Answered step by step

Verified Expert Solution

Question

1 Approved Answer

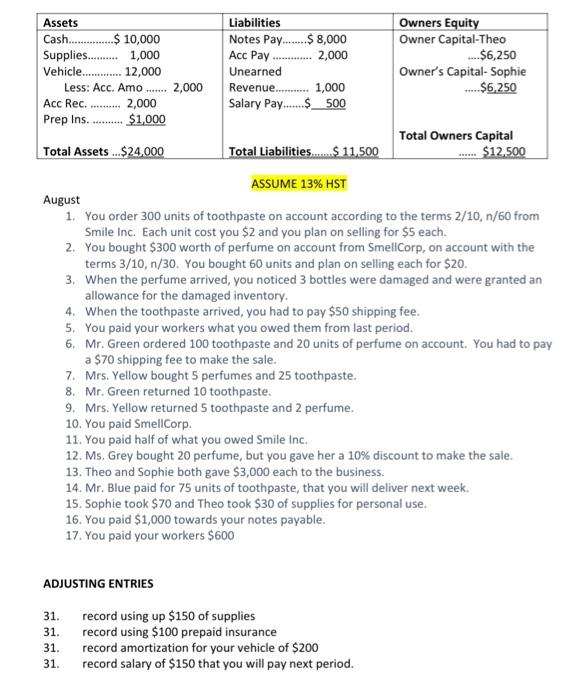

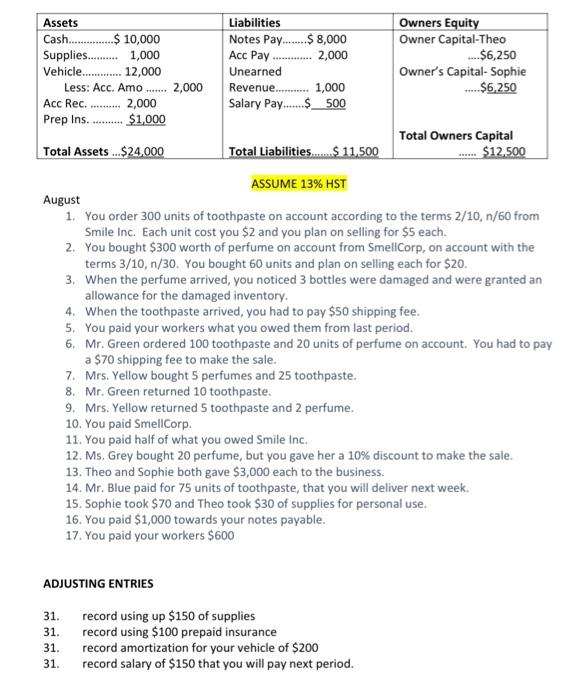

Need 1.Journal 2. Ledger 3. Financial Statements: I/S, SOE, BS Please asap RECALCULATE COGS & DO THE ADJUSTING ENTRIES Acc Pay ..... $1,000 Assets Liabilities

Need

1.Journal

2. Ledger

3. Financial Statements: I/S, SOE, BS

Please asap

RECALCULATE COGS & DO THE ADJUSTING ENTRIES

Acc Pay ..... $1,000 Assets Liabilities Owners Equity Cash...............$ 10,000 Notes Pay........$ 8,000 Owner Capital-Theo Supplies.. 1,000 2,000 ....$6,250 Vehicle.... 12,000 Unearned Owner's Capital-Sophie Less: Acc. Amo..... 2,000 Revenue....... 1,000 ...$6.250 Acc Rec......... 2,000 Salary Pay.......$_500 Prep Ins. Total Owners Capital Total Assets ...$24,000 Total Liabilities. $ 11.500 *. $12.500 ASSUME 13% HST August 1. You order 300 units of toothpaste on account according to the terms 2/10, 1/60 from Smile Inc. Each unit cost you $2 and you plan on selling for $5 each. 2. You bought $300 worth of perfume on account from SmellCorp, on account with the terms 3/10,n/30. You bought 60 units and plan on selling each for $20. 3. When the perfume arrived, you noticed 3 bottles were damaged and were granted an allowance for the damaged inventory. 4. When the toothpaste arrived, you had to pay $50 shipping fee. 5. You paid your workers what you owed them from last period. 6. Mr. Green ordered 100 toothpaste and 20 units of perfume on account. You had to pay a $70 shipping fee to make the sale. 7. Mrs. Yellow bought 5 perfumes and 25 toothpaste. 8. Mr. Green returned 10 toothpaste. 9. Mrs. Yellow returned 5 toothpaste and 2 perfume. 10. You paid SmellCorp. 11. You paid half of what you owed Smile Inc. 12. Ms. Grey bought 20 perfume, but you gave her a 10% discount to make the sale. 13. Theo and Sophie both gave $3,000 each to the business. 14. Mr. Blue paid for 75 units of toothpaste, that you will deliver next week. 15. Sophie took $70 and Theo took $30 of supplies for personal use. 16. You paid $1,000 towards your notes payable. 17. You paid your workers $600 31. ADJUSTING ENTRIES record using up $150 of supplies 31. record using $100 prepaid insurance 31. record amortization for your vehicle of $200 31. record salary of $150 that you will pay next period Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started