Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need a formula on excel to figure out these answers. if it specifies a function to use we need to use that function. 7) You

need a formula on excel to figure out these answers. if it specifies a function to use we need to use that function.

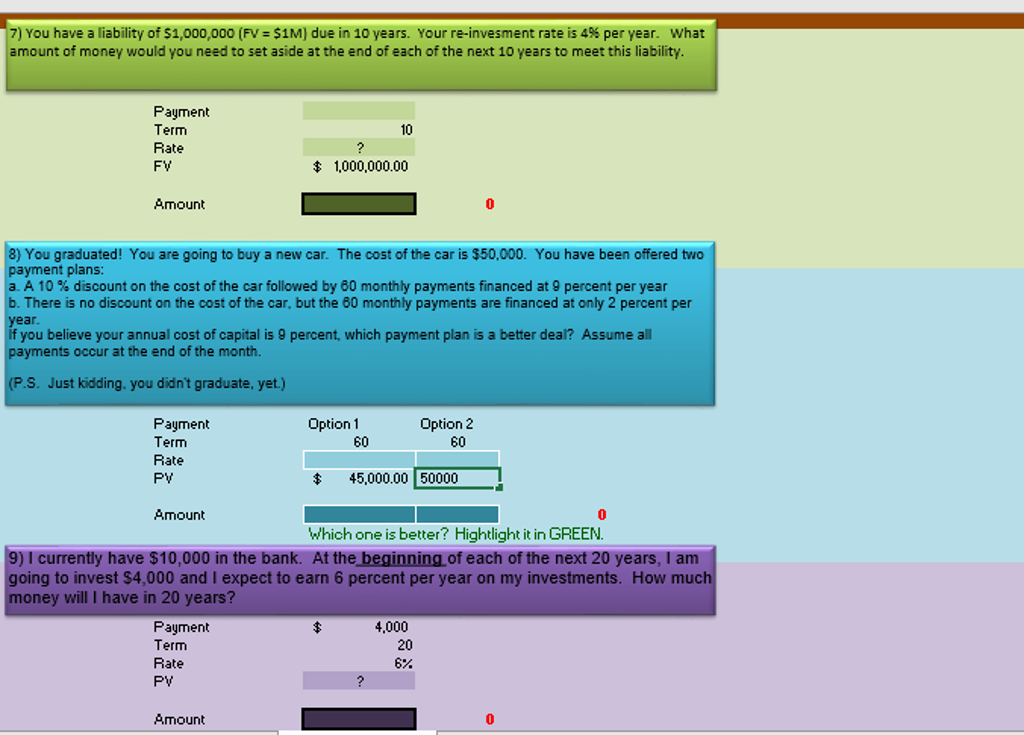

7) You have a liability of $1,000,000 (PV= $1M) due in 10 years. Your re-invesment rate is 4% per yearwhat amount of money would you need to set aside at the end of each of the next 10 years to meet this liability. Payment Term Rate FY 10 $ 1000,000.00 Amount 3) You graduated! You are going to buy a new car. The cost of the car is $50,000. You have been offered two payment plans: a. A 10% discount on the cost of the car followed by 60 monthly payments financed at 9 percent per year b. There is no discount on the cost of the carbut the 60 monthly payments are financed at only 2 percent per year if you believe your annual cost of capital is 9 percent, which payment plan is a better deal? Assume all payments occur at the end of the month. (P.S. Just kidding, you didnt graduate, yet) Payment Term Option 1 60 Option 2 60 Rate PV $ 45,000.00 50000 ! Amount Which one is better? Hightlight it in GREEN. 9) I currently have $10,000 in the bank. At the beginning of each of the next 20 years, I am going to invest $4,000 and I expect to earn 6 percent per year on my investments. How much money will have in 20 years? Payment Term Rate 4,000 20 6. PV Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started