Question

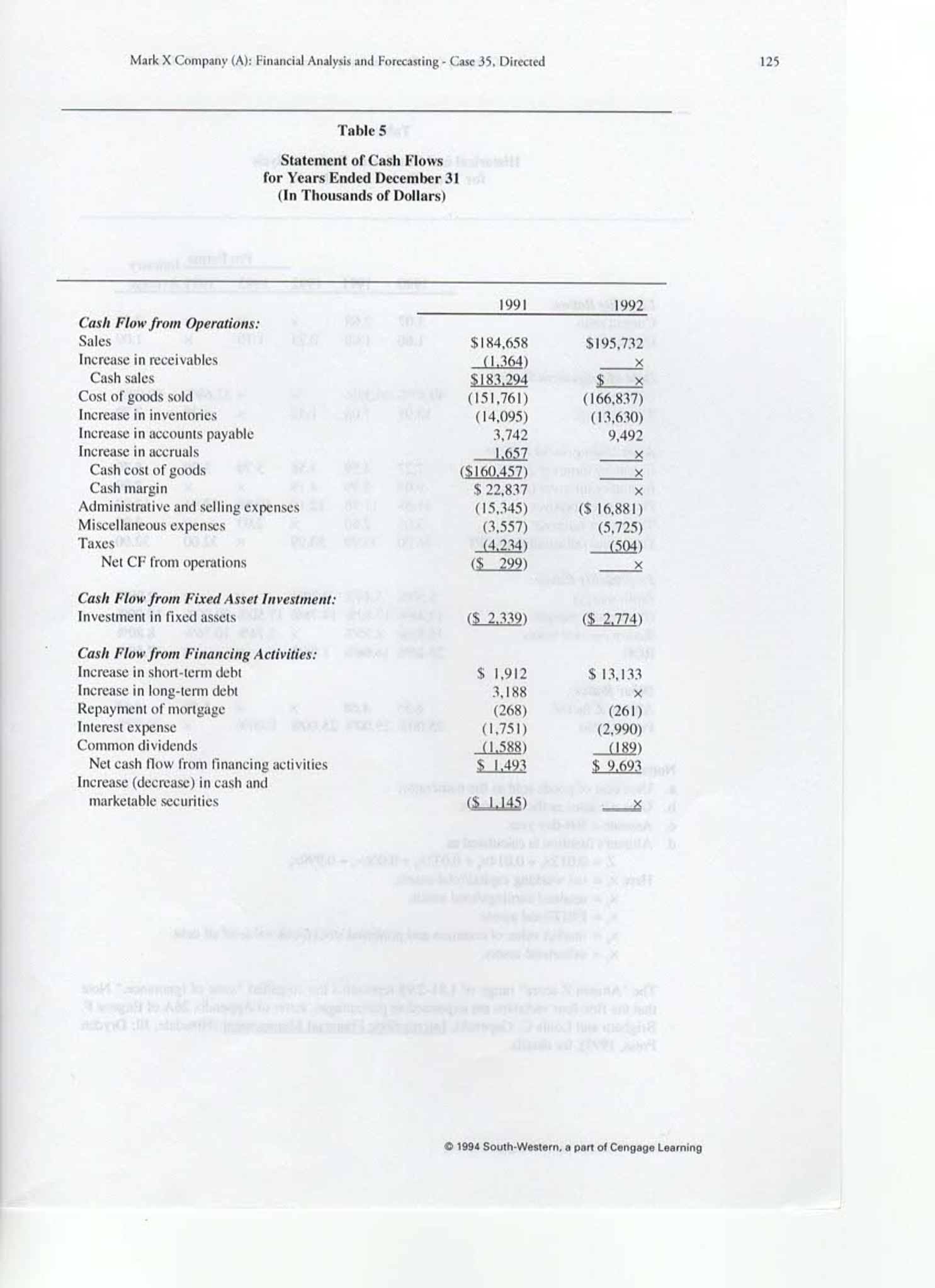

Need 11/14/2016 Question Revise your pro forma financial statements for 1993 and 1994 assuming both of the following conditions: (a) Short-term laons will be repaid

Need 11/14/2016

Question

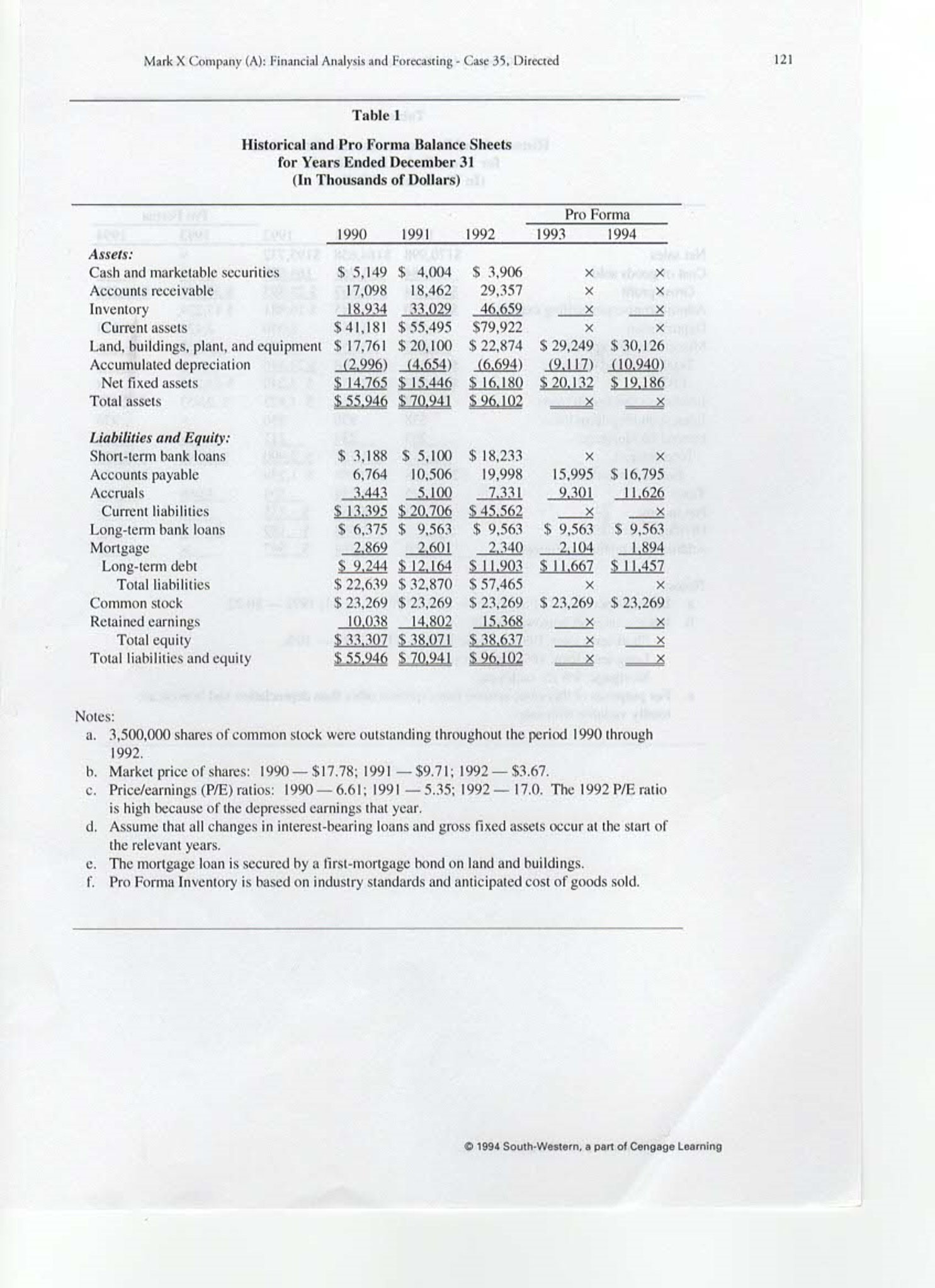

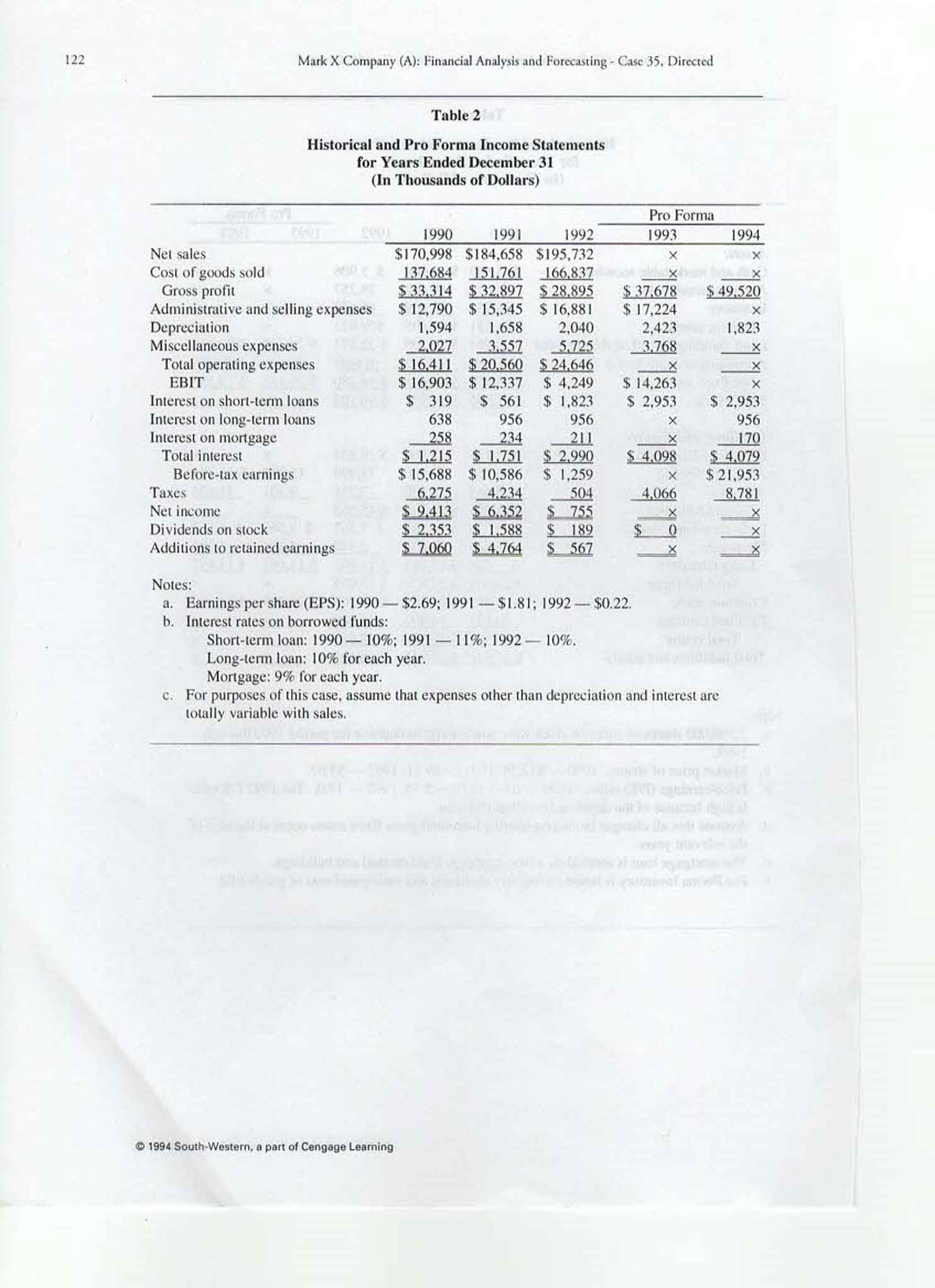

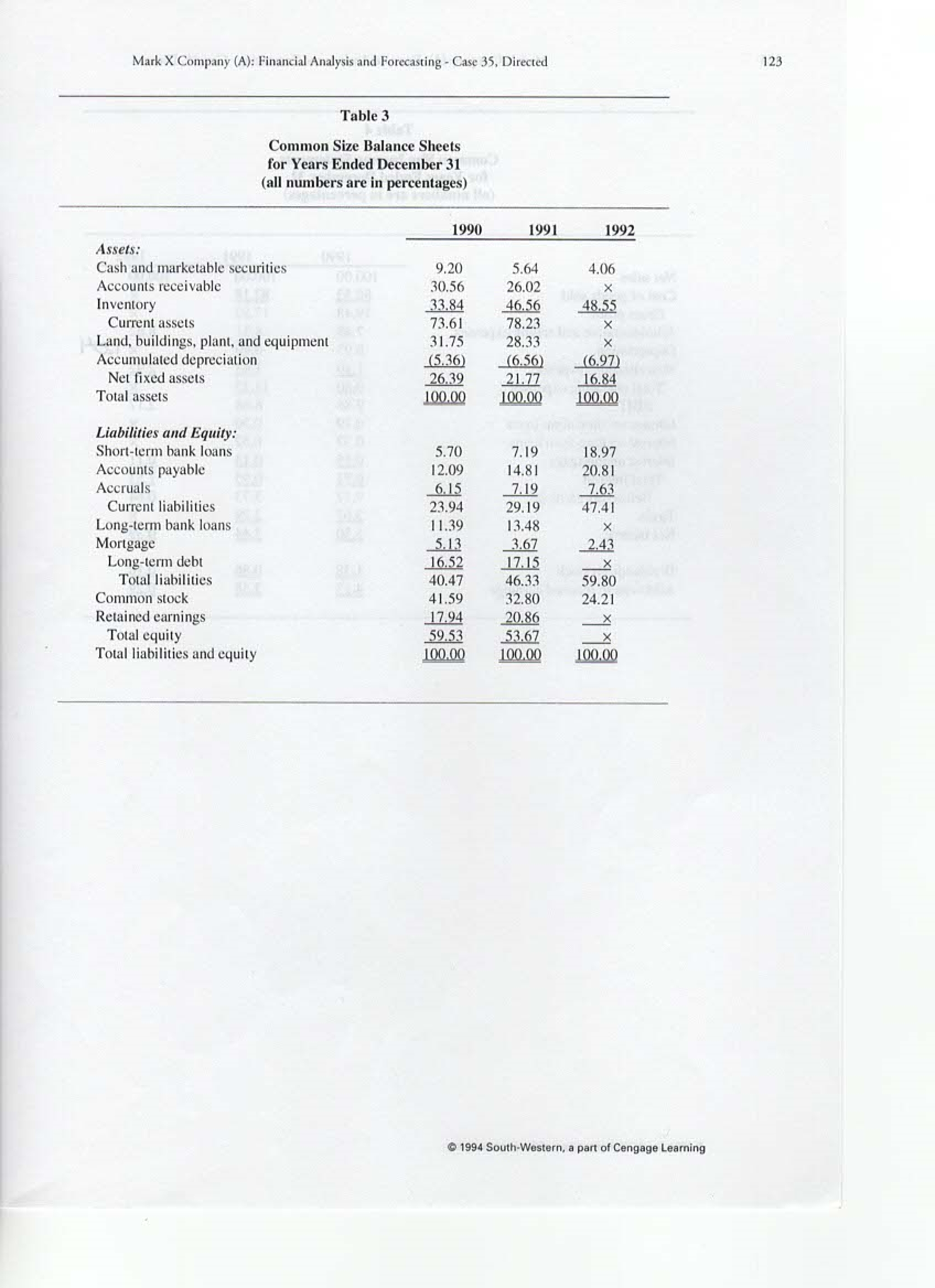

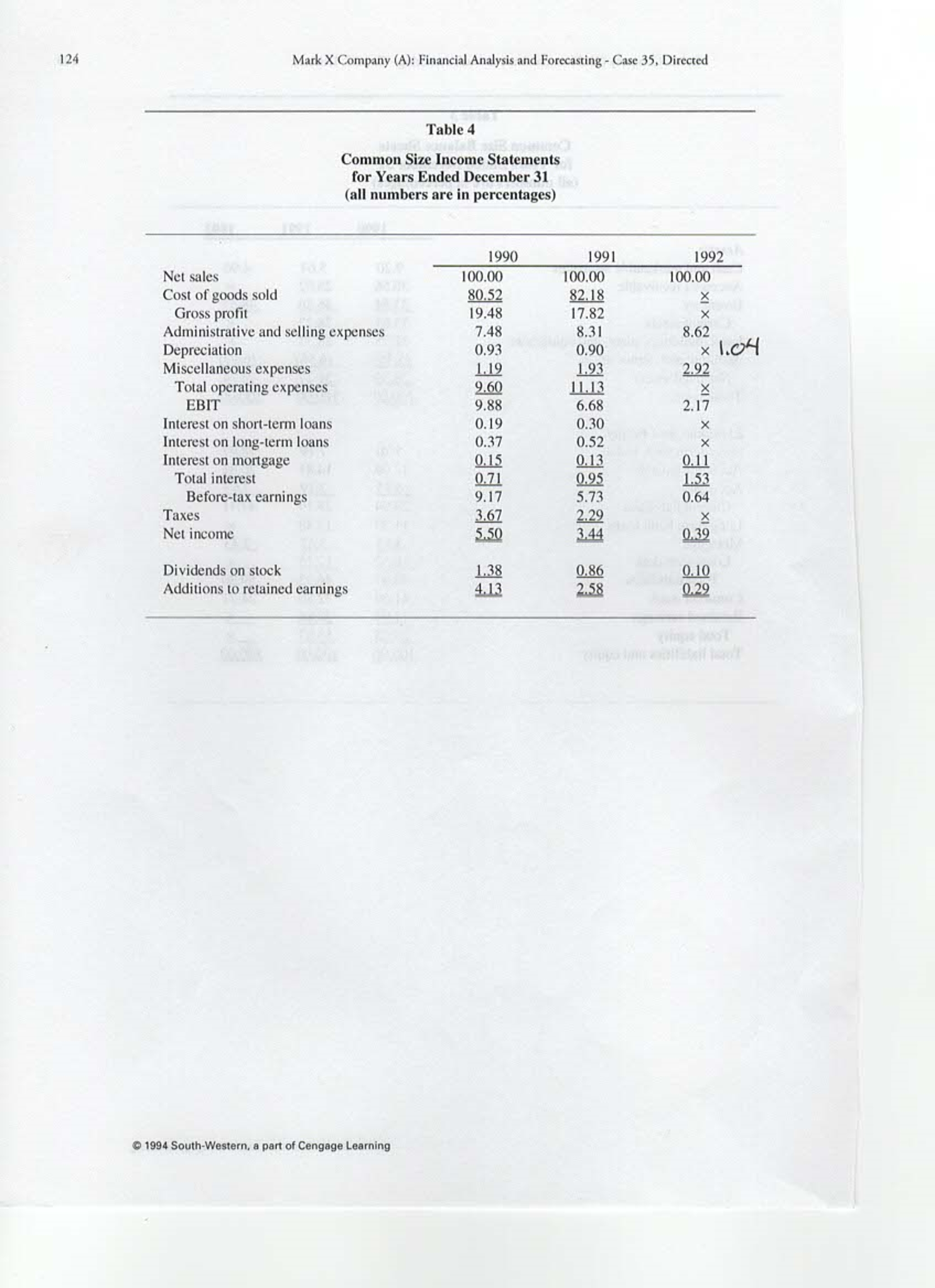

Revise your pro forma financial statements for 1993 and 1994 assuming both of the following conditions:

(a) Short-term laons will be repaid when sufficient cash is available to do so without reducing the liquidity o the firm below the minimum requirements set by the bank and when the company is able to mintain at least the minumum cash balance (5 years).

(b) Mark X will reinstate a 25 percent cash dividend in the year that all short-term loans and credit lines have been fully cleaned up (paid in full).

Tip:

Do income statement first (see Table 2 for example). Fill in blanks in order that you can figure thm out. Make out Table 7-9 for revisions. Example: 1993 interest on short term loan changes numbers below it in the income statement: 24,608 / 2 X .12 = 1,476.

For revised pro forma balnace sheet, short term laons (see Table 1 for example) = 24608 -24608 = 0. The following accounts changes: ahort term loans, current liabilities, total liabilities, retained earnings, total equity, total lliabilities nd equity, total assets, current assets, cash marketable securities. 1994 interest on short term bank loans = $0 (paid off in 1993)

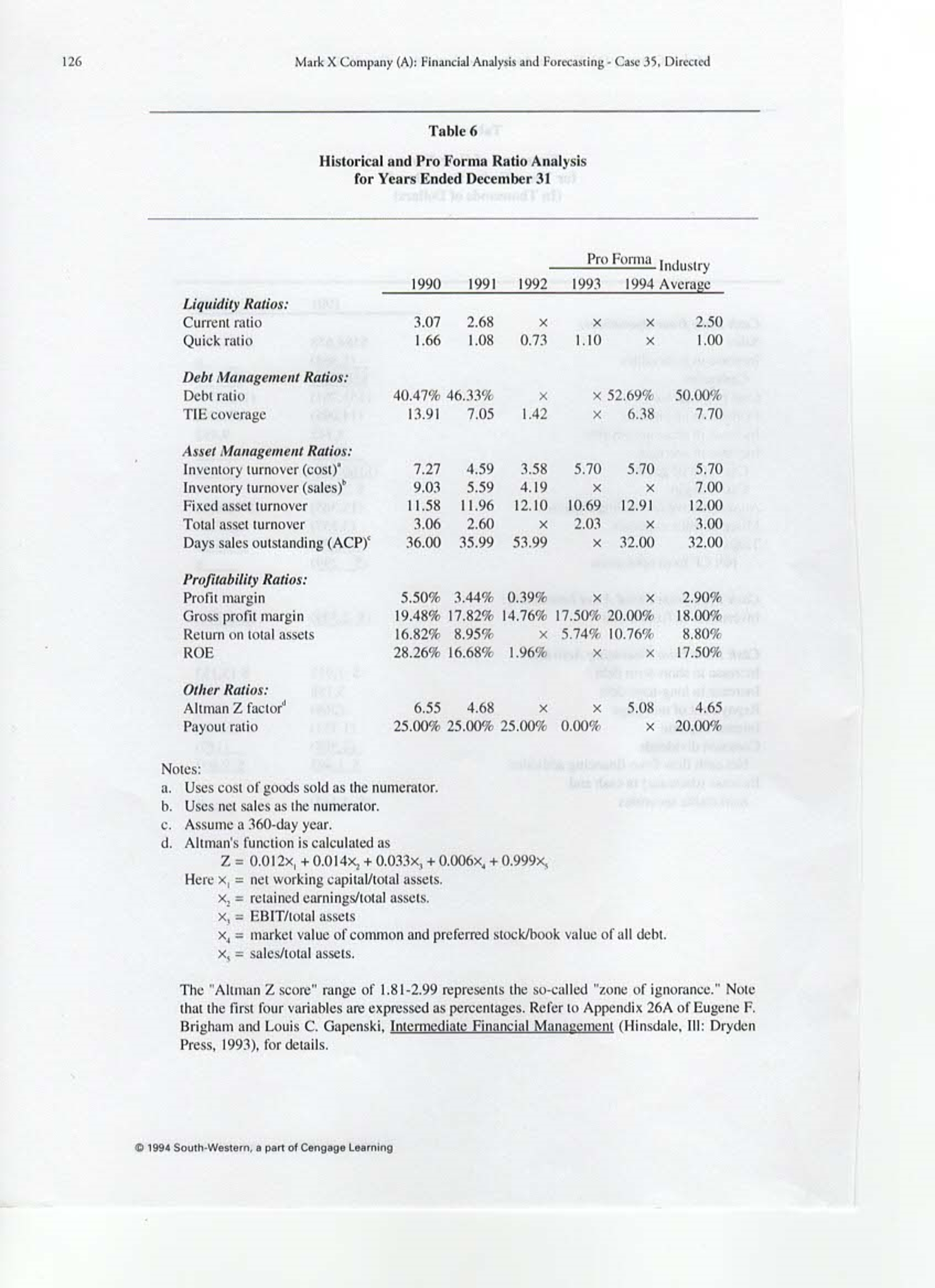

For revisd pro forma ratios (can be Table 9) Current ratio for 1993 = (example) 60707/25296 =2.40 for 1994 = 75775/28421 = 2.67

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started