Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need #6 answered no excel, need #6 answered Chapter 14 Homework Homework Problems: (1) Company BW has issued 2,000 corporate bonds with a maturity value

need #6 answered

no excel, need #6 answered

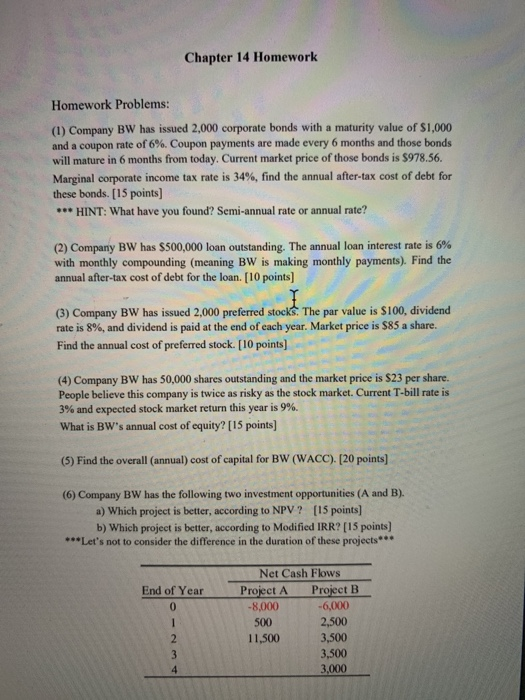

Chapter 14 Homework Homework Problems: (1) Company BW has issued 2,000 corporate bonds with a maturity value of $1,000 and a coupon rate of 6%. Coupon payments are made every 6 months and those bonds will mature in 6 months from today. Current market price of those bonds is $978.56. Marginal corporate income tax rate is 34%, find the annual after-tax cost of debt for these bonds. [15 points) *** HINT: What have you found? Semi-annual rate or annual rate? (2) Company BW has $500,000 loan outstanding. The annual loan interest rate is 6% with monthly compounding (meaning BW is making monthly payments). Find the annual after-tax cost of debt for the loan. [10 points) (3) Company BW has issued 2,000 preferred stock. The par value is $100, dividend rate is 8%, and dividend is paid at the end of each year. Market price is $85 a share. Find the annual cost of preferred stock. [10 points) (4) Company BW has 50,000 shares outstanding and the market price is $23 per share. People believe this company is twice as risky as the stock market. Current T-bill rate is 3% and expected stock market return this year is 9%. What is BW's annual cost of equity? [15 points) (5) Find the overall (annual) cost of capital for BW (WACC). [20 points) (6) Company BW has the following two investment opportunities (A and B). a) Which project is better, according to NPV? (15 points) b) Which project is better, according to Modified IRR? [15 points) ***Let's not to consider the difference in the duration of these projects End of Year 0 Net Cash Flows Project A Project B -8,000 -6,000 500 2,500 11,500 3,500 3,500 3,000 2 3 4 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started