Answered step by step

Verified Expert Solution

Question

1 Approved Answer

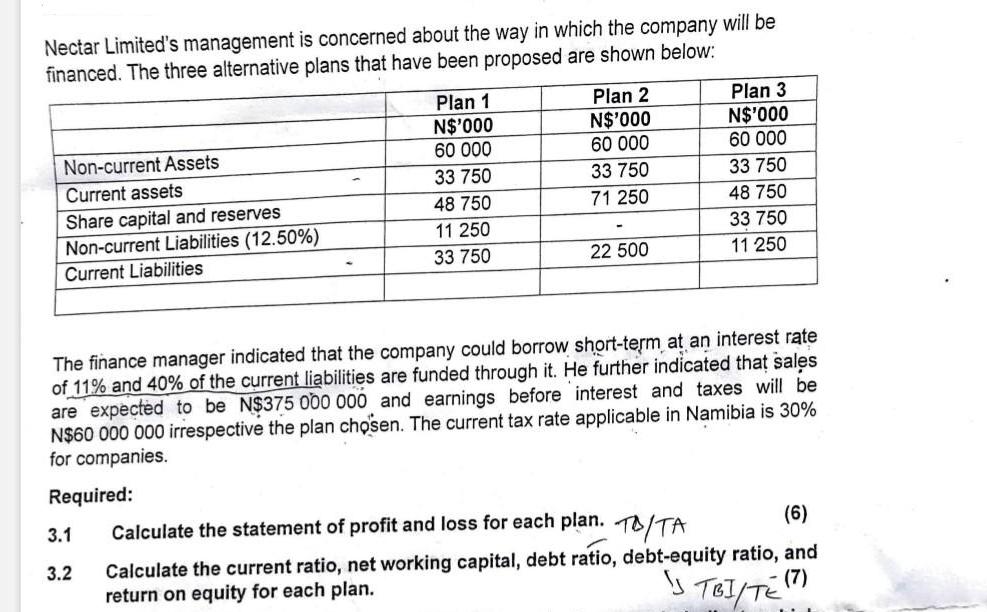

Nectar Limited's management is concerned about the way in which the company will be financed. The three alternative plans that have been proposed are

Nectar Limited's management is concerned about the way in which the company will be financed. The three alternative plans that have been proposed are shown below: Non-current Assets Current assets Share capital and reserves Non-current Liabilities (12.50%) Current Liabilities Plan 1 N$'000 60 000 33 750 48 750 3.1 3.2 11 250 33 750 Plan 2 N$'000 60 000 33 750 71 250 22 500 Plan 3 N$'000 60 000 33 750 48 750 33 750 11 250 The finance manager indicated that the company could borrow short-term at an interest rate of 11% and 40% of the current liabilities are funded through it. He further indicated that sales are expected to be N$375 000 000 and earnings before interest and taxes will be N$60 000 000 irrespective the plan chosen. The current tax rate applicable in Namibia is 30% for companies. Required: Calculate the statement of profit and loss for each plan. T/TA (6) Calculate the current ratio, net working capital, debt ratio, debt-equity ratio, and return on equity for each plan. Is TBI/TE(7) 3.3 Compare the risk and return associated with each plan, clearly indicate which (7) plan the company should consider and why.

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

31 Statement of profit or loss for each plan Plan 1 Sales N375000000 EBIT N60000000 Interest expense ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started