need A, B, C please. asap. thank you

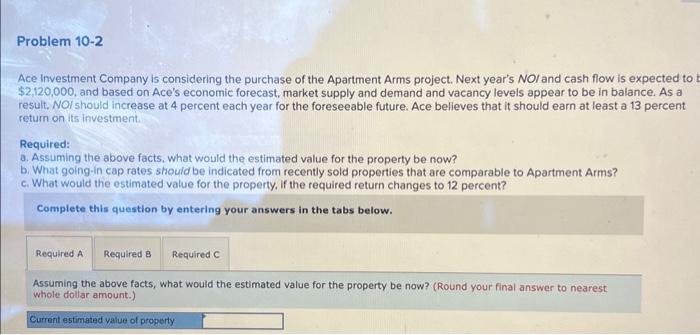

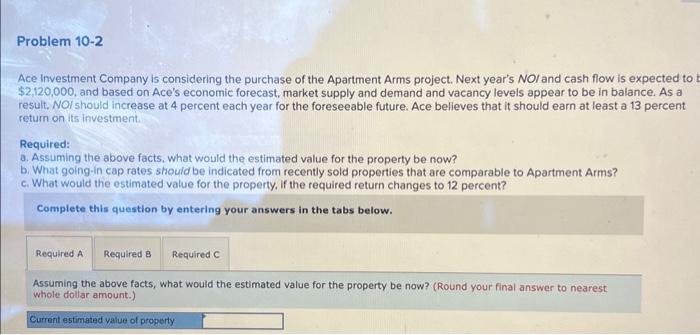

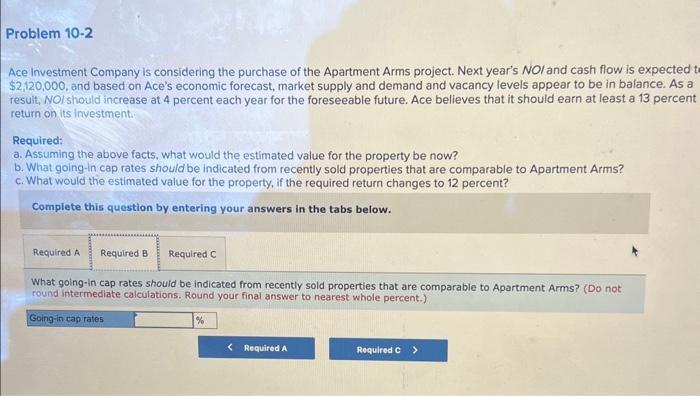

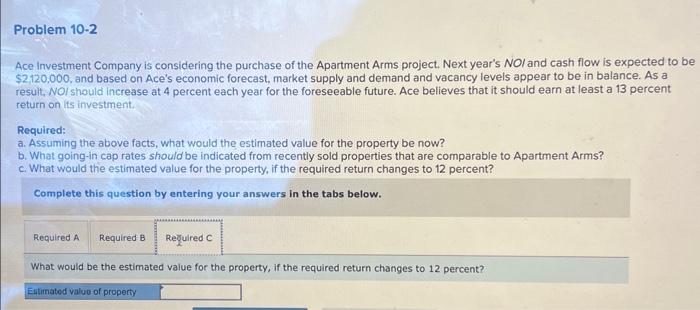

Ace Investment Company is considering the purchase of the Apartment Arms project. Next year's NO/ and cash flow is expected to $2,120,000, and based on Ace's economic forecast, market supply and demand and vacancy levels appear to be in balance. As a result, NO/ should increase at 4 percent each year for the foreseeable future. Ace believes that it should earn at least a 13 percent return on its investment. Required: a. Assuming the above facts, what would the estimated value for the property be now? b. What going-in cap rates should be indicated from recently sold properties that are comparable to Apartment Arms? c. What would the estimated value for the property, if the required return changes to 12 percent? Complete this question by entering your answers in the tabs below. Assuming the above facts, what would the estimated value for the property be now? (Round your final answer to nearest: whole dollar amount.) Ace Investment Company is considering the purchase of the Apartment Arms project. Next year's NOI and cash flow is expected $2,120,000, and based on Ace's economic forecast, market supply and demand and vacancy levels appear to be in balance. As a result, NOI should increase at 4 percent each year for the foreseeable future. Ace believes that it should earn at least a 13 percent return on its investment. Required: a. Assuming the above facts, what would the estimated value for the property be now? b. What going-in cap rates should be indicated from recently sold properties that are comparable to Apartment Arms? c. What would the estimated value for the property, if the required return changes to 12 percent? Complete this question by entering your answers in the tabs below. What going-in cap rates should be indicated from recently sold properties that are comparable to Apartment Arms? (Do not round intermediate calculations. Round your final answer to nearest whole percent.) Ace Investment Company is considering the purchase of the Apartment Arms project. Next year's NO/ and cash flow is expected to be $2,120,000, and based on Ace's economic forecast, market supply and demand and vacancy levels appear to be in balance. As a result, NO/ should increase at 4 percent each year for the foreseeable future. Ace believes that it should earn at least a 13 percent return on its investment. Required: a. Assuming the above facts, what would the estimated value for the property be now? b. What going-in cap rates should be indicated from recently sold properties that are comparable to Apartment Arms? c. What would the estimated value for the property, if the required return changes to 12 percent? Complete this question by entering your answers in the tabs below. What would be the estimated value for the property, if the required return changes to 12 percent