Answered step by step

Verified Expert Solution

Question

1 Approved Answer

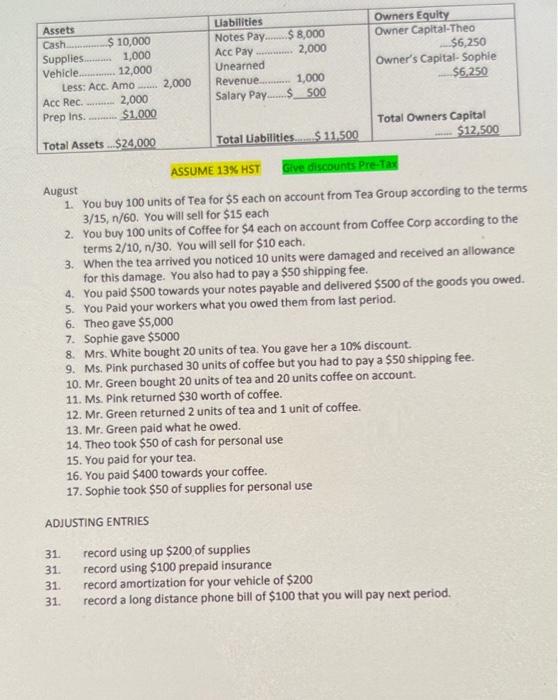

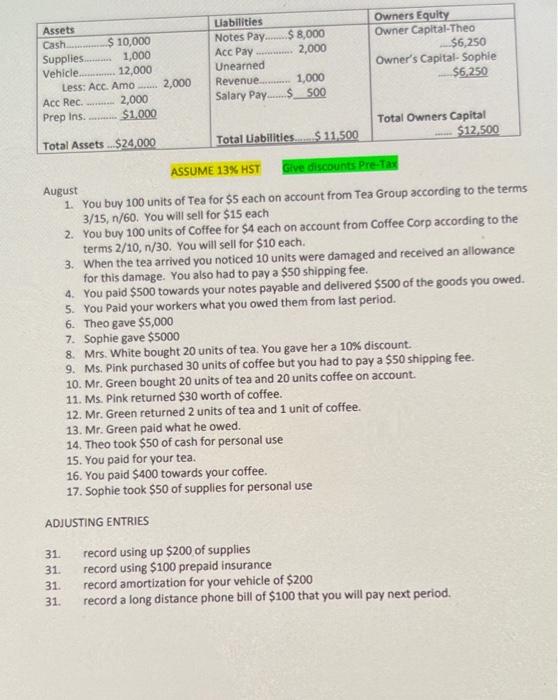

NEED A JOURNAL AND A LEDGER Assets Cash $ 10,000 Supplies....... 1,000 Vehicle 12,000 Less: Acc. Amo ... 2,000 Acc Rec 2,000 Prep Ins. $1.000

NEED A JOURNAL AND A LEDGER

Assets Cash $ 10,000 Supplies....... 1,000 Vehicle 12,000 Less: Acc. Amo ... 2,000 Acc Rec 2,000 Prep Ins. $1.000 Llabilities Notes Pay $8,000 Acc Pay 2,000 Unearned Revenue.... 1,000 Salary Pay_$_500 Owners Equity Owner Capital-Theo $6,250 Owner's Capital-Sophie $6,250 Total Owners Capital $12.500 $ 11,500 Total Assets $24,000 Total Habilities ASSUME 13% HST Give discounts Pre-Tax August 1. You buy 100 units of Tea for $5 each on account from Tea Group according to the terms 3/15, n/60. You will sell for $15 each 2. You buy 100 units of Coffee for $4 each on account from Coffee Corp according to the terms 2/10, 1/30. You will sell for $10 each. 3. When the tea arrived you noticed 10 units were damaged and received an allowance for this damage. You also had to pay a $50 shipping fee. 4. You paid $500 towards your notes payable and delivered $500 of the goods you owed. 5. You Paid your workers what you owed them from last period. 6. Theo gave $5,000 7. Sophie gave $5000 8. Mrs. White bought 20 units of tea. You gave her a 10% discount. 9. Ms. Pink purchased 30 units of coffee but you had to pay a $50 shipping fee. 10. Mr. Green bought 20 units of tea and 20 units coffee on account. 11. Ms. Pink returned $30 worth of coffee. 12. Mr. Green returned 2 units of tea and 1 unit of coffee. 13. Mr. Green paid what he owed. 14. Theo took $50 of cash for personal use 15. You paid for your tea. 16. You paid $400 towards your coffee. 17. Sophie took $50 of supplies for personal use ADJUSTING ENTRIES 31. 31. 31. 31. record using up $200 of supplies record using $100 prepaid insurance record amortization for your vehicle of $200 record a long distance phone bill of $100 that you will pay next period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started