Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need a help with all of them please. The Foundational 15 [LO3-1, LO3-2, LO3-3, LO3-4] [The following information applies to the questions displayed below] Bunnell

need a help with all of them please.

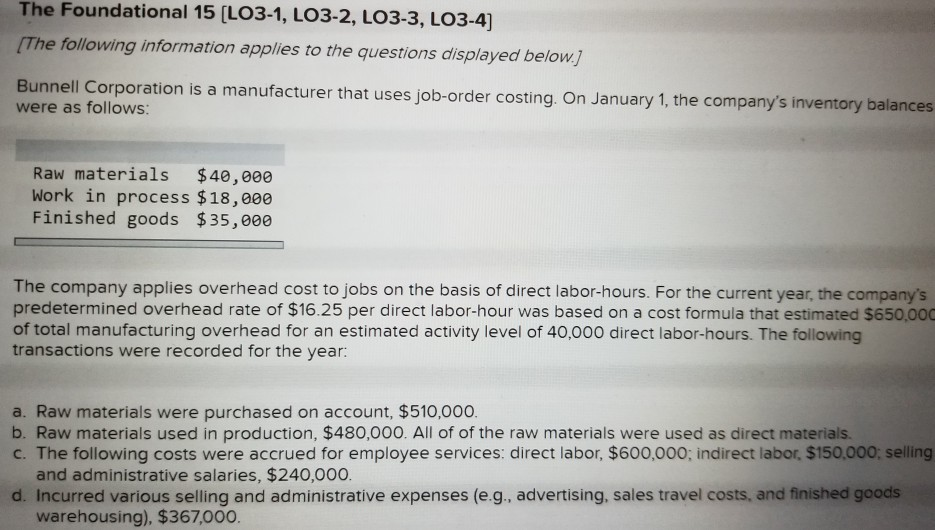

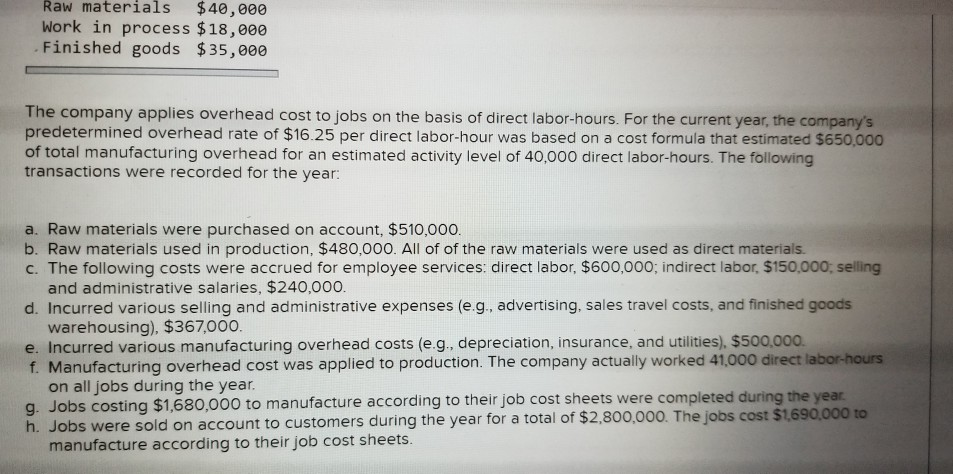

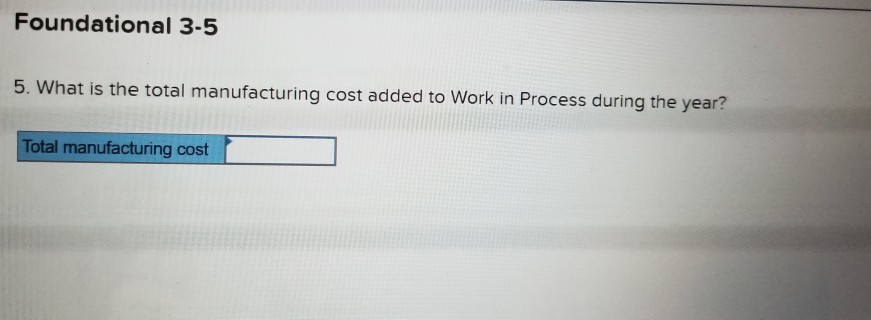

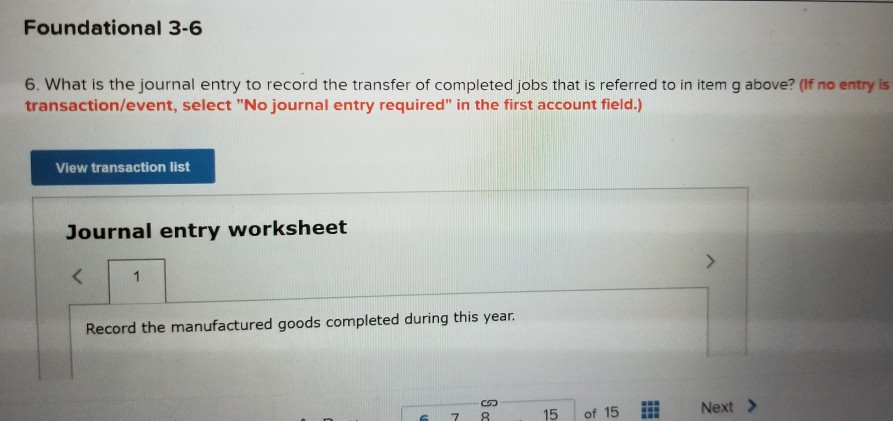

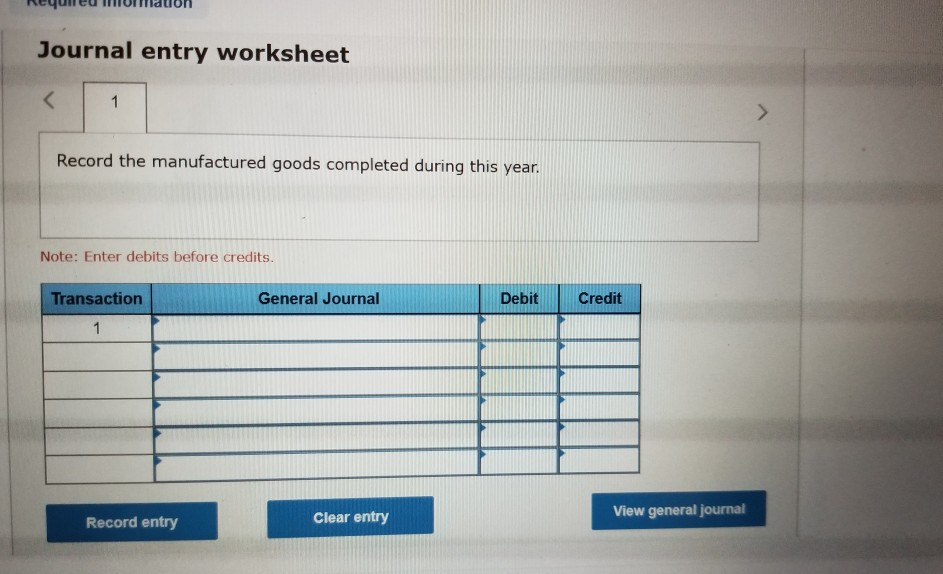

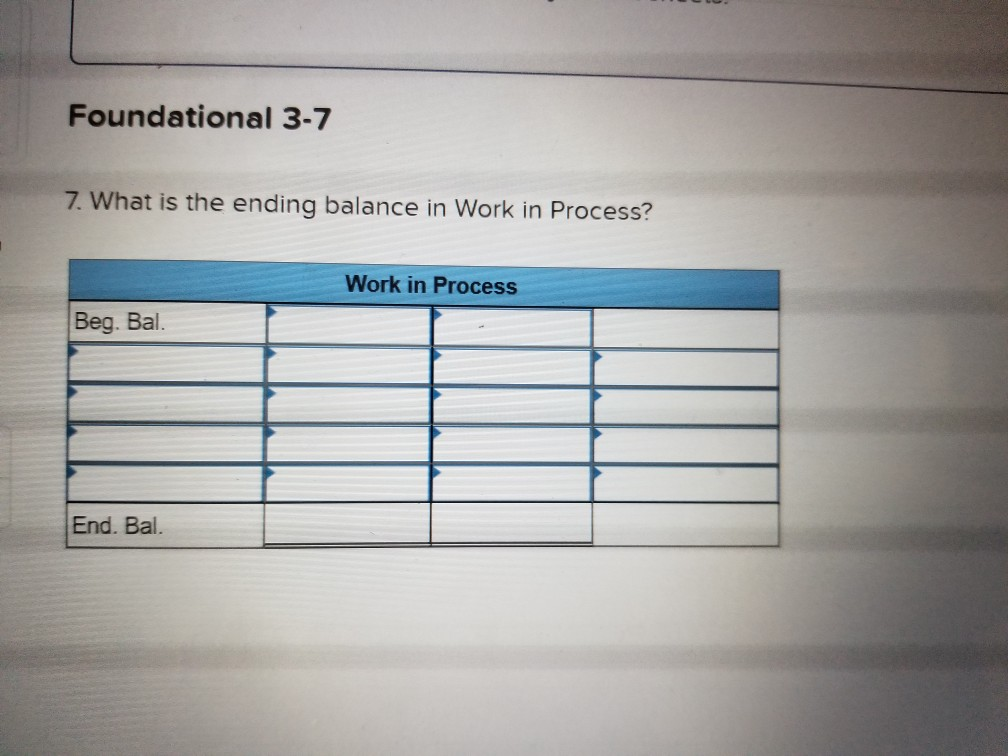

The Foundational 15 [LO3-1, LO3-2, LO3-3, LO3-4] [The following information applies to the questions displayed below] Bunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company's inventory balances were as follows: Raw materials $40,000 Work in process $18,000 Finished goods $35,000 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of $16.25 per direct labor-hour was based on a cost formula that estimated $650,00C of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materials were purchased on account, $510,000. b. Raw materials used in production, $480,000. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $600,000; indirect labor, $150,000; selling and administrative salaries, $240,000. d. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods warehousing), $367,000. Raw materials $40,000 Work in process $18,000 Finished goods $35,000 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of $16.25 per direct labor-hour was based on a cost formula that estimated $650,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materials were purchased on account, $510,000. b. Raw materials used in production, $480,000. All of of the raw materials were used as direct materials c. The following costs were accrued for employee services: direct labor, $600,000; indirect labor, $150,000; selling and administrative salaries, $240,000. d. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods warehousing), $367,000. e. Incurred various manufacturing overhead costs (e.g., depreciation, insurance, and utilities), $500,000. f. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor-hours on all jobs during the year g Jobs costing $1,680,000 to manufacture according to their job cost sheets were completed during the year h. Jobs were sold on account to customers during the year for a total of $2,800,000. The jobs cost $1,690,000 to manufacture according to their job cost sheets. Foundational 3-5 5. What is the total manufacturing cost added to Work in Process during the year? Total manufacturing cost Foundational 3-6 6. What is the journal entry to record the transfer of completed jobs that is referred to in item g above? (If no entry is transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 Record the manufactured goods completed during this year. CD Next> 15 of 15 8 7 Journal entry worksheet 1 Record the manufactured goods completed during this year Note: Enter debits before credits. Transaction General Journal Debit Credit 1 View general journal Clear entry Record entry Foundational 3-7 7. What is the ending balance in Work in Process? Work in Process Beg. Bal End. Bal. Foundational 3-8 8. What is the total amount of actual manufacturing overhead cost incurred during the year? Total actual manufacturing overhead cost Foundational 3-9 9. Is manufacturing overhead underapplied or overapplied for the year? By how much? Foundational 3-10 10. What is the cost of goods available for sale during the year? Cost of goods available for saleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started