Answered step by step

Verified Expert Solution

Question

1 Approved Answer

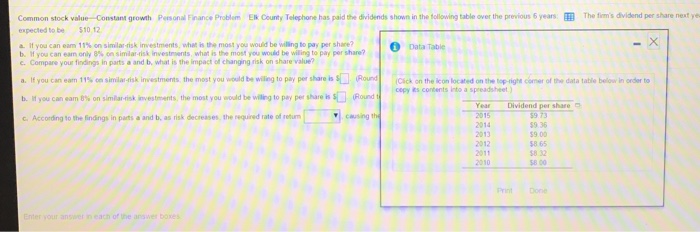

Need A, B and C parts answered. Thanks Common stock value Constant growth Personal Finance Problem ER County Telephone has paid the dividends shown in

Need A, B and C parts answered. Thanks

Common stock value Constant growth Personal Finance Problem ER County Telephone has paid the dividends shown in the following table over the previous 6 years. The firm's dividend per share next year expected to be exist1012 If you can earn 11% on similar-risk investments, what is the most you would be willing to pay per share? If you can earn only 8% on similar-risk investments what is the most you would be willing to pay per share? Compare your findings in parts a and b, what is the impact of changing risk on share value? If you can earn 11% similar-risk investments the most you would be willing to pay per share is exist (Round If you can earn 8% on similar-risk investments the most you would be willing to pay per share is exist (Round According to the findings in parts a and b, as risk decrease the required rate of return causing the Common stock value Constant growth Personal Finance Problem ER County Telephone has paid the dividends shown in the following table over the previous 6 years. The firm's dividend per share next year expected to be exist1012 If you can earn 11% on similar-risk investments, what is the most you would be willing to pay per share? If you can earn only 8% on similar-risk investments what is the most you would be willing to pay per share? Compare your findings in parts a and b, what is the impact of changing risk on share value? If you can earn 11% similar-risk investments the most you would be willing to pay per share is exist (Round If you can earn 8% on similar-risk investments the most you would be willing to pay per share is exist (Round According to the findings in parts a and b, as risk decrease the required rate of return causing the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started