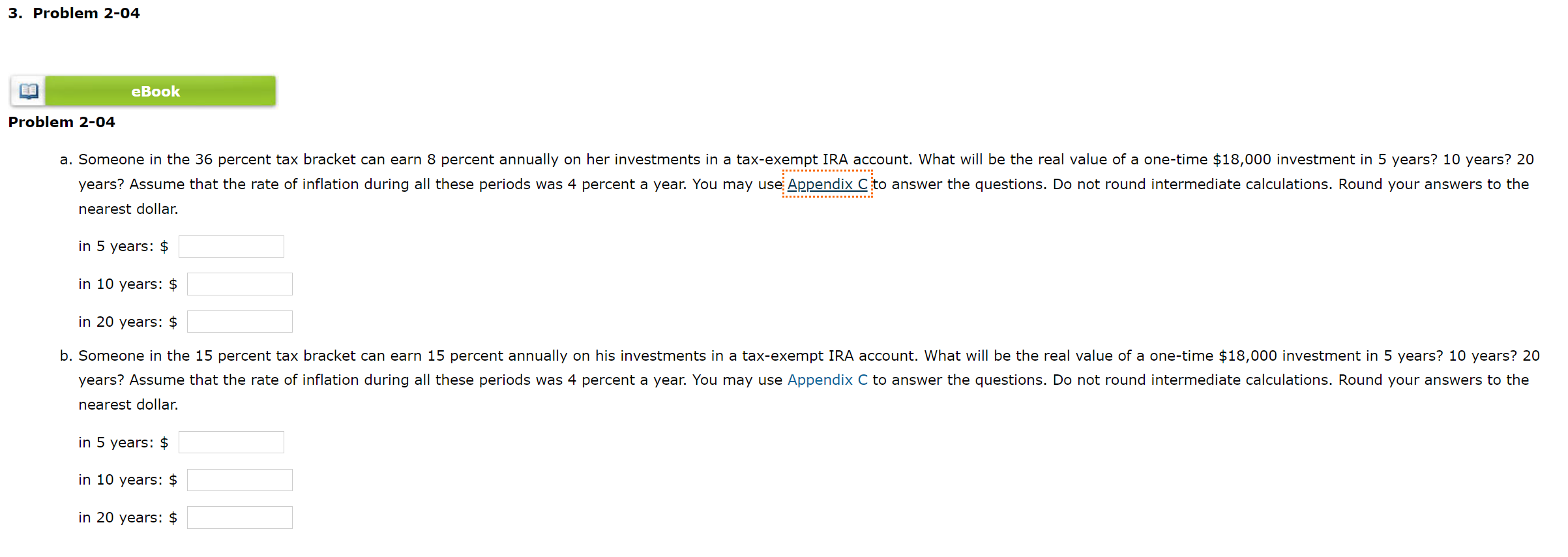

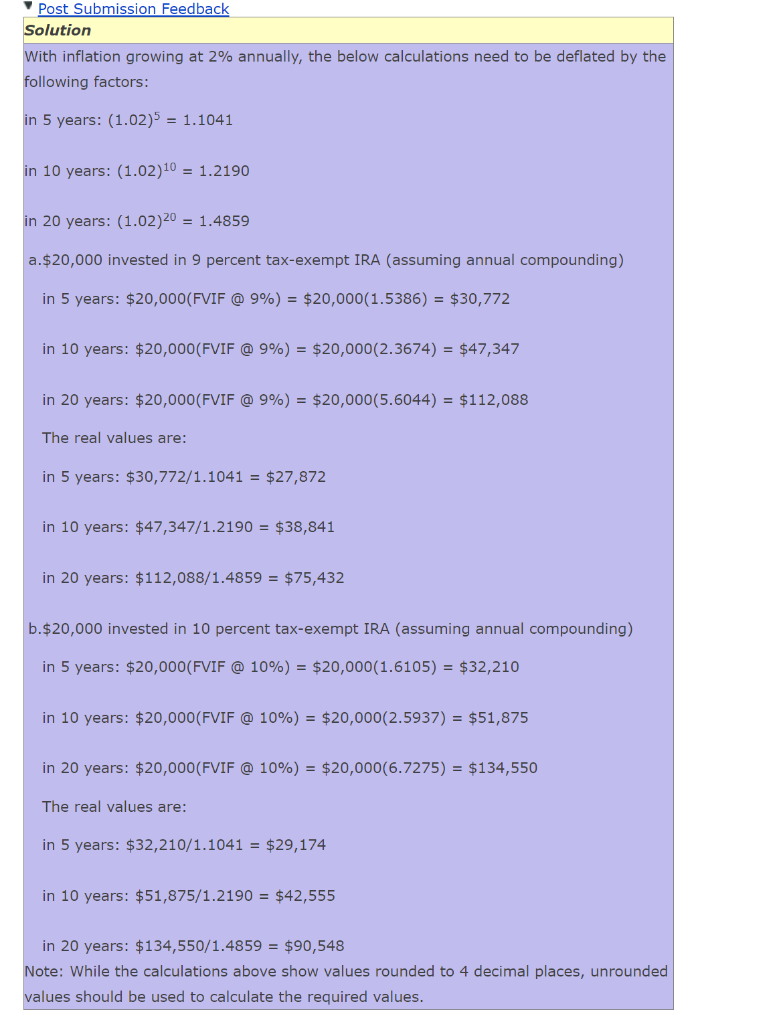

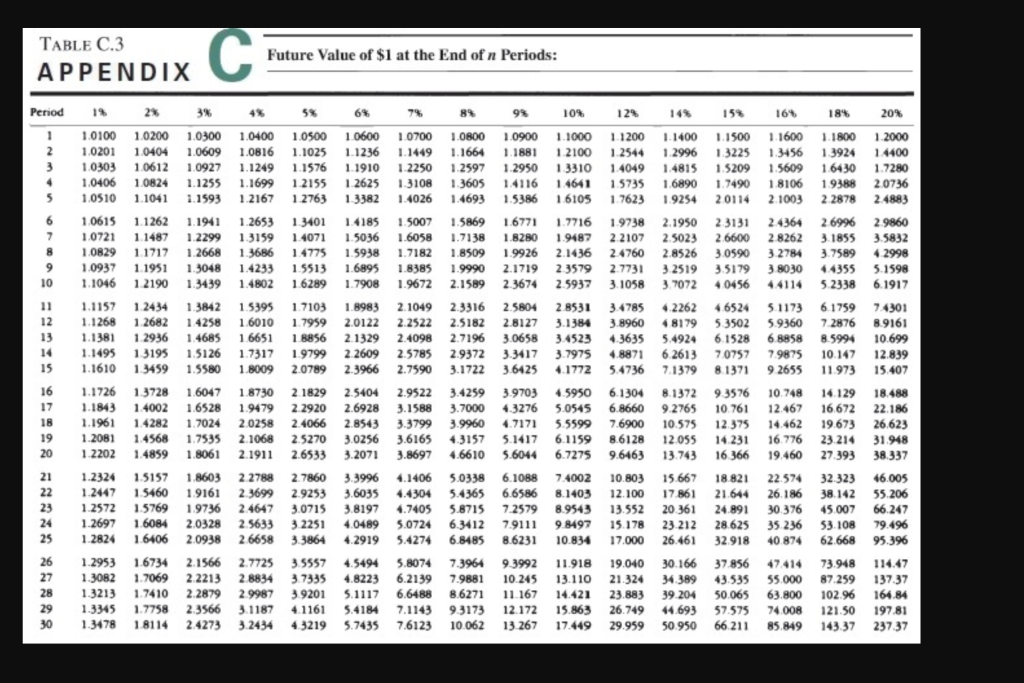

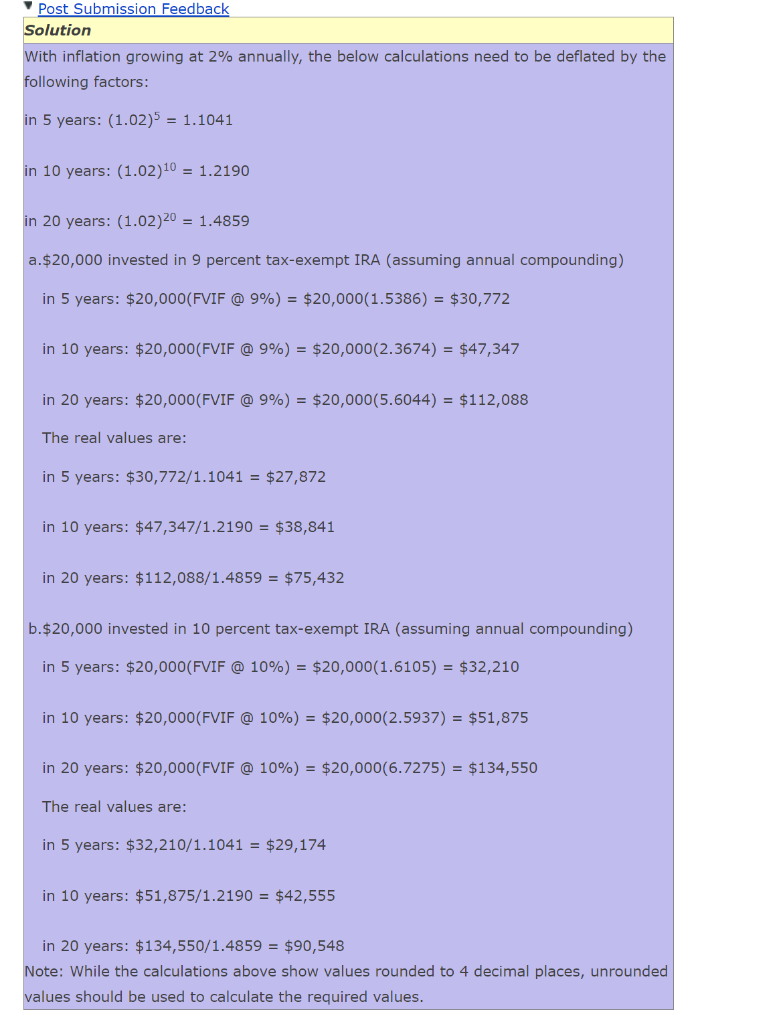

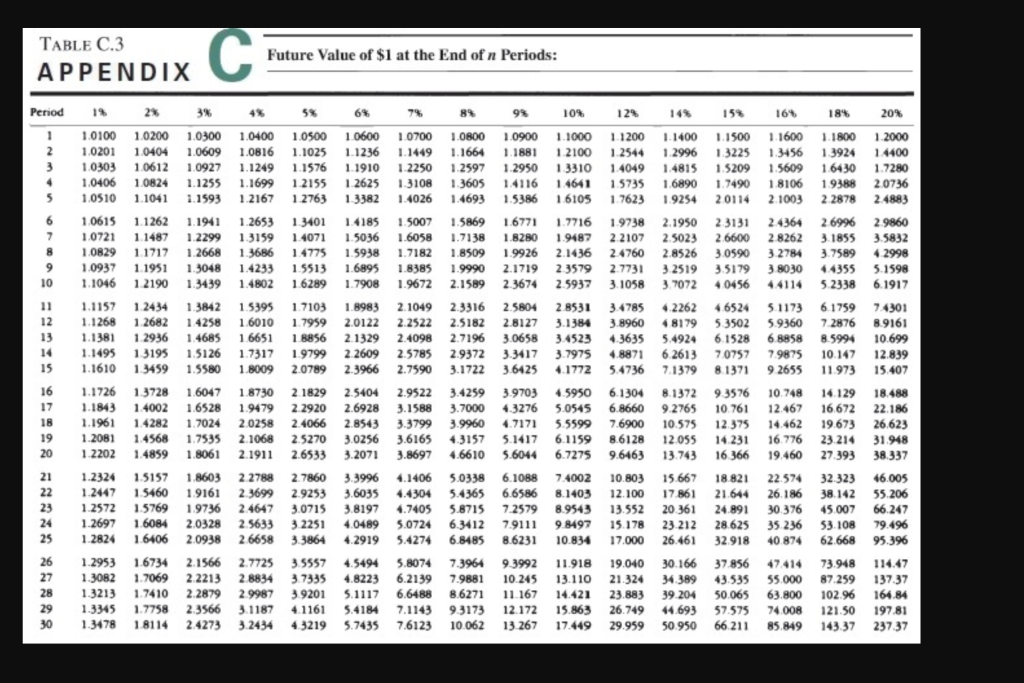

nearest dollar. in 5 years: $ in 10 years: $ in 20 years: $ nearest dollar. in 5 years: $ in 10 years: $ in 20 years: $ Post Submission Feedback Solution With inflation growing at 2% annually, the below calculations need to be deflated by the following factors: in 5 years: (1.02)5=1.1041 in 10 years: (1.02)10=1.2190 in 20 years: (1.02)20=1.4859 a.\$20,000 invested in 9 percent tax-exempt IRA (assuming annual compounding) in 5 years: $20,000(FVIF@9%)=$20,000(1.5386)=$30,772 in 10 years: $20,000 (FVIF @9%)=$20,000(2.3674)=$47,347 in 20 years: $20,000(FVIF@9%)=$20,000(5.6044)=$112,088 The real values are: in 5 years: $30,772/1.1041=$27,872 in 10 years: $47,347/1.2190=$38,841 in 20 years: $112,088/1.4859=$75,432 b. $20,000 invested in 10 percent tax-exempt IRA (assuming annual compounding) in 5 years: $20,000 (FVIF @10%)=$20,000(1.6105)=$32,210 in 10 years: $20,000(FVIF@10%)=$20,000(2.5937)=$51,875 in 20 years: $20,000 (FVIF @10%)=$20,000(6.7275)=$134,550 The real values are: in 5 years: $32,210/1.1041=$29,174 in 10 years: $51,875/1.2190=$42,555 in 20 years: $134,550/1.4859=$90,548 Note: While the calculations above show values rounded to 4 decimal places, unrounded values should be used to calculate the required values. TABLE C.3 A PPENDIX nearest dollar. in 5 years: $ in 10 years: $ in 20 years: $ nearest dollar. in 5 years: $ in 10 years: $ in 20 years: $ Post Submission Feedback Solution With inflation growing at 2% annually, the below calculations need to be deflated by the following factors: in 5 years: (1.02)5=1.1041 in 10 years: (1.02)10=1.2190 in 20 years: (1.02)20=1.4859 a.\$20,000 invested in 9 percent tax-exempt IRA (assuming annual compounding) in 5 years: $20,000(FVIF@9%)=$20,000(1.5386)=$30,772 in 10 years: $20,000 (FVIF @9%)=$20,000(2.3674)=$47,347 in 20 years: $20,000(FVIF@9%)=$20,000(5.6044)=$112,088 The real values are: in 5 years: $30,772/1.1041=$27,872 in 10 years: $47,347/1.2190=$38,841 in 20 years: $112,088/1.4859=$75,432 b. $20,000 invested in 10 percent tax-exempt IRA (assuming annual compounding) in 5 years: $20,000 (FVIF @10%)=$20,000(1.6105)=$32,210 in 10 years: $20,000(FVIF@10%)=$20,000(2.5937)=$51,875 in 20 years: $20,000 (FVIF @10%)=$20,000(6.7275)=$134,550 The real values are: in 5 years: $32,210/1.1041=$29,174 in 10 years: $51,875/1.2190=$42,555 in 20 years: $134,550/1.4859=$90,548 Note: While the calculations above show values rounded to 4 decimal places, unrounded values should be used to calculate the required values. TABLE C.3 A PPENDIX