Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need A,B & C Learning Goal 1: Analytical - Apply appropriate problem-solving methodologies to the analysis and solution of financial problems Students are able to

need A,B & C

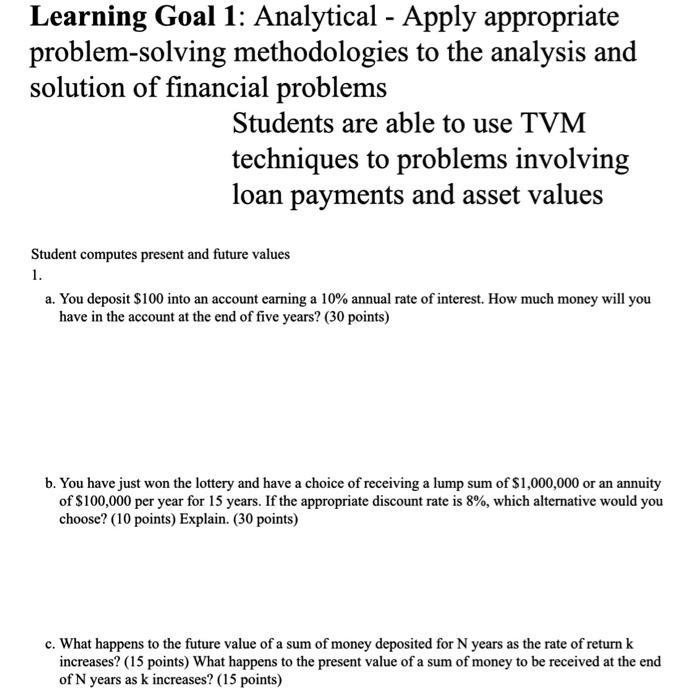

Learning Goal 1: Analytical - Apply appropriate problem-solving methodologies to the analysis and solution of financial problems Students are able to use TVM techniques to problems involving loan payments and asset values Student computes present and future values 1. a. You deposit $100 into an account earning a 10% annual rate of interest. How much money will you have in the account at the end of five years? ( 30 points) b. You have just won the lottery and have a choice of receiving a lump sum of $1,000,000 or an annuity of $100,000 per year for 15 years. If the appropriate discount rate is 8%, which alternative would you choose? (10 points) Explain. (30 points) c. What happens to the future value of a sum of money deposited for N years as the rate of return k increases? ( 15 points) What happens to the present value of a sum of money to be received at the end of N years as k increases? ( 15 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started