Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need actual answer ASAP. course- corporate finance TIA 3. a) Kona International Ltd. uses only debt and equity. Kona is issuing Tk. 25,000 value's bond

need actual answer ASAP. course- corporate finance TIA

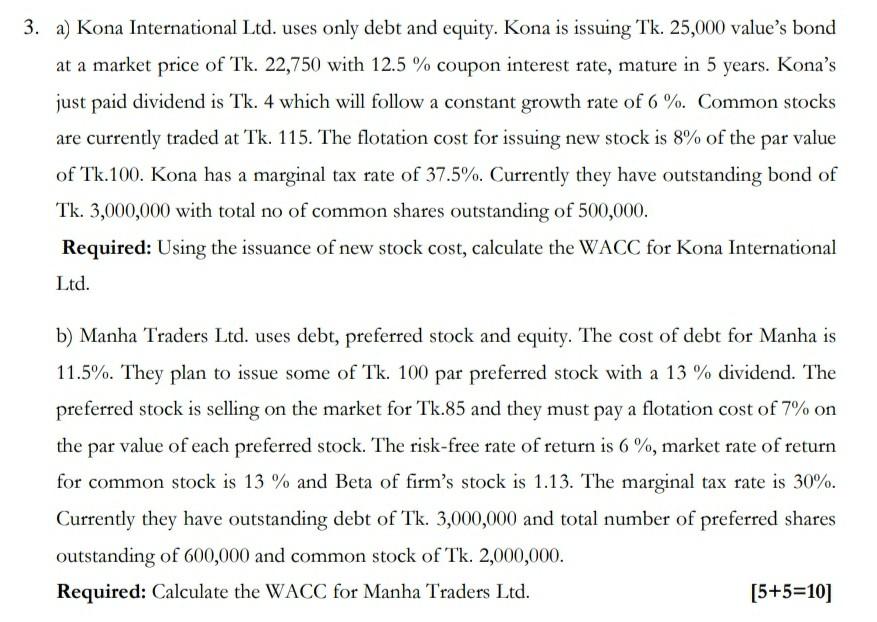

3. a) Kona International Ltd. uses only debt and equity. Kona is issuing Tk. 25,000 value's bond at a market price of Tk. 22,750 with 12.5 % coupon interest rate, mature in 5 years. Kona's just paid dividend is Tk. 4 which will follow a constant growth rate of 6 %. Common stocks are currently traded at Tk. 115. The flotation cost for issuing new stock is 8% of the par value of Tk.100. Kona has a marginal tax rate of 37.5%. Currently they have outstanding bond of Tk. 3,000,000 with total no of common shares outstanding of 500,000. Required: Using the issuance of new stock cost, calculate the WACC for Kona International Ltd. b) Manha Traders Ltd. uses debt, preferred stock and equity. The cost of debt for Manha is 11.5%. They plan to issue some of Tk. 100 par preferred stock with a 13 % dividend. The preferred stock is selling on the market for Tk.85 and they must pay a flotation cost of 7% on the par value of each preferred stock. The risk-free rate of return is 6%, market rate of return for common stock is 13 % and Beta of firm's stock is 1.13. The marginal tax rate is 30%. Currently they have outstanding debt of Tk. 3,000,000 and total number of preferred shares outstanding of 600,000 and common stock of Tk. 2,000,000. Required: Calculate the WACC for Manha Traders Ltd. [5+5=10]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started