Answered step by step

Verified Expert Solution

Question

1 Approved Answer

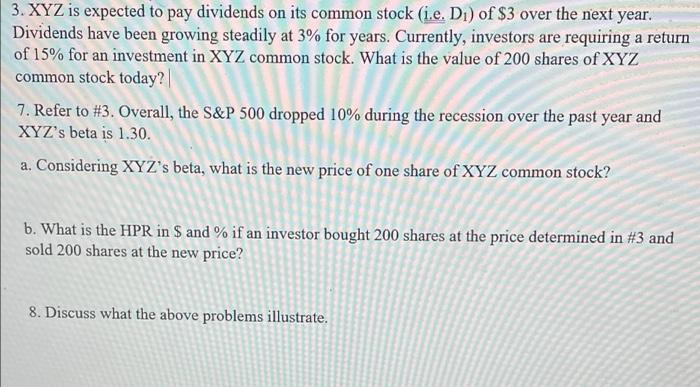

need 7a 7b and 8 3. XYZ is expected to pay dividends on its common stock (i.e. D) of $3 over the next year. Dividends

need 7a 7b and 8

3. XYZ is expected to pay dividends on its common stock (i.e. D) of $3 over the next year. Dividends have been growing steadily at 3% for years. Currently, investors are requiring a return of 15% for an investment in XYZ common stock. What is the value of 200 shares of XYZ common stock today? 7. Refer to # 3. Overall, the S&P 500 dropped 10% during the recession over the past year and XYZ's beta is 1.30. a. Considering XYZ's beta, what is the new price of one share of XYZ common stock? b. What is the HPR in $ and % if an investor bought 200 shares at the price determined in #3 and sold 200 shares at the new price? 8. Discuss what the above problems illustrate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started