Answered step by step

Verified Expert Solution

Question

1 Approved Answer

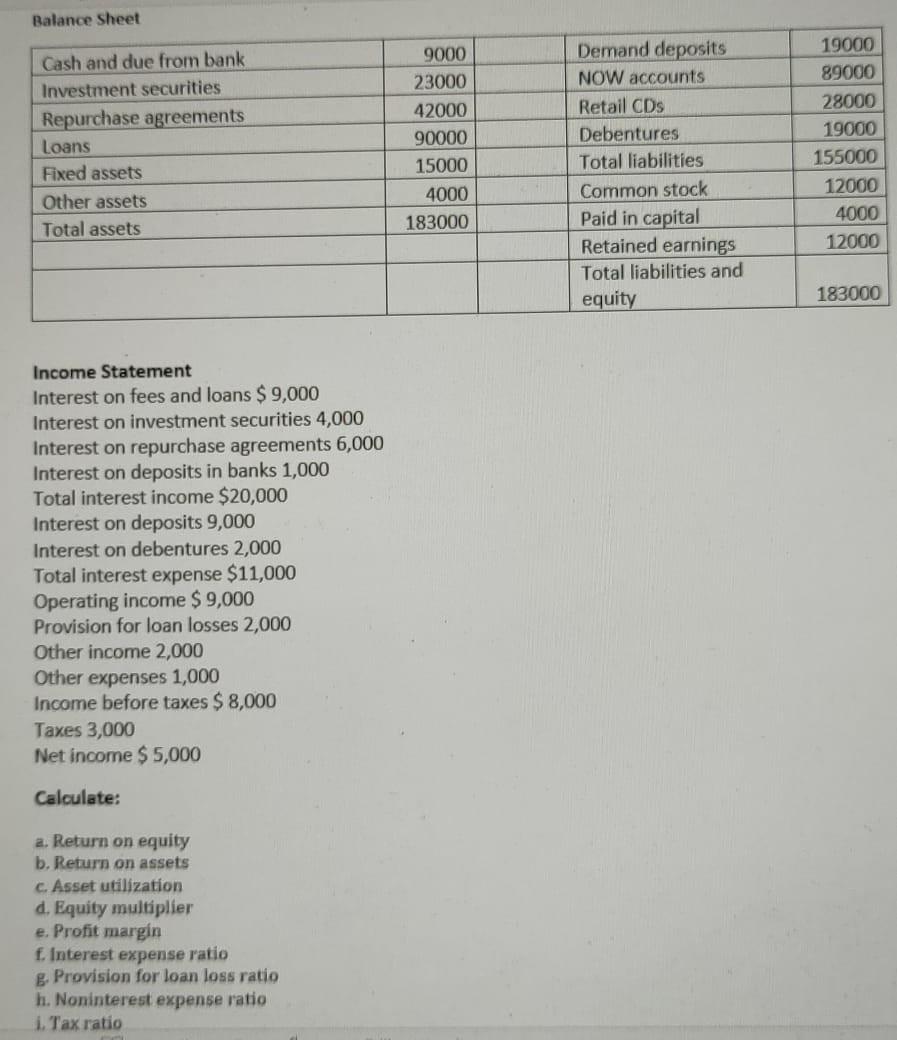

need accurate answers Balance Sheet Cash and due from bank Investment securities Repurchase agreements Loans Fixed assets Other assets Total assets 9000 23000 42000 90000

need accurate answers

Balance Sheet Cash and due from bank Investment securities Repurchase agreements Loans Fixed assets Other assets Total assets 9000 23000 42000 90000 15000 4000 183000 Demand deposits NOW accounts Retail CDs Debentures Total liabilities Common stock Paid in capital Retained earnings Total liabilities and equity 19000 89000 28000 19000 155000 12000 4000 12000 183000 Income Statement Interest on fees and loans $ 9,000 Interest on investment securities 4,000 Interest on repurchase agreements 6,000 Interest on deposits in banks 1,000 Total interest income $20,000 Interest on deposits 9,000 Interest on debentures 2,000 Total interest expense $11,000 Operating income $ 9,000 Provision for loan losses 2,000 Other income 2,000 Other expenses 1,000 Income before taxes $ 8,000 Taxes 3,000 Net income $ 5,000 Calculate: a. Return on equity b. Return on assets c. Asset utilization d. Equity multiplier e. Profit margin f. Interest expense ratio g. Provision for loan loss ratio h. Noninterest expense ratio 1. Tax ratioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started