Answered step by step

Verified Expert Solution

Question

1 Approved Answer

nearest whole dollar. 1 b . Compute a present value index for each project. If required, round your answers to two decimal places. Present Value

nearest whole dollar.

b Compute a present value index for each project. If required, round your answers to two decimal places.

Present Value Index

answers to three decimal places and internal rate of return to the nearest whole percent.

Wind Turbines Biofuel Equipment

Present value factor for an annuity of $

Internal rate of return

The net present value, present value index, and internal rate of return all indicate that the

isare a better financial opportunity compared to the

although both investments meet the

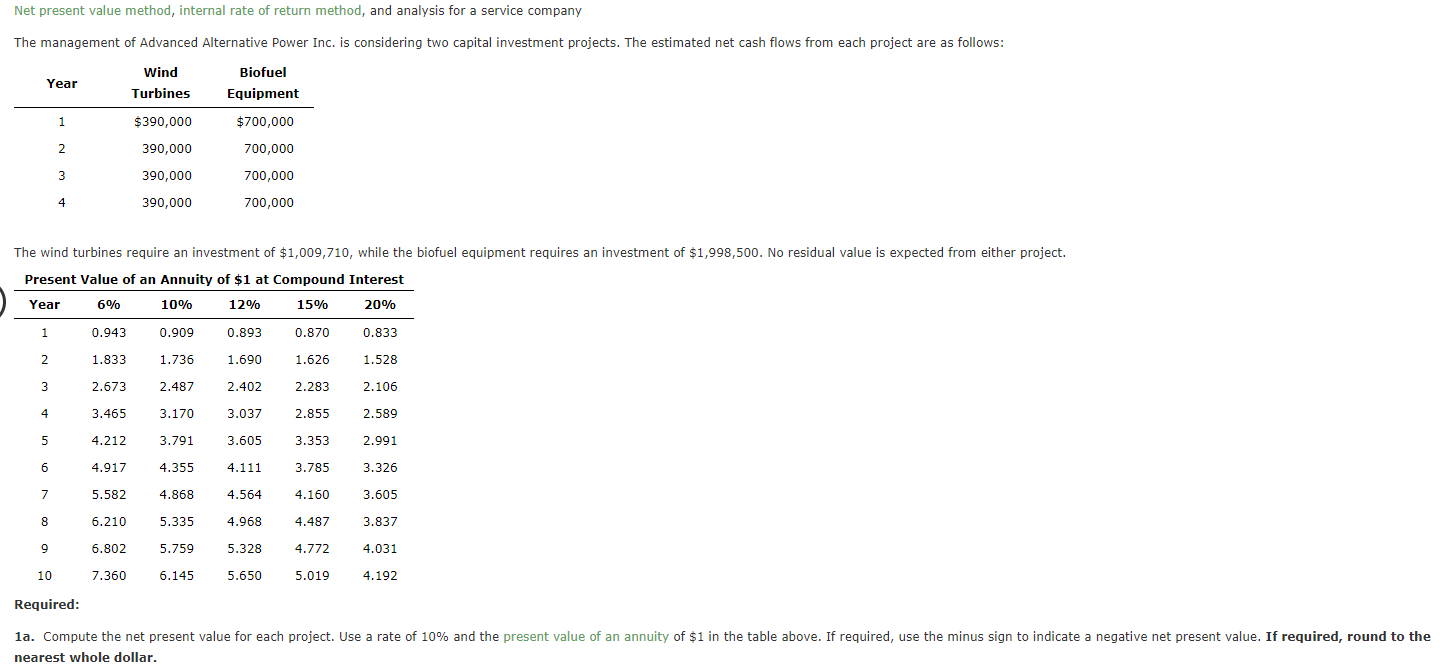

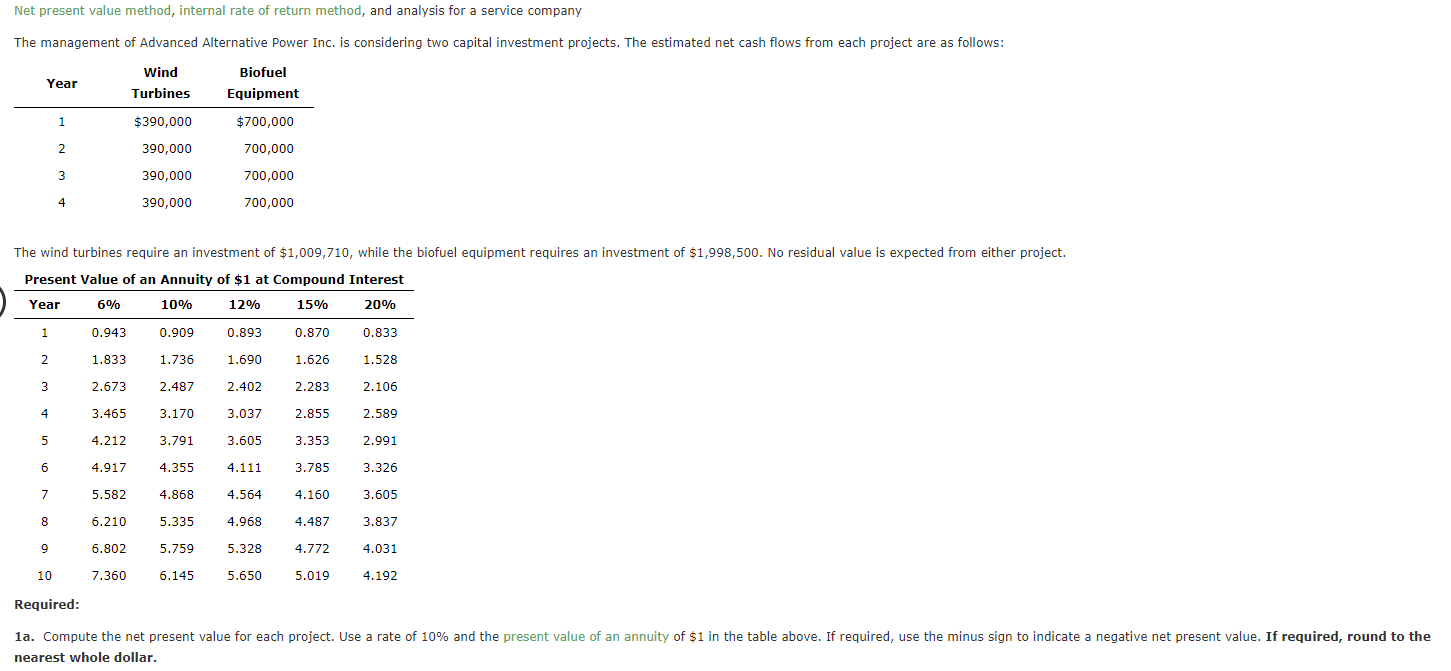

minimum return criterion of Net Present Value Method, Internal Rate of Return Method, and Analysis for a Service Company The management of Advanced Alternative Power Inc. is considering two capital investment projects. The estimated net cash flows from each project are as follows: Net present value method, internal rate of return method, and analysis for a service company

The management of Advanced Alternative Power Inc. is considering two capital investment projects. The estimated net cash flows from each project are as follows:

tableYeartableWindTurbinestableBiofuelEquipment$$

The wind turbines require an investment of $ while the biofuel equipment requires an investment of $ No residual value is expected from either project.

tablePresent Value of an Annuity of $ at Compound InterestYear

Required: nearest whole dollar. nearest whole dollar.

b Compute a present value index for each project. If required, round your answers to two decimal places.

Present Value Index

answers to three decimal places and internal rate of return to the nearest whole percent.

Wind Turbines Biofuel Equipment

Present value factor for an annuity of $

Internal rate of return

The net present value, present value index, and internal rate of return all indicate that the

isare a better financial opportunity compared to the

although both investments meet the

minimum return criterion of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started