-line depreciation. The income tax rate is 34% for all transactions that affect income taxes. Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Value of Annuity of S1 table Read the feauirement Requirement 1. Calculate the following for the special-purpose eye-testing machine: a. Net present value (NPR) (Round interim calculations and your final answers to the nearest whole dollar Use a minus sign or parentheses for a negative net present value.) The net present value is $ 2,804 7 b. Payback period (Round your answer to two decimal places.) The number of years for the payback period is Reference th len le Present Value of $1 Periods 2% 4% 6% 8% 10% 12% Period 1 0.980 0.962 14% 0.943 0.926 0.909 0.893 0.877 Period 2 0.961 0.925 0.890 0.857 0.826 0.797 0.769 Period 3 0.942 0.889 0.840 0.794 0.751 0.712 0.675 Period 4 0.924 0.855 0.792 0.735 0.683 0.636 0.592 Period 5 0.906 0.822 0.747 0.681 0.621 0.567 0.519 Period 6 0.888 0.790 0.705 0.630 0.564 0.507 0.456 Period 7 0.871 0.760 0.665 0.583 0.513 0.452 0.400 Period 8 0.853 0.731 0.627 0.540 0.467 0.404 0.351 Period 9 0.837 0.703 0.592 0.500 0.424 0.361 0.308 Period 10 0.820 0.676 0.558 0.463 0.386 0.322 0.270 Period 11 0.804 0.650 0.527 0.429 0.350 0.287 0.237 0.397 Period 12 0.788 0.625 0.497 0.319 0.257 0.208 0.368 0.290 0.229 0.182 Period 13 0.773 0.601 0.469 0.263 0.340 0.205 0.160 Period 14 0.758 0.577 0.442 0.239 0.183 0.140 Period 15 0.743 0.555 0.417 0.315 0.218 0.163 0.123 Period 16 0.728 0.534 0.394 0.292 0.108 Period 17 0.714 0.513 0.371 0.270 0.198 0.146 nn06 18n n6n n 250 Dorind 19 non 16 0.8 0.7 0.6 0.5 0.4 0.4 0.3 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.0 0.0 nn N e el PI 12n ne