need A and B

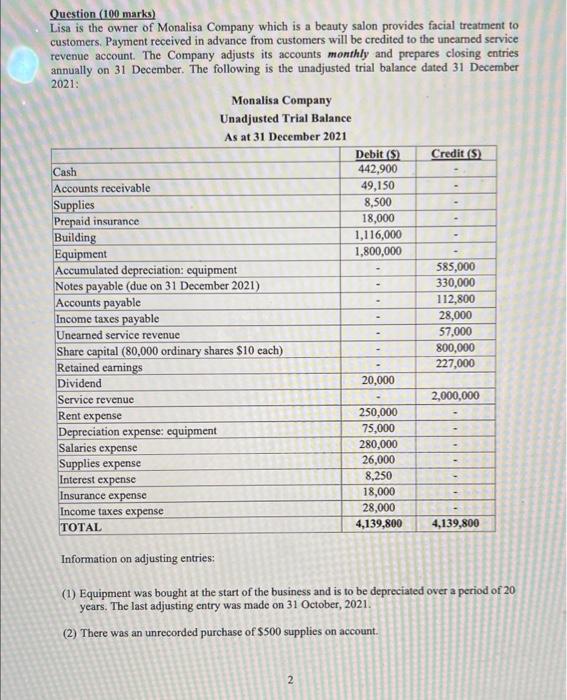

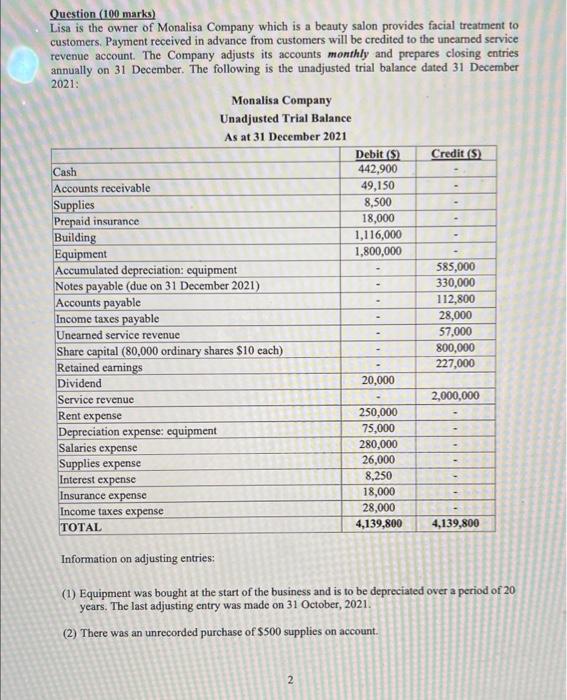

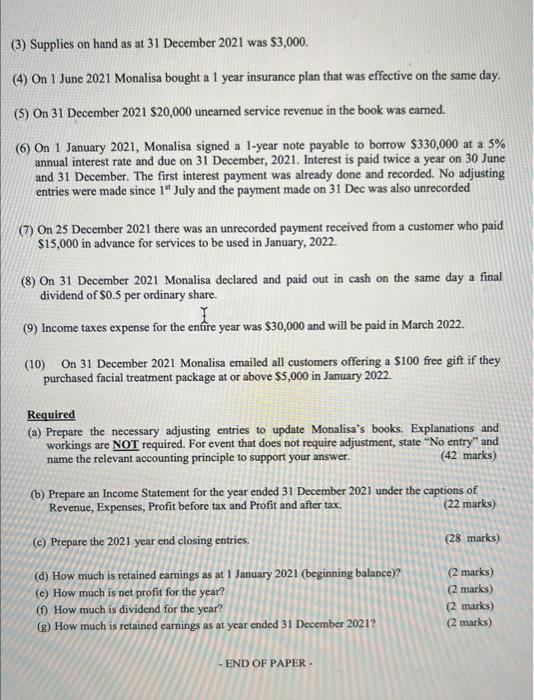

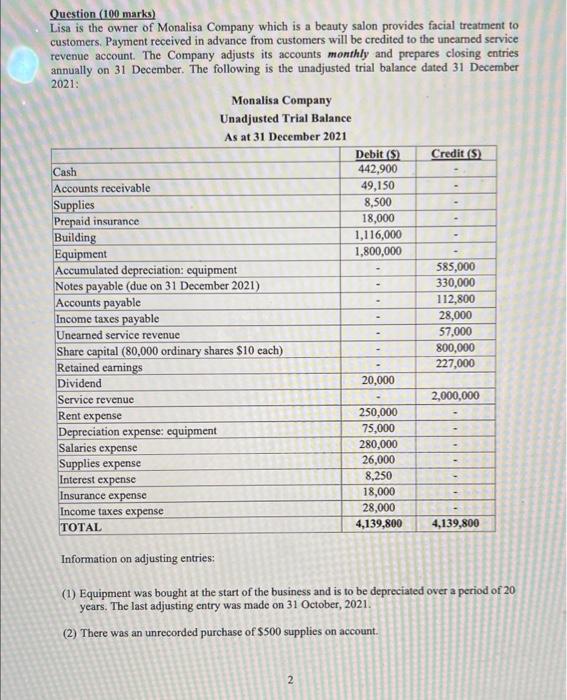

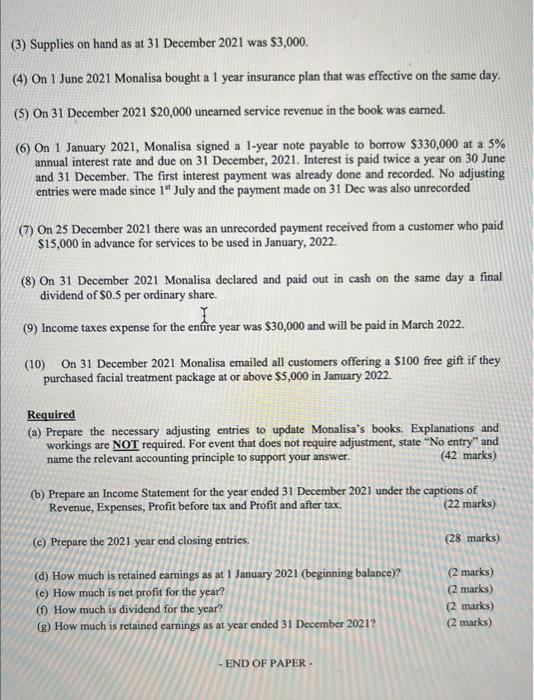

Question (100 marks) Lisa is the owner of Monalisa Company which is a beauty salon provides facial treatment to customers. Payment received in advance from customers will be credited to the uneamed service revenue account. The Company adjusts its accounts monthly and prepares closing entries annually on 31 December. The following is the unadjusted trial balance dated 31 December 2021: Monalisa Company Unadjusted Trial Balance Information on adjusting entries: (1) Equipment was bought at the start of the business and is to be depreciated over a period of 20 years. The last adjusting entry was made on 31 October, 2021 . (2) There was an unrecorded purchase of $500 supplies on account. (3) Supplies on hand as at 31 December 2021 was $3,000. (4) On 1 June 2021 Monalisa bought a 1 year insurance plan that was effective on the same day. (5) On 31 December 2021$20,000 unearned service revenue in the book was earned. (6) On 1 January 2021, Monalisa signed a 1-year note payable to borrow $330,000 at a 5% annual interest rate and due on 31 December, 2021. Interest is paid twice a year on 30 June and 31 December. The first interest payment was already done and recorded. No adjusting entries were made since 1st July and the payment made on 31 Dec was also unrecorded (7) On 25 December 2021 there was an unrecorded payment received from a customer who paid $15,000 in advance for services to be used in January, 2022. (8) On 31 December 2021 Monalisa declared and paid out in cash on the same day a final dividend of $0.5 per ordinary share. (9) Income taxes expense for the entire year was $30,000 and will be paid in March 2022. (10) On 31 December 2021 Monalisa emailed all customers offering a $100 free gift if they purchased facial treatment package at or above $5,000 in January 2022. Required (a) Prepare the necessary adjusting entries to update Monalisa's books. Explanations and workings are NOT required. For event that does not require adjustment, state "No entry" and name the relevant accounting principle to support your answer. (42 marks) (b) Prepare an Income Statement for the year ended 31 December 2021 under the captions of Revenue, Expenses, Profit before tax and Profit and after tax. (22 marks) (c) Prepare the 2021 year end closing entries. (28 marks) (d) How much is retained earnings as at 1 January 2021 (beginning balance)? (2 marks) (e) How much is net profit for the year? (2 marks) (f) How much is dividend for the year? (2 marks) (g) How much is retained earnings as at year ended 31 December 2021 ? (2 marks) - END OF PAPER